The Case(s) Against WorldCoin

WorldCoin rocketed to a $30B valuation on its launch day yesterday. Here's why that is concerning, and why it highlights other risks with this proof-of-personhood launch.

TylerD's Market Summary

GM!

Today's top news includes:

WorldCoin debuts at $22B FDV in controversial launch

The Grapes lead top ETH NFT movers in mixed day

Opepen Set 10 reveals, opens at 2x floor

LooksRare adds a GM button

Big week ahead for macro with FOMC and more

👁 WorldCoin's Controversial Debut

The public outcry and pushback against WorldCoin on its launch day seemed to greatly outweigh its open support.

Why is that?

The arguments against WorldCoin revolve around privacy and security, accessibility, centralization, and its tokenomics, with Vitalik even weighing in on the debate.

Before diving into each of those, quick background on WorldCoin and its mission.

What Is WorldCoin?

WorldCoin was co-founded by Sam Altman, now famous for being the CEO of OpenAI.

The idea of WorldCoin goes hand-in-hand with OpenAI, as Sam believes that there is a good chance that AI will create wealth but also take away a huge chunk of human jobs, while also making it nearly impossible to differentiate between AI-created bots online and real humans.

Thus WorldCoin tries to tackle those issues by launching a global UBI (Universal Basic Income) and a proof-of-personhood system to verify real humans.

There are 4 components to the WorldCoin project:

WorldCoin: Its cryptocurrency $WLD, providing a path to AI-funded UBI

World ID and WLD: Its global ID system, one available per real human

World App: Its protocol-compatible wallet, required to reserve $WLD

Orbs: Biometric verification devices, key to the proof-of-personhood system

The orbs are the most controversial and widely talked about aspect of this ecosystem, as people seem to have a strong reaction to scanning their irises to verify their humanity (along with concerns over handing over their iris data to a central party).

But the token and its tokenomics took over the debate yesterday on launch day.

$WLD shot up as high as $3.30 at peak after it launched early yesterday morning, before falling overnight and settling at $2.14.

Even at $2.14, WLD already has a $21B FDV - mostly because of its tokenomics.

WorldCoin Tokenomics

WorldCoin launching with around 100M tokens on day 1, about 1% of their total supply of 10B tokens.

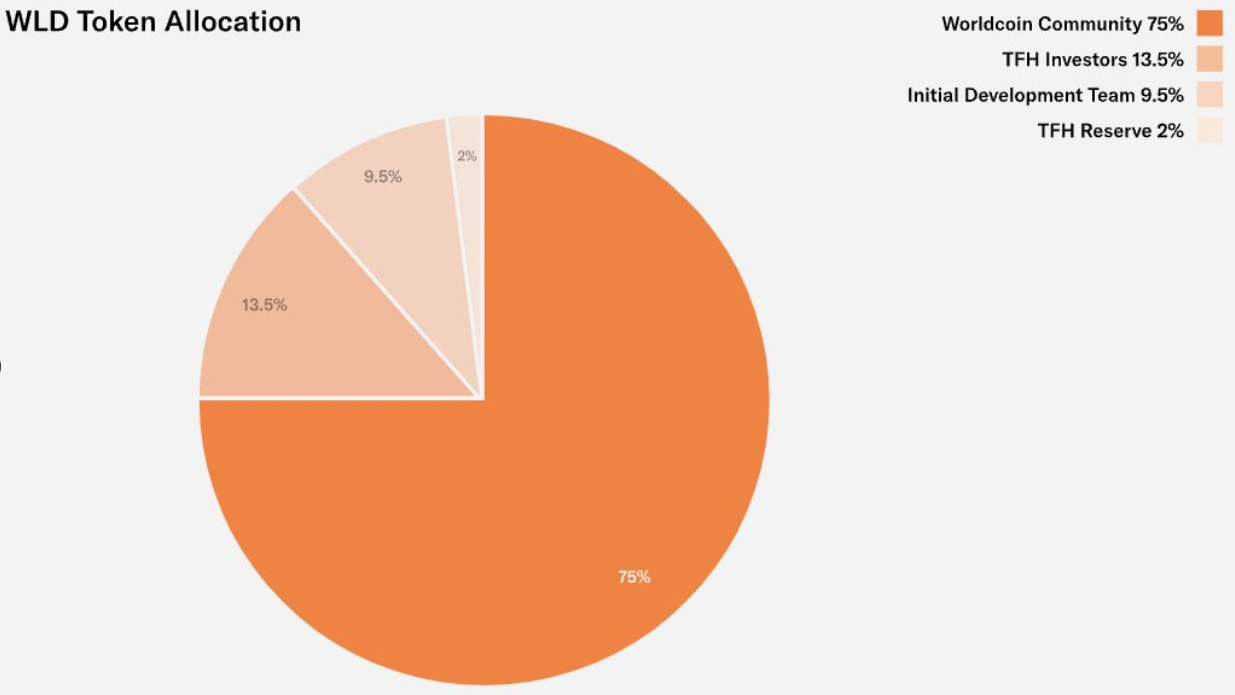

The token allotment breakdown is as follows:

75% of the tokens have been earmarked for the community

13.5% to investors of Tools for Humanity

9.8% to the initial development team

1.7% in reserve

Interestingly, that allocation to insiders increased to 25% from the 20% previously shared earlier "because the process of developing and launching the network was more 'complex and costly' than initially thought."

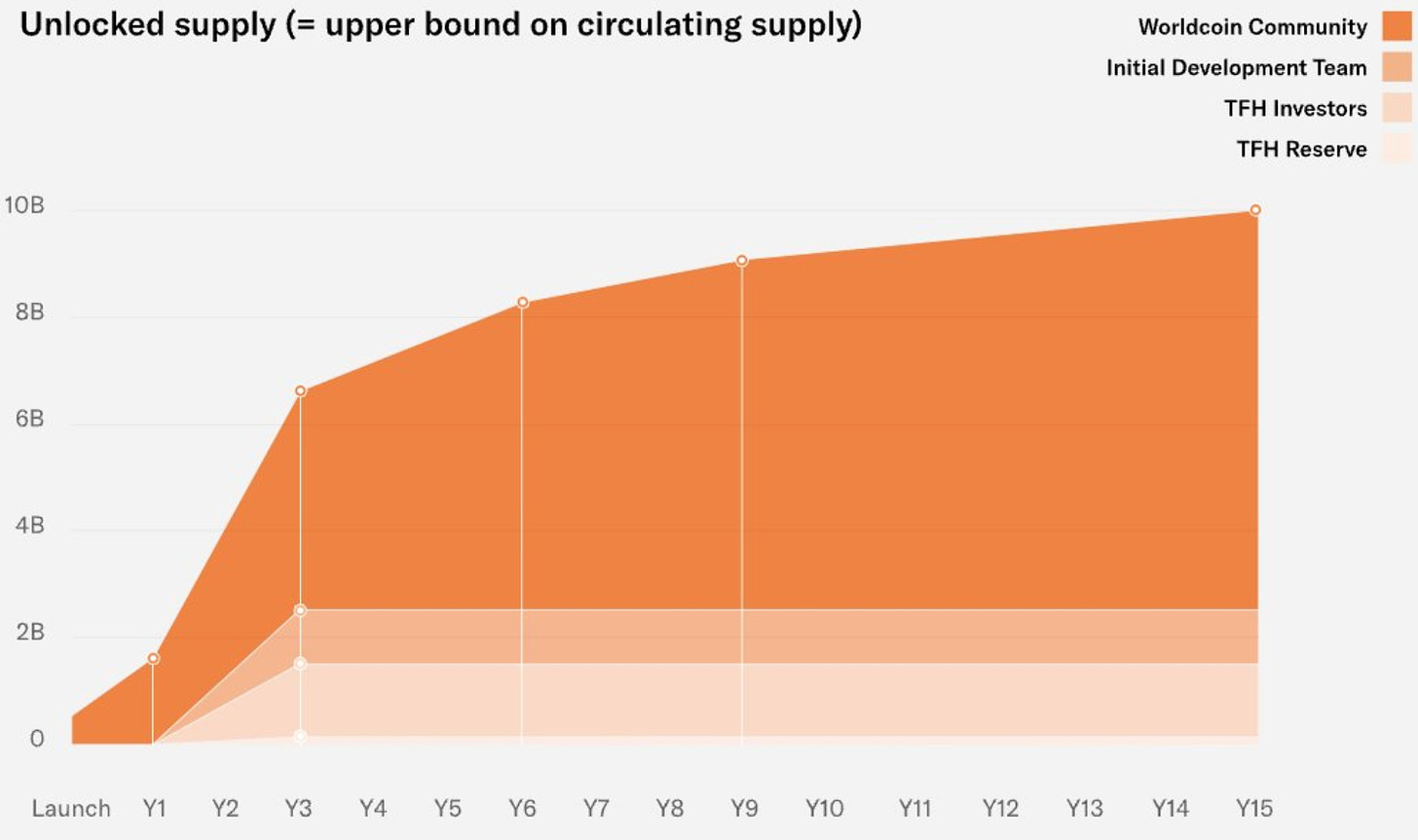

As for vesting, the insider tokens vest (evenly) between years 1 and 3, while the community tokens vest across 15 years.

Now for those tokens given to the community - only 43M were available at launch, with 100M available for loan to market makers (not all claimed yet).

As of this morning, just 107M of the 10B tokens are in circulation (1% of the supply).

That makes the team's allocation worth over $2B on paper on day 1, an insane day-1 payday.

Tokenomics Backlash

This highlights the predatory nature of this style of crypto token launch dubbed "low float, high FDV," a strategy where the team launches a very small % supply of the token to artificially drive up the FDV and thus their stake.

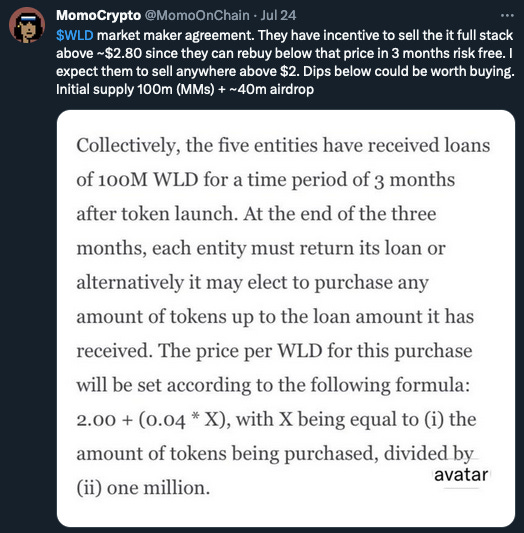

Another complaint has been regarding 100M tokens going to market makers while real users received just 43M tokens (at 25 per person).

Those 100M tokens were given as loans to be returned after 3 months in order to make the WLD coin more liquid for trading in the early days.

But the reality is, these market makers have the chance to buy tokens at a specific price during that 3-month period and thus are able to capture a spread - a huge windfall for a function that would have happened organically in the market (even if at smaller scale).

The last point of contention here - the team fully vesting within 3 years while the community vests over 15.

This is a common tactic in crypto and web3 but also perhaps the worse tactic. Founders' incentives are not aligned with their communities when they can exit 2-3 years post-launch with most of all of their money.

It's completely different from traditional raising and lock-up models and leads to token valuations skyrocketing in the early days/months before a gradual trend to zero in nearly every case.

So this is effectively a manipulated token launch to make the founders rich - on paper for now, but for real soon enough.

Now for the other contention points.

Vitalik Speaks Out

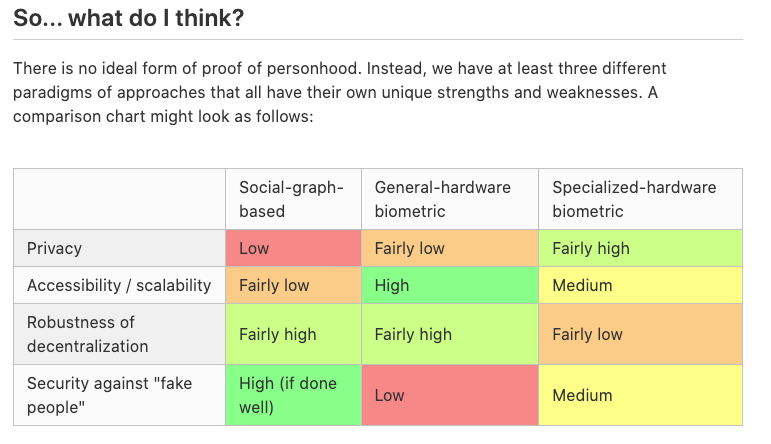

Ethereum founder Vitalik Buterin posted a very thoughtful piece about WorldCoin and proof-of-personhood yesterday.

The piece outlines the risks he sees to proof-of-personhood and how WorldCoin is set up, compared to other entities that have attempted proof-of-personhood.

It's far too long, and I'm not nearly eloquent enough to recreate it here, but I will summarize the core risks he pointed out.

Privacy: By storing information from your eye scan, there might be a risk to your privacy, which could be exploited in many different ways (with more dystopian outcomes anywhere with cameras).

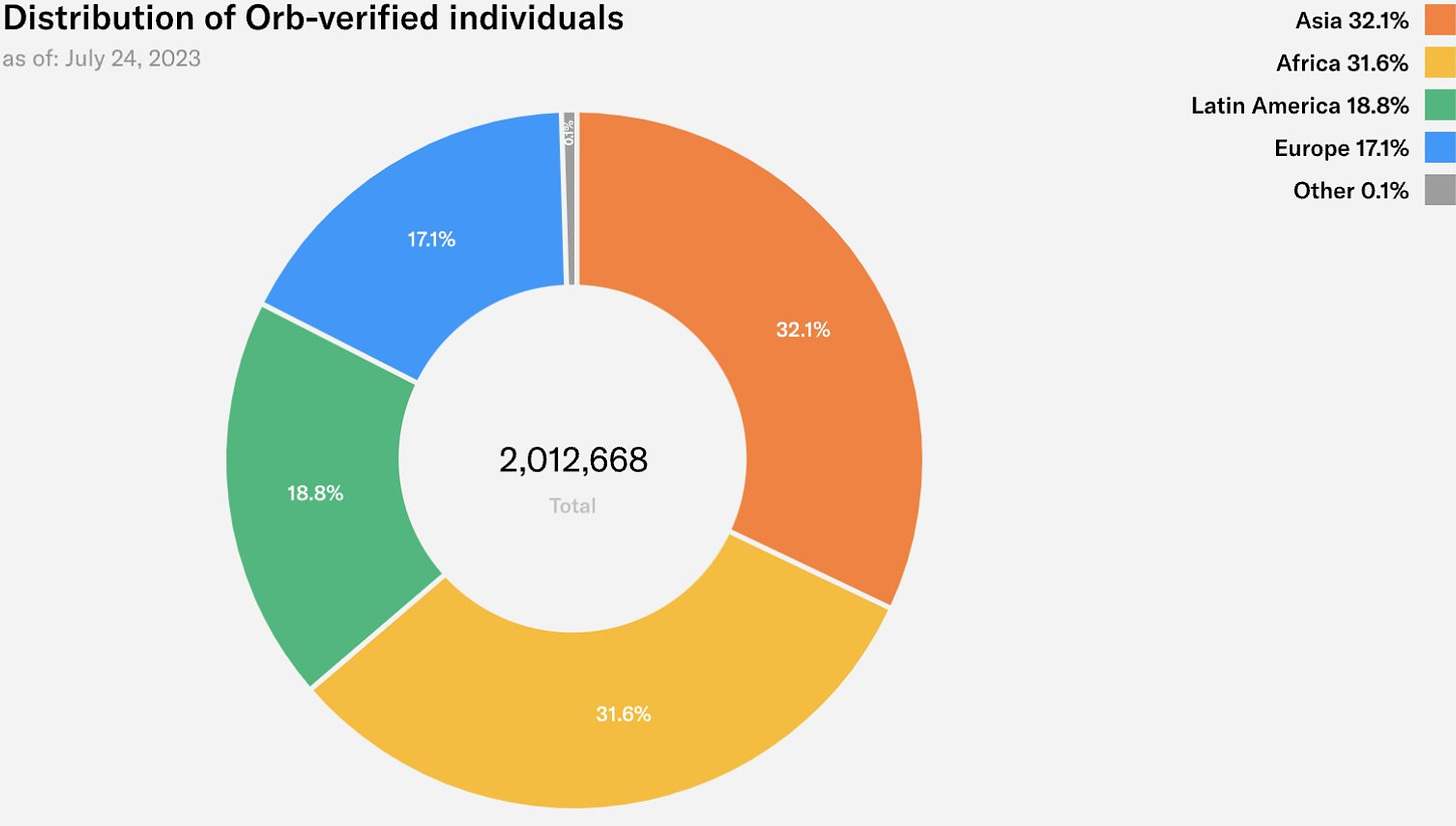

Accessibility: World IDs will not be easy enough for everyone to access unless there are enough "Orbs" located conveniently around the world. Currently, Worldcoin is scaling up to just 1,500 Orbs; for example, they are in just a handful of U.S. cities, let alone across continents like Africa.

Centralization: The Orb is a physical device that can't be thoroughly inspected for potential problems. Therefore, even if the software is designed to be decentralized, the Worldcoin Foundation could have a backdoor device allowing them to potentially manipulate the system and create fake identities.

Security: There are safety concerns. A user's phone could get hacked, or they could be pressured into scanning their eyes while using another person's public key. It might also be possible to create fake eye scans with 3D printing to get World IDs.

He then goes on to outline each of these risk areas in detail, comparing and contrasting the WorldCoin model to others. It's an incredible post and I encourage everyone to read it.

Conclusion

While the most common pushback so far seems to be related to the privacy aspect, the centralization component seems highest risk to me.

This is a whole lot of very valuable data, and a whole lot of money and power for one core team to hold even conceptually - controlling a global UBI. And some of their decisions made to date, especially lately regarding their predatory tokenomics, do not make them seem trustworthy.

Vitalik ends his post very diplomatically, sharing his risk ratings for WorldCoin compared to other proof-of-personhood systems and stating he does not envy those creating these systems.

He signs off by saying he looks forward to seeing more progress and more well-designed approaches in the future. It feels like a nice way of saying - this ain't it.

One thing is now certain - WorldCoin isn't going away any time soon. We now wait and see how widely adopted it becomes...

🚚 What else is happening in NFTs?

Here is the list of other notable headlines from the day in NFTs:

Trading volume came in just below 9k ETH on Tuesday; leading NFTs saw a mix of red and green with The Grapes leading top movers and HV-MTL and Opepen up slightlly

Jack Butcher revealed Opepen Set 10 yesterday afternoon; 11 of the revealed NFTs sold in the first 3-4 hours and the floor is at 1.19 ETH (almost 2x the current floor of 0.69 ETH)

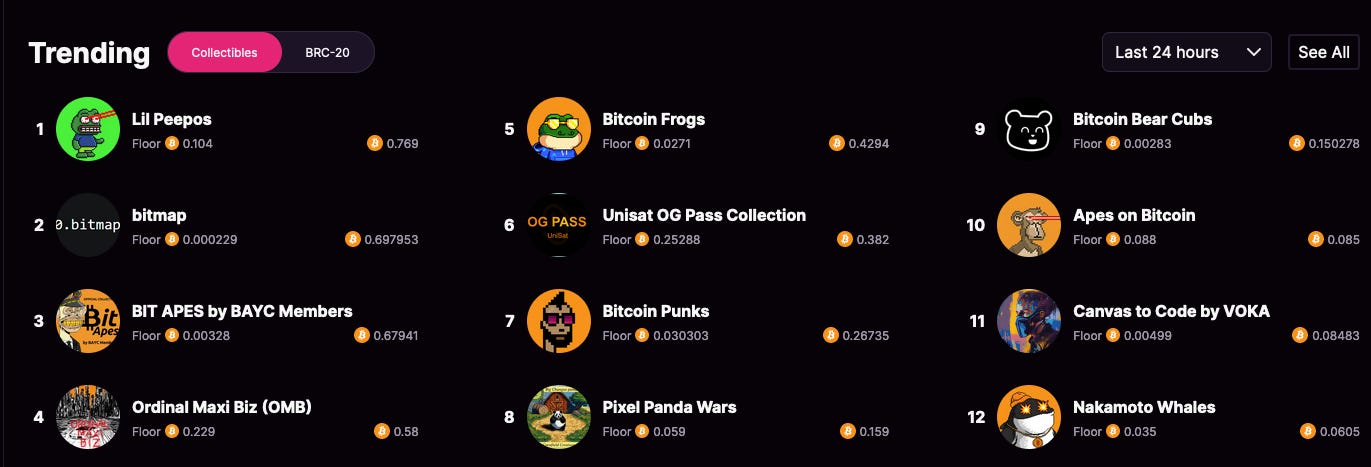

Bitcoin NFT volume has fallen off a cliff as of late, with 0.1 BTC volume (~1.57 ETH) being enough to reach the top 10 in trading volume on Magic Eden BTC

LooksRare has added a "gm" button to its site providing users with the chance to click the button daily to receive gems (and eventually $LOOKS) as rewards in a "gm-to-earn" model

Beeple shared that he is in the market for his first CryptoPunk, requesting suggestions on which he should pursue

Chimpers released their 5th adventure called "The Fluorescent Isles", opening up for gameplay on July 25

VeeFriends is teaming up with toy giant Jazwares to transform 4 beloved characters into Squishmallows for an exclusive release, coming Aug 7 priced at $24.99

🌎 Around Crypto and Web3

A few other Crypto and Web3 headlines that caught my eye:

The crypto market fell slightly on Monday; BTC -0.4% to $29,130; ETH even at $1,850; DOGE up 2% to $0.0777 on rumors Elon may integrate it with X

Transient Labs introduced Synergy yesterday, a new feature aimed at preventing unauthorized changes to NFT metadata; collectors will have the power to approve or reject metadata changes, and this logic will be embedded in their ERC721TL contracts going forward

It's a major week ahead for macro news, including Consumer Confidence data (7/25), an FOMC Meeting (7/26), the Q2 GDP Report + Unemployment data (7/27) and Core PCE data (similar to CPI) coming on 7/28, along with major token unlocks for Optimism ($37.7M) and SUI ($5.2M)

🚀 NFT Total Volume

BAYC (2,230 ETH, 30.9 ETH Floor)

Azuki (985 ETH, 4.74 ETH)

MAYC (797 ETH, 5.68 ETH)

DeGods (411 ETH, 8.41 ETH)

Pudgy Penguins (305 ETH, 3.99 ETH)

📈 NFT Floor Price Increase

The Grapes (46%, 0.27 ETH Floor)

Lazy Lions (28%, 0.3 ETH)

10ktf (25%, 0.16 ETH)

Sappy Seals (25%, 0.54 ETH)

Rektguy (22%, 0.55 ETH)

🗓 Upcoming NFT Mints and Reveals

Today is set to be a very slow day of new drops.

Two of the main events are just auctions end draws closing, with the Open Eyes (Flower) draw ending at 9 am ET and the Future Frequencies auctions ending at 12 pm ET. The main even there is definitely the Future Frequencies, with some major artists and pieces in those auctions.

The other drop to watch today is the Lala drop of Wolf of Wall Street collectibles coming at 10 am ET.

If you want more, see the full list of today's drops from Swizzy's daily mint monitor.

Avante Art x Cozomo x Jake Fried - Open Eyes (Flower) (9:00 a.m. ET)

Lalaxyz "The Wolf of Wall Street" (10:00 a.m. ET)

Future Frequencies - auctions end (12:00 p.m. ET)

Enjoy this write-up? Follow along with me on Twitter @tyler_did_it or reach out via email tyler.warner@luckytrader.com.

For all volume and floor price data, see Lucky Trader's Project Rankings page.

For all upcoming mints, see Lucky Trader's NFT Calendar page.