The SEC vs Binance (and Crypto)

Binance and the broader crypto space is formally under attack in the U.S. Here's what you need to know.

TylerD's Market Summary

GM!

Today's top news includes:

Binance under attack

Crypto tokens called securities

Jack releases Opepen 005

OMB reaches a 4 BTC floor

MapleStory teases Doodles

🚨 The SEC Goes on Attack

"we are operating as a fking unlicensed securities exchange in the USA bro" - Binance's Chief Compliance Officer in December 2018

None of the old emails or tweets are safe, as the SEC digs through the archives to try to make Binance and the larger crypto space look as bad as possible.

In fact, they led with that quote in their announcement tweet yesterday, sharing the news that they had charged Binance U.S and its CEO CZ with a variety of securities law violations.

CZ responded with his typical "4" (calling the suit FUD) - but is this really just FUD? Or something more serious?

The Binance Attack

This is the situation so far.

The SEC filed a lawsuit against Binance and its founder and CEO Changpeng "CZ" Zhao.

The lawsuit alleges that:

Binance violated federal securities laws by offering unregistered securities to the public through its native token BNB and its stablecoin BUSD

Binance's staking service violated securities law

Binance failed to register as a clearing agency, broker, and exchange

CZ secretly controlled Binance.US and inflated its trading volume through a CZ-owned and operated entity

Binance's poor financial controls allowed for the commingling and diversion of customer funds

BAM Trading, the operator of Binance.US, is also facing similar charges.

Beyond the items mentioned above, the heart of the lawsuit seems to revolve around Binance allowing U.S. persons to trade on its platform despite claiming otherwise.

The SEC alleges that Binance and CZ actively worked to circumvent controls and ensure that high-value U.S. customers could continue trading on the platform.

But the charges against CZ and Binance perhaps aren't the most interesting aspect of the suit.

Crypto Tokens Are Securities?

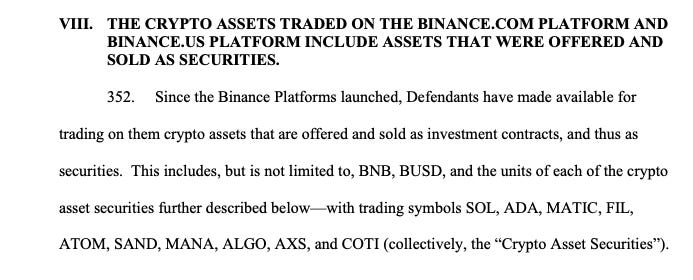

The lawsuit states that BNB and BUSD are securities, but goes further to call out several other tokens, including SOL, ADA, MATIC, COTI, ALGO, FIL, ATOM, AXS, ALGO, SAND and MANA.

This is a very notable list, featuring 4 of the top 10 coins by marketcap. It's a full on attack on crypto.

The inclusion of MANA, SAND and AXS puts the metaverse and gaming sector of NFTs squarely under the microscope, starting to impact the NFT sector.

Interestingly, ETH is left off the list, but perhaps not for long.

The SEC also used the language "includes, but is not limited to," when calling out those specific tokens above, which means they have left the door open for more crypto tokens to be deemed securities.

Early sentiment around why these tokens were chosen revolved around their being deflationary as well as being included on the Binance launchpad.

What You Can and Can't Say

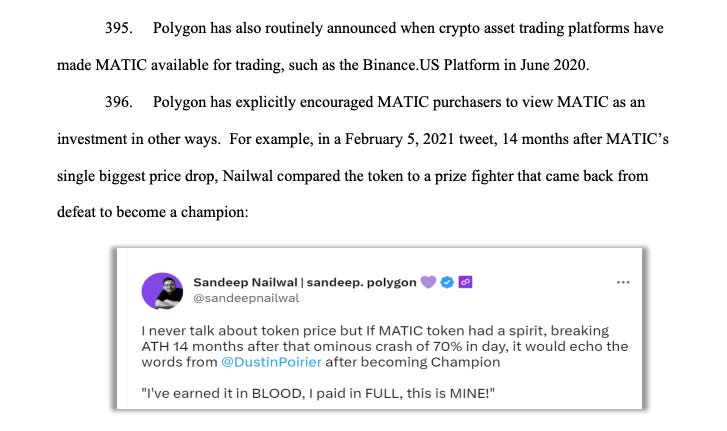

Founder promotion tweets seemed to matter as well (another lesson for founders across NFT and crypto).

A specific tweet from Sandeep Nailwal (Polygon CEO) was included in the lawsuit via screenshot, where Sandeep is talking about the price action of $MATIC and how he would react if MATIC hit a new ATH.

They also included the tweet below:

"I will not rest till @0xPolygon gets its well-deserved ‘Top 3’ spot alongside BTC & ETH. No other project comes even close.”

The SEC pointed to commentary like this as encouraging market participants to buy MATIC as an investment, thus Polygon had launched a security.

While there is certainly a spectrum of "egregiousness" of the tweets included, some of these really aren't that bad.

And it raises the question - where is the line? What can founders or promoters say about these tokens, safely?

That's certainly a storyline to watch as this unfolds.

Market Impact

Binance and the broader crypto market certainly took a hit after this news broke.

Binance saw over $700M in withdrawals in the hours following the lawsuit announcement.

Regarding some of the named tokens, most fell in 5%-15%:

BNB at $278 (-7%)

SOL at $19.94 (-8%)

MATIC at $0.83 (-7%)

ADA at $0.35 (-5%)

SAND at $0.52 (-16%)

AXS at $6.63 (-10%)

MANA at $0.45 (-13%)

Crpyto market leaders BTC and ETH took a hit as well, albeit smaller, down 3%-4%.

Why It Matters

First holders of any of these tokens don't need to be worried about personal legal ramifications. The primary worry should be around token volatility as the matter of their being deemed securities is resolved.

It's clear that the SEC is leading Operation Chokepoint and trying to crack down on the crypto sector.

And their actions will likely continue to drive innovation outside of the U.S.

The UK recognizes that, with its Digital Assets group stating yesterday that "The UK must move within a finite window of opportunity within the next 12-18 months to ensure early leadership within this sector."

The best outcome here in the U.S. would be a ruling on this case that provides some clarity on what is and what is not a security, and the beginnings of a crypto regulatory framework can be developed.

But it remains to be seen if we will get that.

Until then, expect more volatility.

🚚 What else is happening in NFTs?

Here is the list of other notable headlines from the day in NFTs:

Trading volume jumped back to 16k ETH on Monday, led by BAYC which saw nearly 7k ETH volume alone; most NFTs chopped on the day

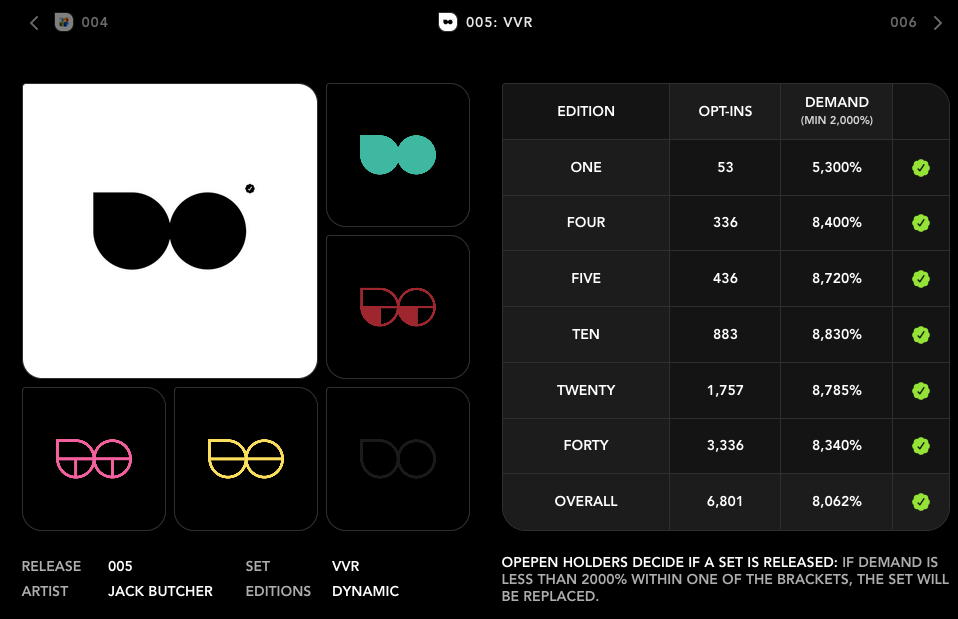

Jack Butcher dropped a VR-themed pack for Opepens called "VVR" on Monday, with the stipulation that it must be 2,000% over-subcribed to be released

ALTS by adidas tweeted that holders should get their Rift Valley Motel Coins ready because Chapter 2 continues at the end of June

Ordinal Maxi Biz (OMB) reached a 4 BTC floor, as the 191 supply Ordinals collections from ZK Shark becomes a leading BTC NFT set

🌎 Around Crypto and Web3

A few other Crypto and Web3 headlines that caught my eye:

The crypto market fell on Monday following the SEC suing Binance news; BTC -3.7% to $25,760; ETH -2.5% to $1,820

Apple shared details for its new mixed reality headset Vision Pro on Monday, with speculation about its metaverse impact already beginning

MapleStory Universe, a game ecosystem with 180M users, shared a teaser featuring a Doodles character in an animated world

🚀 NFT Total Volume

BAYC (6,960 ETH, 46.8 ETH Floor)

Azuki (2,644 ETH, 17.79 ETH)

MAYC (1,061 ETH, 10 ETH)

Opepen (411 ETH, 0.9 ETH)

Beanz (395 ETH; 1.6 ETH)

📈 NFT Floor Price Increase

Kitaro World (72%, 0.11 ETH Floor)

reepz (38%, 0.08 ETH)

Full Send Metacard (30%, 0.3 ETH)

Mutant Hound Collars (23%, 0.48 ETH)

Killabears (10%, 1.65 ETH)

🗓 Upcoming NFT Mints and Reveals

A few events today to watch. OSF is the rotating artist for SuperRare's RarePass today, which saw a surge to 22 ETH after OSF was announced.

Then for those in the Starbucks program, there is a snapshot happening today for those who own at least 1 limited-edition stamp and have completed 2 or more Journeys.

If you want more, see the full list of today's drops from Swizzy's daily mint monitor.

Metabrc (9:00 a.m. ET) - (BTC)

The 11th Hour from 6529er (11:00 a.m. ET)

OSF x SuperRare RarePass (TBD)

Starbucks Odyssey snapshot (TBD)

Enjoy this write-up? Follow along with me on Twitter @tyler_did_it or reach out via email tyler.warner@luckytrader.com.

For all volume and floor price data, see Lucky Trader's Project Rankings page.

For all upcoming mints, see Lucky Trader's Project Schedule page.