Signature Bank Shut Down and The War on Crypto

New information is trickling out that Signature Bank was shut down without merit to send a message to the crypto space. Here is what you need to know.

TylerD's Market Summary

GM!

Today's top news includes:

Signature Bank shut down in anti-crypto move

BUSD winding down?

Blur adds mobile buys

Yuga's TwelveFold mistake

Instagram shuts down NFT program

🛑 Signature Is Shuttered

Just 2 days after we saw the 2nd-largest bank failure in U.S. history, we got the 3rd-largest failure.

Signature Bank was shut down Sunday after a $10B run on the bank occurred over the weekend.

But now, more details are trickling out about "why" it happened.

Enter Signature Bank board member and former congressmen Barney Frank*.

“I think part of what happened was that regulators wanted to send a very strong anti-crypto message."

Quick sidebar - if that name sounds familiar, it's because it should. Frank co-authored the Dodd-Frank Act, which was brought into law in the wake of the 2008 financial crisis to prevent excessive risk-taking by banks.

By The Numbers:

A few interesting stats for Signature Bank tied to the shutdown:

$110B in assets at end of 2022

$88B in deposits

$16.5B in deposits from digital-asset-related customers (where crypto clients fit in)

$10B - the amount of the "run on the bank" on Friday that led to their collapse

According to Frank, this $10B run caught the Bank totally off guard.

“We had no indication of problems until we got a deposit run late Friday, which was purely contagion from SVB,” Frank told CNBC.

How It Went Down

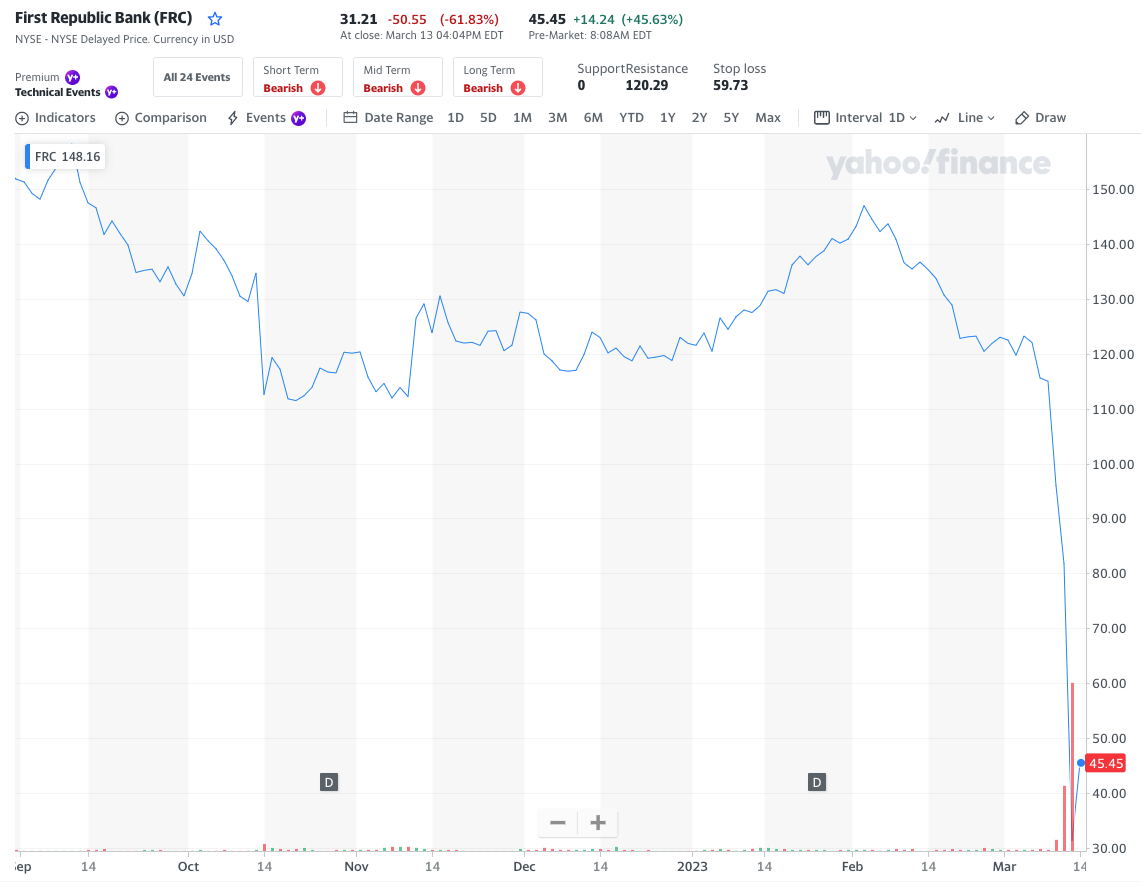

The "shadiness" and anti-crypto aspect of this story can be seen in comparison to the situation at First Republic Bank.

First Republic was facing a similar crisis over the weekend as Signature, seeing their own run on deposits.

Yet they made one marquee announcement on Sunday that Signature was unable to make.

First Republic had lined up $70B in liquidity from the Fed and JPMC.

This was apparently enough to keep them afloat through Monday (even though the stock price is tanking).

But this line of liquidity was not offered to Signature.

Signature execs had gathered Sunday to explore their options to shore up deposits and believed they had stabilized their situation.

The run on their bank had slowed.

Though just hours later, they came to learn that they were removed from the bank, and it was being shuttered.

There was no line of credit offered to Signature.

It was a tale of two banks - one famously crypto-friendly, and one not as much.

One is still standing, and one is not.

Frank went on to tell CNBC that there was "no real objective reason" for Signature to be seized.

He felt it was all a part of the anti-crypto regime.

“We became the poster boy because there was no insolvency based on the fundamentals.”

Here is a former Congressman and author of the Dodd-Frank Act publicly stating that Signature was shut down solely because of its ties to crypto and not based on an objective reason.

The war on crypto rages forward, and while this battle may have been lost, perhaps this will be the moment that turns out to be a rallying call for the pro-crypto regime.

💸 Binance Abandons BUSD?

Somewhat lost in the chaos that is the U.S. financial system right now was a major move from Binance.

Around midnight Sunday evening, CZ announced that Binance would convert the rest of its $1B Industry Recovery Initiative funds from BUSD to crypto.

They moved into a combination of BTC, BNB and ETH.

CZ tweeted about the move, bragging about how moving $980M took just 15 seconds and cost $1.29.

But where things get interesting is in the replies.

One of the highest-viewed replies praises that people "unnerved with recent stablecoin developments will feel more reassured."

CZ responds to that comment with "Didn't even think about it that way. Was just discussing how to keep the funds in a safe asset."

Does this seem to imply that BUSD was not a safe asset?!

He was asked as much, and then goes on to clarify that there will be no more new minting, that the marketcap will only decrease over time and so will liquidity.

These seem like fairly important details of the announcements to bury in the reply section.

Additionally, this move may have been somewhat in response to Coinbase announcing that is would disable trading for BUSD effective March 13.

Why It Matters

Stablecoins are squarely under the magnifying lens in crypto right now after the USDC depeg this past weekend, and the narrative is shifting around how "stable" they truly are.

BUSD is a major stablecoin, and overall cryptocurrency (11th biggest by market cap at $8.4B).

It's the 3rd biggest stablecoin by market cap, behind USDT ($74B mc) and USDC ($39B mc). DAI is next at $6.3 B mc.

With less major stablecoin options in play, crypto holders will have to choose where to park their assets and there will likely be new winners (perhaps Bitcoin?).

This dance of the stablecoins will be a very interesting one to watch as the fallout from SVB continues to play out.

🚚 What else is happening in NFTs?

Here is the list of the other major headlines from a slower day in NFTs:

Trading volume came in just over 26k ETH, up from Sunday but still clearly in a down trend, with most NFTs down slightly on the day

Blur enables mobile buying, sharing the major announcement yesterday that purchasing is now functional on the mobile app; $BLUR jumped 27% on the day following the news

Yuga's TwelveFold sparks controversy as the full collection is revealed on Ordinal Hub, showing a lack of variety in the outputs and a mistake duplication of TwelveFold 205

RTFKT shared a teaser of their next forging event taking place on April 24, along with a preview of an upcoming Murakami Animus event taking place in Japan on April 30

Jack Butcher airdropped Twelve Checks, a play on Yuga's TwelveFold, to all 12 holders of the single Check NFTs.

Memeland Potatoz holders can now quest their NFTs with "valuable" rewards on the line

🌎 Around Crypto and Web3

A few other Crypto and Web3 headlines that caught my eye:

The crypto market was up big on the day; BTC +11% at $24,500, ETH +6% at $1,680; $APE +2% at $4.36 and $BLUR +27% to $0.65

Instagram shutters its NFT program after just a few months of existence, in order to focus on other monetization products and opportunities for creators on the platform

Sesame Street is coming to the blockchain, as a Cookie Monster collection gets set for a launch on Veve coming on March 19

The Pokemon Company is currently hiring for Web3 roles, leading to speculation of their potential entry to the NFT space

🚀 NFT Total Volume

MAYC (3,142 ETH, 14.6 ETH Floor)

Wrapped CryptoPunks (2,407 ETH, 67.2 ETH)

BAYC (1,953 ETH, 66.3 ETH)

Azuki (1,765 ETH, 14.4 ETH)

Sewer Pass (1,180 ETH, 2.83 ETH)

📈 NFT Floor Price Increase

Hedz (66%, 3 ETH Floor)

Ethlizards (54%, 1.06 ETH)

Sewer Pass (20%, 2.83 ETH)

goblintown (21%, 0.47 ETH)

RTFKT Animus Egg (7%, 0.67 ETH)

🗓 Upcoming NFT Mints and Reveals

Today is another slow day for new drops with just two main drops on the calendar.

Pollen is semi-interesting because the artist is tied to RTFKT and their AF1 Space Drip shoes, but with 3,333 supply and 0.085 ETH mint, it's a bit on the pricey side.

The AI Art Collection Mint Pass from Bright Moments is likely the mint of the day, but BM Mint Passes typically sell out higher than the true value of the NFTs they represent, so be careful.

DraftKings Reignmakers: UFC 286 Event Pack (1:00 p.m. ET); $35 pack

Pollen (5:00 p.m. ET); 0.085 ETH mint

AI Art Collection Mint Pass (12:00 p.m. ET); Dutch Auction

Enjoy this write-up? Follow along with me on Twitter @tyler_did_it or reach out via email tyler.warner@luckytrader.com.

For all volume and floor price data, see Lucky Trader's Project Rankings page.

For all upcoming mints, see Lucky Trader's Project Schedule page.