Why The Pokemon Scandal Is Bullish for NFTs

The Pokemon community has been rocked by a rare card skimming scandal; here's how NFTs solve this issue. And has the crypto market topped?

TylerD's Market Summary

GM!

Today's top news includes:

Pokemon rocked by skimming scandal

Has crypto topped?

Memeland leading bleeding NFTs

Starbucks doesn't mint out

Moonpay partners with ENS

🚩Pokemon Rocked by Skimming Scandal

The largest media franchise in the world isn't Mickey Mouse or Star Wars.

It's Pokemon.

Pokemon has made over $76B in revenue since inception, including a staggering $1.6B in 2022, in their best year of their 25-year history.

And now they might be facing their biggest threat yet.

A recent scandal has blown up, rocking the community and forcing the company to respond.

Rare Pokemon trading cards have allegedly been stolen by an employee off one of the game's printers, in a scheme that has potentially been happening for a long time.

The Details

Rare Pokemon trading cards from the "Fusion Strike" and "Evolving Skies" sets published in 2021 were targeted

One of the employees involved tried selling the cards in bulk at a Texas hobby store called Trading Card World

Workers at Trading Card World noticed that something might be up, given the difficulty of one person having so many rare cards, and alerted Pokemon

Pokemon allegedly launched an investigation and asked Trading Card Word to stay quiet during the investigation

The return of these cards resulted in the "largest return of stolen property to date."

Why It Matters

Trust in Pokemon is understandably shaken as a result.

People are saying "Pokemon just rugged."

Collectors buy packs expecting a fair chance (albeit low) to pull rare cards.

If the production companies are holding those rare cards back, pack buyers have no real chance of pulling the best cards.

And thus their incentives to buy packs falls considerably.

Even worse, Pokemon effectively covered the scandal for months while investigating. The skimming could have still been happening!

The Pokemon company has responded but is seemingly in denial of the magnitude of the issue:

"We take the protection of our IP and associated products very seriously. This matter remains under investigation and we cannot comment on details at this time. However, we can confirm that Sword & Shield booster packs and products were shipped to retail as intended and we have no indication that the integrity of the products were impacted by any confirmed or unconfirmed theft."

Not a great response.

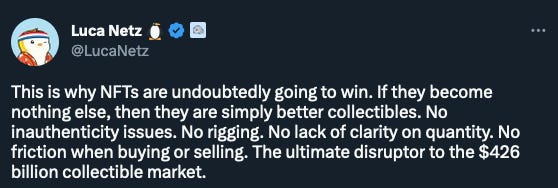

How NFTs Solve This

The beauty of rolling out collectibles via NFTs is that everything is public on the blockchain.

Provenance and authenticity are easily provable.

Full supply and rarity stats are known as soon as a collection mints out (or is revealed).

If a mint is rigged (i.e. rares go to one wallet, are front-loaded, etc.), the collectors find out almost immediately and push back.

This Pokemon scandal took place 2 years ago and is just now coming to light.

If a similar scandal happened via an NFT drop, it would have come out within 2 hours or less (maybe 2 minutes).

And the collectors are not reliant on the centralized body to tell them what is happening - everything is easily discoverable in a decentralized manner.

NFTs are inevitable for the world of collectibles - it's just a matter of time.

📉 Is The Crypto Top In?

Legendary crypto trader GCR tweeted an ominous message in Chinese yesterday.

Luckily we have Google Translate.

The message?

"Take profits."

GCR famously called the top of the 2021 crypto bull run and the recent bottom as well and is one of the more trusted traders in the space for his calls.

Is crypto in trouble?

Bitcoin is down 10% from local highs of $31,000, now at $28,000

ETH is down 10% from local highs of $2,130, now at $1,910

All while the market is gambling on random shitcoins every day.

Feels toppy.

Have NFTs Bottomed?

If crypto has topped, is that bullish for NFT price action?

Many have speculated that once the crypto run cools off, NFTs might see a resurgence.

That is certainly hard to see right now when looking at the Blur board, which is washed in red for basically every collection/ecosystem other than Azuki and Memeland.

Punks and Apes are at 48 ETH, the lowest levels in several months

Mid-tier PFPs like Doodles, Moonbirds and Clone X are below 3 ETH and revisiting their mint price levels

The Art Blocks market is in shambles, with Fidenzas at 53 ETH, a Ringers selling for 22 WETH this week, Archetypes at 10 ETH and Squiggles at 9 ETH

There are signs of capitulation, but we have seen those signs for a few weeks now.

Perhaps the most important signal is what is happening with Blur farming.

Blur TVL is at its lowest levels since the airdrop and SZN2 of farming began, indicating that many are giving up and pulling their liquidity.

Given that Blur farming has had the biggest impact on the current market, its reduction would be an indicator that the market might start returning to normal.

But for a real bottom, we need true buyers.

And is there a reason to buy many NFT collections right now?

Not really. But that's a story for another day.

So it's hard to say the bottom is in - but maybe we are getting close.

🚚 What else is happening in NFTs?

Here is the list of other notable headlines from the day in NFTs:

Trading volume was around 18.5k ETH on Thursday, up 8% from Wednesday; OS Pro captured 7% share, with Blur holding 56%

NFTs were mostly red again on the day, with Captainz and Potatoz leading top movers (up 16% and 12%) along with Moonbirds up 9%

Starbucks' recent NFT launch "The First Store" collection closed without selling out, as only 4579 of 5000 sold at its $100 price; immediately after, the floor surged over 100% before retracing to $147 overnight

Jack Butcher announced a snapshot is coming for Opepen holders on April 21 at 7 pm ET, ahead of the next stages of the Opepen evolution

Bong Bears NFT founders have raised $42M for a new L1 blockchain focused on DeFi called Berachain

Pixelmon has released its strategy whitepaper, detailing its Right-of-Game system and dual Web2 / Web3 economy

Cool Cats expanded their ecoystem with Shadow Wolves, a new NFT to be featured in their dynamic gameplay ecosystem; the mint is open from Apr 20 - May 19 and requires the burn of a Cool Cats Fracture (0.12 ETH)

Mocaverse NFT holders can now participate in exclusive tournaments on GAMEE's Arc8 gaming application; Mocaverse up 10% on the day to 0.75 ETH

Adidas has introduced a new series of shoes and hoodies with the Indigo Herz pack, token-gated for ALTs NFT owners

Killacubs have yet to mint out, with 7,528 minted so far with the floor even with mint price at 0.25 ETH

🌎 Around Crypto and Web3

A few other Crypto and Web3 headlines that caught my eye:

The crypto market fell again yesterday; BTC -2.5% at $28,000; ETH -2% at $1,910

$PEPE fell 30% on the day with its marketcap now below $100M again, perhaps a signal that shitcoin mania is nearing its end

Moonpay has partnered with ENS to make the ".eth" domain buying and registering process easier, with the ability to accept fiat payment methods like Apple Pay or Google Pay

TransUnion to provide credit scores for individuals applying for DeFi (blockchain-based) loans without exposing personal information

🚀 NFT Total Volume

Wrapped CryptoPunks (2,829 ETH, 48 ETH Floor)

BAYC (2,586 ETH, 48.1 ETH)

MAYC (2,185 ETH, 10.7 ETH)

Azuki (1,104 ETH; 14.8 ETH)

Captainz (835 ETH, 7.65 ETH)

📈 NFT Floor Price Increase

Captainz (17%,7.65 ETH)

Valhalla (11%, 0.6 ETH)

Checks - Originals (10%, 0.4 ETH)

Mocaverse (10%, 0.75 ETH)

Potatoz (9%, 3.05 ETH)

🗓 Upcoming NFT Mints and Reveals

Not too much on the docket today after a big day yesterday.

The Meme card is coming from Crypto Climates and will be 669 in supply, likely the mint of the day with a light list.

KrisK is launching their open edition at 0.015 ETH this afternoon, and then Celestia Ultimate is an unlimited mint at 0.8 EH for their blockchain-based MMORPG.

Memes by 6529 (11:00 a.m. ET); 0.06529 ETH

Spring and Autumn by KrisK (1:30 p.m. ET); 0.015 ETH

Celestia Ultimate - Solar Land (5:05 p.m. ET); 0.8 ETH

Enjoy this write-up? Follow along with me on Twitter @tyler_did_it or reach out via email tyler.warner@luckytrader.com.

For all volume and floor price data, see Lucky Trader's Project Rankings page.

For all upcoming mints, see Lucky Trader's Project Schedule page.