🤯 Tether Reports $5.2B in Profits in 2024

Plus VanEck lays out some eye-popping 2050 BTC price predictions.

TylerD's Market Summary

GM!

Today's top news:

Crypto majors dip amidst war escalation, other concerns

Tether reports $5.2B in profits in H1 2024

Senator Lummis officially intros BITCOIN Act for strategic reserve

Polymarket closes record-smashing month, $387M in volume

Doodles tease partnership with Arizona Ice Tea

💰 USDT Stablecoin Issuer Sees Massive H1 2024

Many in crypto had strong starts to 2024.

Crypto majors rallied 50%+ and many protocols launched billion-dollar tokens amidst the rally.

But no one had a better start to 2024 than Tether.

What Happened?

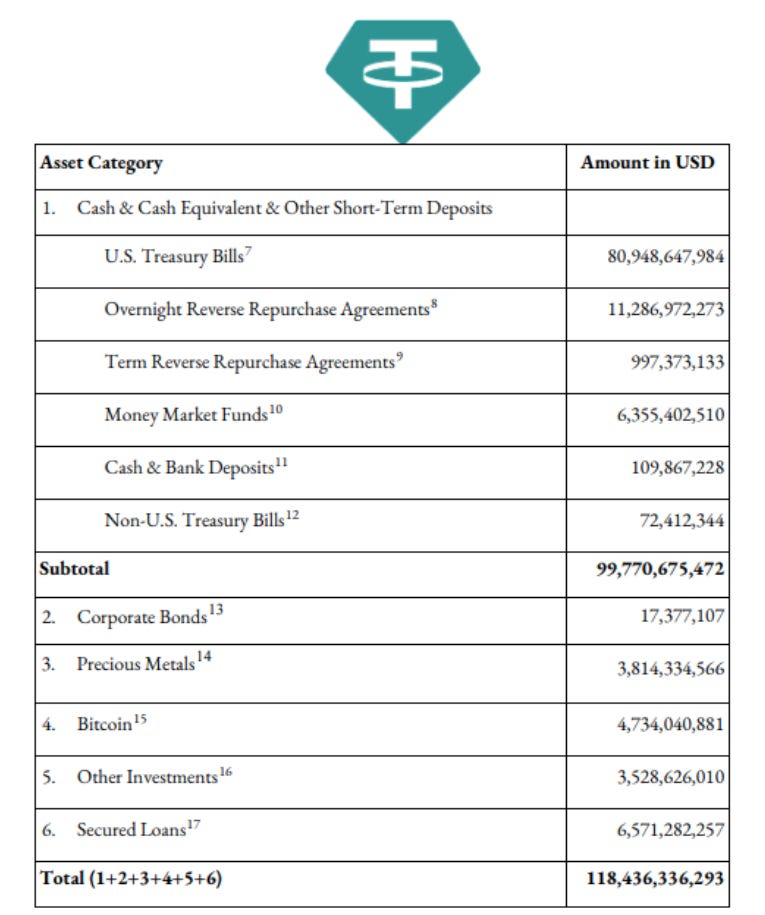

Tether reported a massive $5.2B in net profits for the first half of 2024 in its latest attestation report.

They hold $118.4B in assets against a reserve of $113.1B in liabilities, translating to a $5.3B excess.

Those assets notably include $4.7B in Bitcoin and $98B in US debt holdings, enough to rank 18th globally and with more than nations like Germany.

How Does It Work?

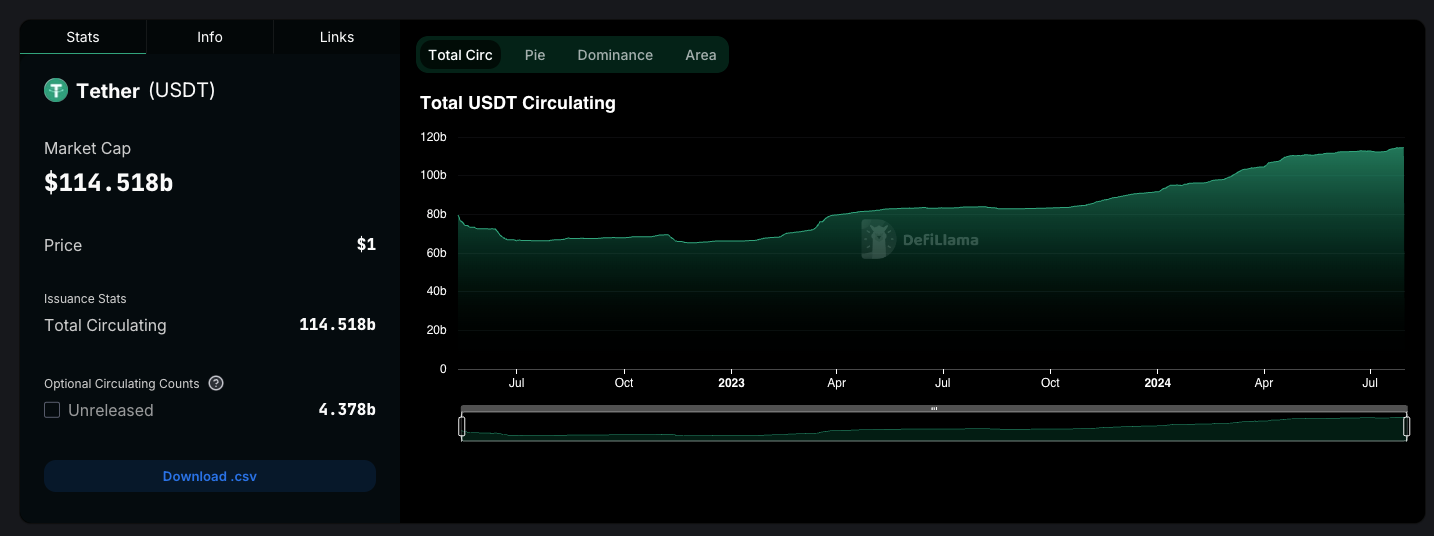

If you aren't familiar with Tether, they issue stablecoins which are pegged to fiat currency.

For their leading stablecoin USDT, it is pegged 1-1 to the USD and is backed 100% by reserves (which are published in their quarterly attestations).

The Tether 5-step lifecycle works like this:

KYC verified user deposits fiat (USD) into Tether

Tether issues tokens (USDT) and sends to the user, equal to the deposit minus fees

Tether tokens are used for transactions by the user at their discretion

A user can redeem USDT by depositing USDT back into Tether

Tether then removes those USDT tokens from circulation and sends the fiat currency (USD) back to the user

This is why tracking stablecoin supply is important for those monitoring the crypto market, because it shows how many people are effectively exchanging fiat for crypto, and in what quantities.

If all crypto asset prices stay the same, but more USDT is issued on a daily basis, the total crypto market cap will increase, and thus there is more money to be potentially used in the broader crypto economy (and potentially exchanged for other tokens like BTC).

Why It Matters

Tether is proving to be one of the most valuable companies in the world.

They have less than 100 employees and have generated $5B in profit in 6 months.

They are also instilling more confidence in their reserve assets, which were subject to question when stables briefly crashed back in the 2023 bear.

Others like Circle (USDC) are trying to match Tether's success.

And with Circle looking to IPO sometime soon (rumored at $5B valuation), savvy investors may look at buying in for exposure to another potential rocketship.

🚚 What else is happening in NFTs?

Here is the list of other notable headlines from the day in NFTs:

ETH led NFT trading volume with $6.3M on the day; Bitcoin was next with $3.2M, and then Solana with $2.6M

ETH NFT leaders were green, up 1-5%; Pudgy +1% at 9.64 ETH, Captainz +6% to 2.2 and BAYC +5% at 9.64

Notorious crypto whale Machi introduced a BAYC memecoin $BACY "fully backed" by BAYC NFTs, allowing each holder can trade a BAYC NFT for 100M BAYC (leading to the BAYC pump)

Memeland introduced NFT utility with nMEME on Stakeland, allowing the staking of different Memeland NFTs to accrue various levels of nMEME daily (Captainz +6% and Potatoz +13%)

BTC NFT leaders were mostly red again; NodeMonkes even at 0.12 BTC, Puppets -8% at 0.078 BTC, Quantum Cats -7% at 0.258, OMB -1% at 0.173

The Runes leaders were also mostly red; DOG -6% at $307M mc, RSIC +2% at $54M mc, PUPS -16% at $29M

Solana NFTs were red; Mad Lads -6% at 59 SOL, SMB Gen 2 -7% at 21.5, DeGods -1% at 13

Doodles teased a new limited edition collab with Arizona Tea coming tomorrow

Trump launched phygital Bitcoin shoes priced at $499 each, which sell out in 2 hours

💰 Token, Airdrop & Protocol Tracker

Here's a rundown of major token or airdrop news from the day:

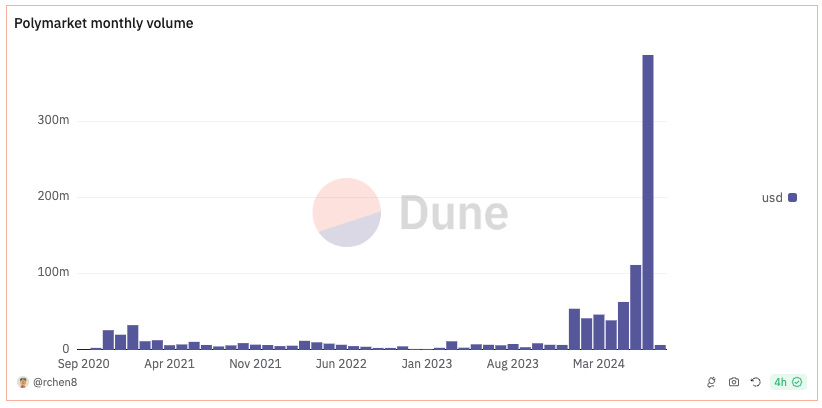

Polymarket closed the month of July with a record $387M in volume, up 250% on the month

Pacmoon completed its final $PAC airdrop to participants of its contest over the last month, promising to share a new chapter soon

Wasabi added leverage trading for $NEIRO after the coin continued to dominate market action through Wednesday

Fantasy Top introduced a new voting mechanism where FAN holders can vote to "evict" heroes and have them replaced with similar tiered heroes from a new pool

🌎 Around Crypto and Web3

A few other Crypto and Web3 headlines that caught my eye:

Crypto majors are red this morning; BTC -2% at $64,450; ETH -4% at $3,190, SOL -7% at $169

Memecoin majors are very red with DOGE -4%, PEPE -7%, WIF -14%, BONK -9%, MOG -15%

Senator Lummis officially introduced the BITCOIN Act into the U.S. Senate, which would implement a 1M unit purchase of Bitcoin over 5 years, along with storage, affirming self-custody and more

Lloyd's of London is bringing its insurance marketplace onchain on Ethereum

Van Eck laid out its 2050 price predictions for Bitcoin, with $130k as its Bear case, $2.9M as its Base case and $52M as its Bull case

🚀 Memecoin Movers

$FWOG (+111%, $33M market cap, SOL)

$GINNAN (+34%, $50M market cap, SOL)

$NEIRO (+19%, $164M market cap, ETH)

$TIME (+13%, $15M market cap, SOL)

$MSI (+10%, $19M market cap, ETH)

📈 NFT Floor Price Increase (ETH)

Xborg (55%, 0.85 ETH Floor)

Alts by Adidas (33%, 0.09 ETH)

Skyborne Nexian Gems (18%, 0.8 ETH)

L3E& Worlds (19%, 3.45 ETH)

Potatoz (10%, 0.9 ETH)

🗓 Upcoming Mints and Events

Today is a slower day of mints and events to kick off the week without any notable highlights.

See the full list and dive in for more details with Swizzy's daily mint monitor.

GOAT Gaming (10:00 a.m. ET)

orkhan - HolyMath (12:00 p.m. ET)

diid x Vertu Fine Art - Machine in The Ghost (1:00 p.m. ET)

Newtro - Onchain Summer (1:00 p.m. ET)

Mochi Circle (4:00 p.m. ET)

Enjoy this write-up and/or want to sponsor the Morning Minute? Follow along with me on Twitter @tyler_did_it or reach out via email to tyler.warner@luckytrader.com.