Tokenized Funds Are Coming to Arbitrum

Plus crypto majors rally with a surprising leader and a surprising alt runner

TylerD's Market Summary

GM!

Today's top news:

Crypto majors rally as recovery continues, ETH leads

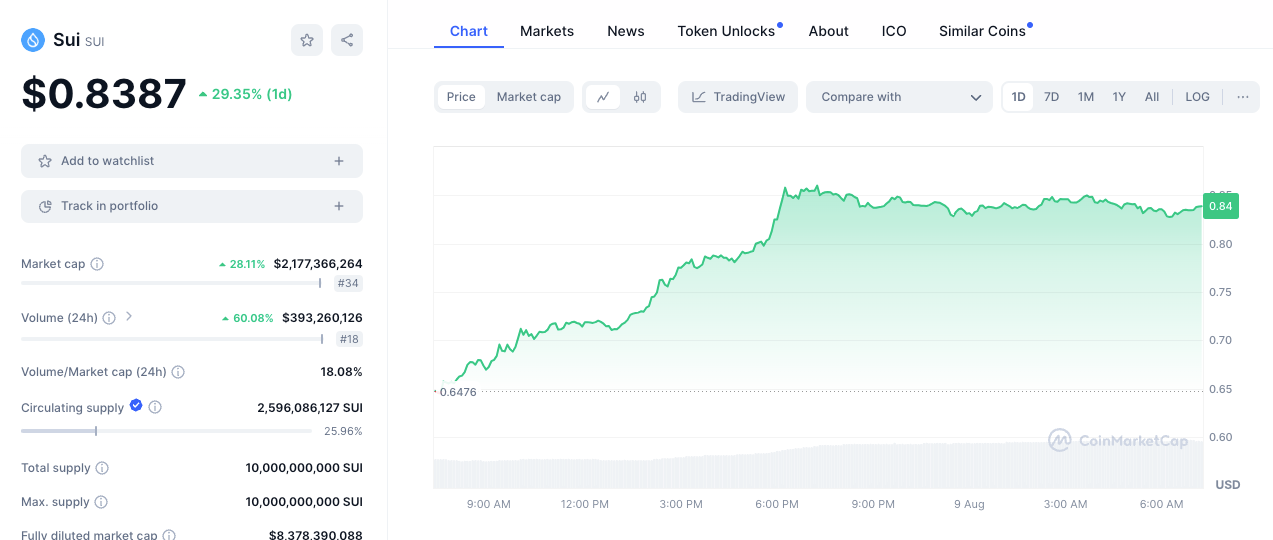

SUI soars 30%, calls for alt szn pick up

Franklin Templeton launches tokenized fund on Arbitrum

Pump Fun intros free coin launches and fees to creators

RTR launch turns to debacle as Trump family denies, Kanpai Pandas tank 40%

💰 Franklin Templeton Launches Tokenized Fund on Arbitrum

The next big narrative for Ethereum and perhaps crypto overall is tokenization.

Tokenization of all real world assets, likely starting with funds of various kinds.

Well the future is here, thanks to Franklin Templeton and Arbitrum.

What Happened?

Yesterday Franklin Templeton launched their Onchain U.S. Government Money Fund FOBXX on Arbitrum.

For a quick reminder, Franklin Templeton is one of the world's biggest asset managers with $1.5T in assets under management.

Quick TLDR of the FOBXX launch:

FOBXX invests 99.5% of its assets in US government securities, cash and repurchase agreements with a focus on preserving capital while capturing yield

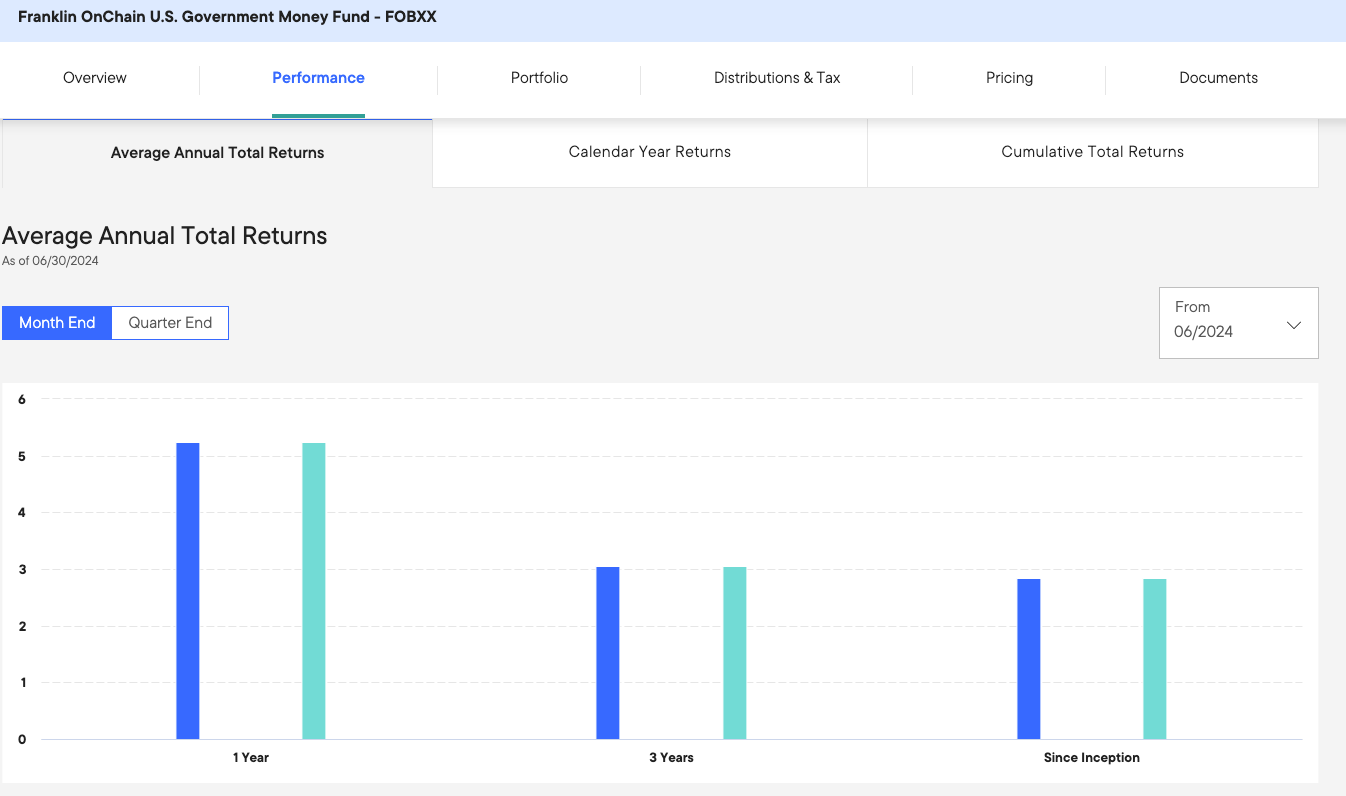

It returned 5.24% yield in the past year and 3% over the past 3 years

FOBXX had $420M in assets as of July 31

The Arbitrum launch is part of a wider initiative to widen access to retail investors

Franklin Templeton's head of digital assets Roger Bayston told Decrypt:

"The cost of using the network [and] the resiliency and the scalability of the network are all… factors that we take into consideration when we are building [FOBXX’s] wallet infrastructure into various blockchain ecosystems."

Bayston went further, mentioning their efforts with regulators:

"What’s super important for us is to not just work with the network’s team, but also with our friends in the… SEC to speak about why [the fund’s launch] improves outcomes for all the stakeholders that are involved."

Why It Matters

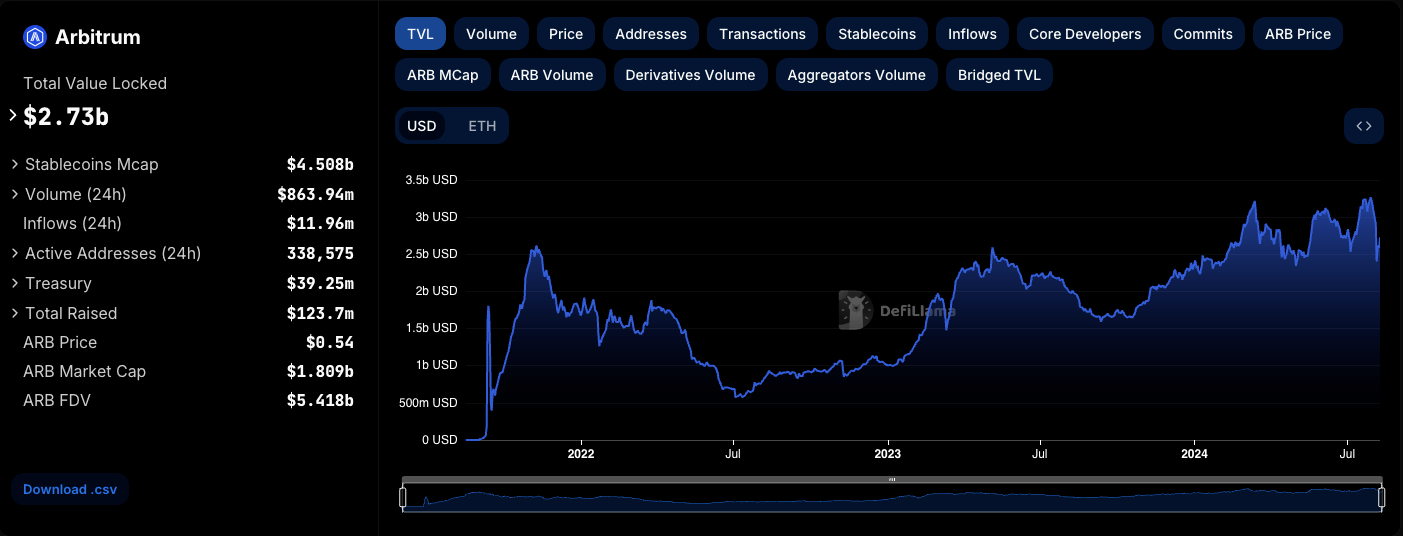

Zooming in, it's bullish for Arbitrum (and ETH) that investment giants like Franklin Templeton trust it with launching funds of this size.

And strengths like resiliency can only be proven over time, giving the existing L2s with the most TVL (i.e. Arbitrum) and history a leg up in the race to capture the tokenization effort.

It also provides onchain traders with new options for their capital, especially for those who look to go risk off and sell crypto for stables (vs simply holding majors).

Zooming out, the tokenization effort is clearly making more progress than some may realize.

The tokenized treasury market has already reached $1.8B in size, largely thanks to BlackRock's BUIDL fund (which has already paid out $7M in dividends this year).

Seemingly, the SEC has already given their wave of approval.

So tokenization is only going one way from here - up.

And Ethereum (and its L2s) is clearly the blockchain of choice.

🚚 What else is happening in NFTs?

Here is the list of other notable headlines from the day in NFTs:

ETH led NFT trading volume with $4.5M on the day; Bitcoin was next with $2.8M, and then SOL with $2.7M

ETH NFT leaders mostly chopped; Pudgy even at 8.4 ETH, BAYC -1% at 9.69, Milady +3% at 3.95

Zer0 Name Service (+70%) and Mittaria (+30%) were top movers; Kanpai Pandas a notable loser down 38% after the RTR debacle

BTC NFT leaders were mostly green; NodeMonkes +6% at 0.129 BTC, Puppets +8% at 0.09 BTC, Quantum Cats +1% at 0.264, OMB +6% at 0.177

The Runes leaders were green as well; DOG +4% at $319M mc, RSIC +14% at $50M mc, PUPS +12% at $39M

Solana NFTs were red; Mad Lads even at 55 SOL, SMB Gen 2 even at 22, DeGods -19% at 21

Doodles announced a new hyper-limiter apparel collaboration with adidas

ApeChain partnered with Sushi Labs to build its first DEX and Nirvana Labs for dApp development

💰 Token, Airdrop & Protocol Tracker

Here's a rundown of major token or airdrop news from the day:

Pump Fun introduced 2 new changes to their mechanism including 1) making coin creation free and 2) giving creators 0.5 SOL if their coin reaches the bonding curve

Vega, a blockchain and DEx backed by Coinbase Ventures, added prediction markets to its DEX app

$MEW & $MEME perpetual futures went live on Coinbase International and Coinbase Advanced

🌎 Around Crypto and Web3

A few other Crypto and Web3 headlines that caught my eye:

Crypto majors are green with ETH leading; BTC +6% at $60,600; ETH +8% at $2,640, SOL +1% at $156

Memecoin majors are slightly green up 4-10% with DOGE +4%, PEPE +9%, WIF +9%, BONK +3%, MOG +12%

Sui soared 30% after being touted by Raoul Pal and others as the next Solana-like L1 with potential to take off

Customer's Bank was hit with an enforcement action from the FRB related to its digital assets business

Tether plans to double its staff to 200 in the next year with the new resources focused on compliance

Eric Trump confirmed that the official Trump project has not been announced and to stay tuned, news that sent the RTR token down 90%

Russian President Putin signed bill to legalize crypto mining

Animoca Brands announced a new partnership with Lamborghini to help drive brand engagement

🚀 Memecoin Movers

$WDOG (+55%, $12.6M market cap, SOL)

$ANDY (+40%, $14M market cap, Blast)

$BRAINLET (+33%, $17M market cap, SOL)

$BEER (+31%, $13M market cap, SOL)

$FWOG (+17%, $19M market cap, SOL)

📈 NFT Floor Price Increase (ETH)

Wilder Beasts (55%, 0.07 ETH Floor)

Radbro (47%, 0.09 ETH)

Keepers (45%, 0.04 ETH)

Remnants (17%, 4.79 ETH)

Sam Spratt - Luci (13%, 7 ETH)

🗓 Upcoming Mints and Events

Today is a slower day of mints to end the week.

Shoneec is the meme card artist and MIO is doing a drop on Bitcoin.

See the full list and dive in for more details with Swizzy's daily mint monitor.

Neurochain.AI - 4NCN (8:00 a.m. ET)

Memes by 6529 (11:00 a.m. ET)

Mio - PunkRoyale (11:00 a.m. ET)

Doodles x Coi x Pharrell Williams (3:00 p.m. ET)

Enjoy this write-up and/or want to sponsor the Morning Minute? Follow along with me on Twitter @tyler_did_it or reach out via email to tyler.warner@luckytrader.com.