Friend Tech Comes Roaring Back

While NFTs are cold, Friendship is scorching hot and setting new ATHs. Find out all the latest with Friend Tech, how people are using the app, why it's taking off and more with today's post.

TylerD's Market Summary

GM!

Today's top news includes:

Friend Tech volume passes NFTs in massive growth weekend

lors' Acid Pepes soar 600%, lead top movers in NFTs

Vitalik's Twitter hack event leads to major losses

Nouns DAO Fork goes live

Opepen set 16 does not subscribe enough, is replaced

👥 Friend Tech Is Back

NFTs and Crypto have been boring.

Friend Tech has not.

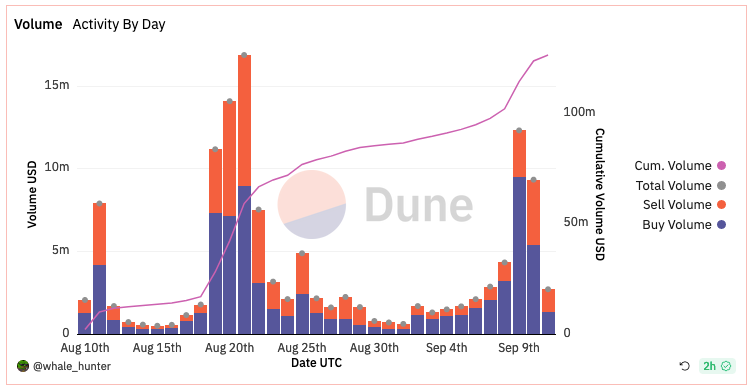

This was best showcased in weekend trading volume.

On Saturday, total Friend Tech key trading volume came in at $12.3M, vs just $9.15M for the entire ETH NFT market.

Why is this happening? And what do you need to know?

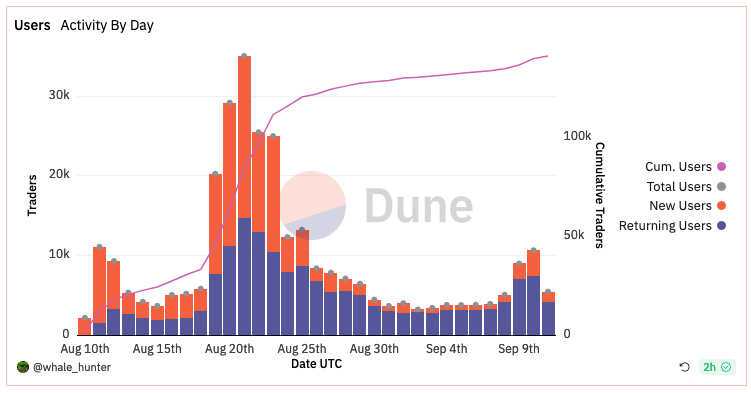

Explosive Growth Metrics

Before getting into the narrative, let's look at some of the metrics from 9/9 (and their day-over-day growth).

New users: 1,960 (+105%)

Return users: 7,031 (+71%)

Daily Buy volume: $9.47M (+294%)

Total volume: $118.2M (+11%)

TVL: $20M (+31%)

Highest key: Racer at 6.85 ETH (+10%)

Friendship is hot.

The explosive growth cooled a bit on Sunday, with total volume dropping back to $9.3M. Racer dipped to 6.1 ETH (-15%) as we saw a pull back on the leaderboard.

Though total users did jump to 10,650 (+18%) with a whopping 3,200 new users. That brings total users over 141,000 - in just one month.

We are seeing this spill over into NFTs as well.

One of the best NFT ROIs of the week was from MetakeysDAO which soared 515% to a 0.52 ETH floor; the premise - they are aggregating the alpha from their 55 ETH worth of key holdings into a Discord for key holders to access.

So what's driving this?

The Friend Tech Metas

Friend Tech mega-mind 0xBreadguy put together an amazing list of the current archetypes (metas) of FT users.

This is basically a list of the types of people/groups using FT and how they're using it.

I'll paraphrase here.

Aggregators/Indexors: Those who are buying up many keys, aggregating the content and providing it to their key holders

Builders: Teams using key token-gating for their products

Celebs/Insiders/Influencers: Big social accounts that people simply want access to

Alpha group: Token-gated market commentary (crypto, NFTs, etc.)

Non-crypto: People outside of our bubble experimenting with the tech

Protocols: Teams launching protocols or boosting their tokens via keyholders

(3, 3): Those who promise to buy the keys of their holders (Olympus DAO throwback) or share airdrop benefits

Creatives: Artists providing special access to their content for key holders

Dormant accounts: People who signed up, set up an account and abandoned it

There are likely a few other metas but this is a pretty comprehensive list.

And each of these have seen success in different ways. You could pull examples from each of those archetypes and find valuable keys.

Now that we know the user types, let's look at product use.

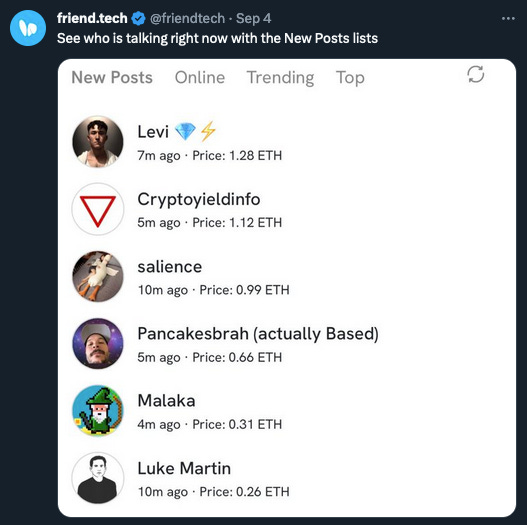

Using Friend Tech

Many (especially NFT-natives) have written off Friend Tech as just a ponzi.

While there's certainly the points airdrop aspect, and key speculation aspect to FT, there is more.

Here are some of the primary ways uses for FT early on:

Access to people: This is the base case of the product and its foundation. You can choose to buy the keys of thought leaders in various niches simply for access to their stream of thoughts, Q&A or more. It is dependent on the person being active (many are not). For me, a great example here is Derek Edwards.

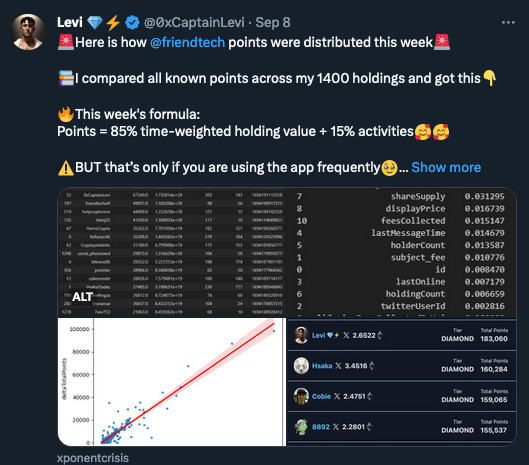

Airdrop farming: While the formula is said to change every week, more evidence is pointing to 1) portfolio value and 2) being active as the primary levers that matter. This rewards those with the biggest bags, and who actually talk in rooms. The easiest way to implement this strategy is by buying and holding the biggest accounts. To participate here, many are buying accounts like Racer, Hsaka, Cobie, etc. off the leaderboard.

Key Flipping: Buying "Friends" who you think will appreciate in value. A few ways to go about this include 1)buying newcomers cheap as soon as they launch, 2)targeting "under-valued" mid-tier and low-tier accounts with big-ish followings and who are active on X and in their rooms and 3)spotting dormant accounts with chance to re-activate.

Buy the FT Index: This is Racer (the founder). Racer's keys have become the de facto index for Friend Tech and are seen as the easiest way to bet on the success of the app without diving in to individuals.

Of course there are more uses and strategies than this, but this is a solid primer for beginners.

Conclusion

For me, the primary reason FT took off this past weekend is a combination of those top 3 use cases.

First, the past 2 point airdrops have been very rewarding for power users, and the formula seems to be cracked. With big players getting thousands of points (and many saying 1 point = $1 or more) per week, and now a rough idea of what to do to get those points, many more are going after farming.

The second reason, and main reason I came back and am active - the chats are actually good. Real thought leaders are sharing insights. Scrappy hustlers are providing alpha. Builders are creating useful products on top of FT and token-gating them.

And of course, key prices soaring over the past few days has also been a big driver of interest.

The other anecdotal drivers I've heard is related to the app improving - the team keeps shipping features, and the app has become more usable (though still buggy).

Overall, it's becoming a bustling ecosystem. This is where the action is now.

And it's fun.

We are still in the early stages of this marathon, with weekly airdrops happening for 6 months. Today we are 1 month in.

It won't be up only and it will be a bumpy ride (we're already seeing a pullback today).

But those who stick around are likely to be rewarded, at least that's the current risk/reward bet.

It's going to be fun to watch play out.

🚚 What else is happening in NFTs?

Here is the list of other notable headlines from the weekend in NFTs:

Trading volume notched up to 6,600 ETH on Sunday; NFTs mostly chopped over the weekend

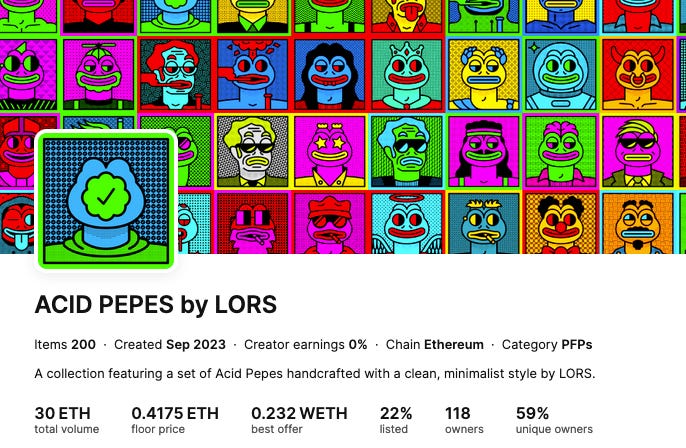

The top movers in NFTs were out of artist lors, whose Acid Pepes soared from a 0.069 ETH mint to a 0.42 ETH floor over the weekend; his other set PSD also jumped 200% to 0.78 ETH

Vitalik's X account was hacked Saturday evening with the hacker posting an NFT-related phishing link, which resulted in over $600k in NFTs lost including 2 CryptoPunks

Opepen Set 16 from Luke Weaver did not subscribe enough to go live, and was replaced with a new set 16 from Jack Butcher called "4x4", now subscribed enough to go live

The Nouns DAO fork went live on Saturday, meaning interested holders can "return" their Nouns for 35.5 ETH; the Nouns floor has since rallied to 36 ETH

DraftKings Reignmakers saw their Core-tier tournaments reach 115,000+ entrants for NFL Week 1 contests, a sign of major participation

Vinnie Hager's "Diary" mint ended on Friday afternoon with 3,100 mints and 152 ETH raised for the artist,though the floor is now below mint at 0.033 ETH

After giving away a Tesla and with the upgrade to Points Parlor v1.2, DeGods is adding new NFT prizes, teasing a BTC DeGod valued at $13,000

🌎 Around Crypto and Web3

A few other Crypto and Web3 headlines that caught my eye:

The crypto market fell over the weekend; BTC -0.5% at $25,670; ETH -2% at $1,590; SOL -4% at $17.67

Base is uniting with industry giants like Aave, Centrifuge, and others to form the Tokenized Asset Coalition (TAC), aiming to propel the adoption of tokenized real-world assets

Nissan opened its virtual Heisman House where users can play games, hang with former winners, and experience Heisman history, while also able to claim a free All-Access NFT which gives holders the chance to earn exclusive benefits

🚀 NFT Total Volume

MAYC (1,152 ETH, 5.24 ETH Floor)

BAYC (688 ETH, 27.1 ETH)

Azuki (568 ETH, 3.84 ETH)

DeGods (435 ETH, 4.35 ETH)

Nouns (354 ETH, 35.75 ETH)

📈 NFT Floor Price Increase

PSD by lors (250%, 0.78 ETH Floor)

Acid Pepes by lors (200%, 0.42 ETH)

Budverse Cans (106%, 0.4 ETH)

Blips (18%, 0.15 ETH)

v1 CryptoPunks (9%, 3.53 ETH)

🗓 Upcoming NFT Mints and Reveals

Today is a lighter day of drops to start the week but with one marquee mint.

Artist Adam Genlight is back for his 2nd gmDAO mint with "A Daydream for Libby." I covered the drop in detail in Friday's newsletter, but for a quick recap:

It's Adam's follow-up to the majorly successful "A Fundamental Dispute"

548 supply, priced at 0.15 ETH available for gmDAO holders (public if it doesn't sell out)

The pieces are interactive and effectively become storybooks as the holder engages - something we haven't really seen before.

Given the success of Friday's art drop Acid Pepes, expect a lot of attention and demand on this one today.

If you want more, see the full list of today's drops from Swizzy's daily mint monitor.

Memes by 6529 (11:00 a.m. ET)

A Daydream for Libby (2:00 p.m. ET)

Michelin 3xplorers (6:00 p.m. ET)

Enjoy this write-up and/or want to sponsor the Morning Minute? Follow along with me on Twitter @tyler_did_it or reach out via email tyler.warner@luckytrader.com.

For all volume and floor price data, see Lucky Trader's Project Rankings page.

For all upcoming mints, see Lucky Trader's NFT Calendar page.