Prime Trust and a New Crypto Scandal

A new crypto scandal is brewing with potential impacts to stablecoins and Binance. Find out what's happening, plus catch up on Azuki's Elementals debacle from yesterday.

TylerD's Market Summary

GM!

Today's top news includes:

Crypto scandal brewing at Prime Trust

Azuki fumbles with Elementals

Azuki Green Bean introduced this morning

DeGods flips Azuki in wake

Transient Labs launches The Lab

🚩 Prime Trust Breaks Trust

Somewhat overlooked in the recent crypto euphoria - a scandal is brewing.

Yesterday Nevada's Financial Institution Division filed to overtake crypto custodian Prime Trust and freeze its businesses.

Why?

They owe far more money to customers than they have on hand and are operating at an equity deficit.

Perhaps worse, stablecoin TrueUSD (TUSD) is caught up in this mess.

The Details

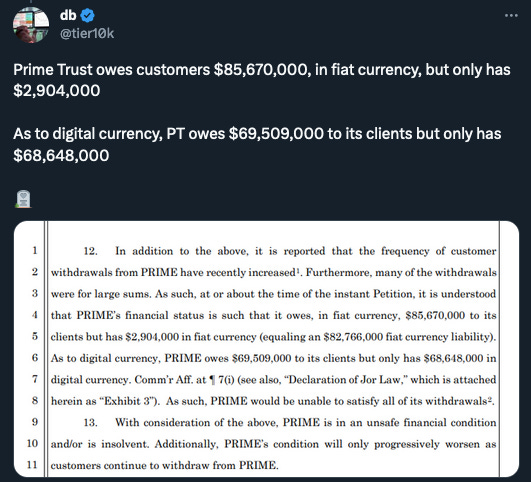

According to the filing from the FID:

Prime Trust allegedly owes over $85M in fiat, with only $3M on hand

They owe $69.5M in crypto and have $68.6M on hand

Their operations have a $12M equity deficit

The company is reportedly unable to access "legacy wallets"

That's bad.

It gets worse. See this quote from the filling:

"It is understood that from December 2021 to March 2022, to satisfy the withdrawals from the inaccessible Legacy Wallets, [Prime] purchased additional digital currency using customer money from its omnibus customer accounts. [Prime] is reported to have been making efforts to regain access to the Legacy Wallets. However, as of the date of this Petition, [Prime] has been unable to do so."

That sounds an awful lot like a ponzi scheme - using customer money to try to pay back other customer's whose money was lost.

But wait - it gets even crazier.

Is TrueUSD Fully Backed?

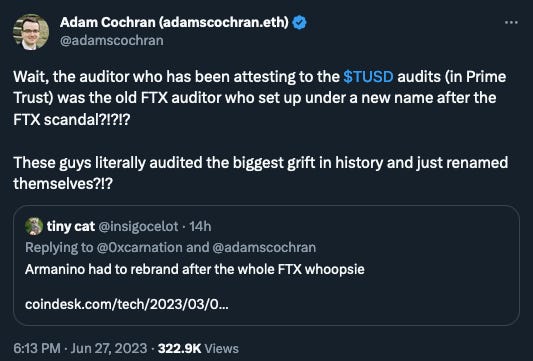

Enter Adam Cochran, notable CT personality.

According to his recent thread (which does point to real sources and evidence):

Prime Trust was being audited by "The Network Firm" - which is the old FTX auditor with a new name

Given their liabilities and cash on hand, it seems "impossible" that their TrueUSD is fully backed

Two recent prints of TUSD for $1B each went straight to Binance and are looking very suspicious (Binance then added incentives for users to trade with TUSD)

There are several firsthand reports of users trying to redeem TUSD and have been unable to do so

This is just a basic summary, the details look even worse.

There could be an explanation for all of this, but there are several red flags, and with this set of facts, the natural conclusion is that TUSD is not fully backed.

We will see how this unfolds and if CZ responds, but this smells like trouble.

🐇 Azuki's $38M Mess

Azuki was in the spotlight on Tuesday for their Elementals mint, the most hyped mint in months.

And it was a major let down (for holders), from mint mechanics to art reveal to team comms (or lack thereof).

But it doesn't look like things are quite done yet.

What happened? And where do they go from here?

Azuki Elementals Mint TLDR

As the situation is still evolving, I'll be brief this morning:

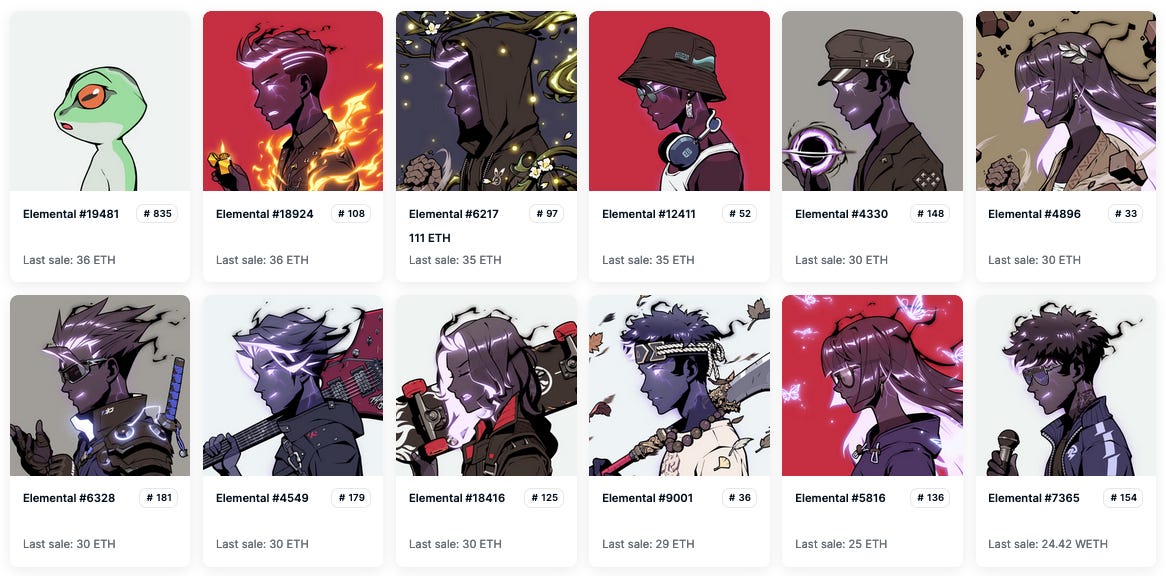

Elementals minted out in the Azuki and Beanz presale yesterday at the 2 ETH level (a 20,000 ETH sale and a $37M raise)

The website did not work for several participants during the mint and many holders missed

The art reveal was very Azuki-like, with only a small percent of rares and new characters; basically an expansion of the current set

The art reveal also included duplicates in the set and several examples of technical mistakes (bad shadows, incorrect hand placement, bad mouth structure)

Team members and the official team have made a few apologies so far, with the Azuki apology from this morning introducing a new Green Bean NFT (10k for Azuki holders)

Community sentiment seems to be evolving by the minute and moving in big swings, from FUD based on the bad mint experience, to FUD on the art reveal, to "the art is growing on me", to "what are they doing with green beans, there is no plan."

How has the market held up?

Here are the 4 primary floors and 1-day change:

Azuki at 9.07 ETH (-29%)

Azuki Elemental Beanz (unrevealed) at 1.84 ETH

Azuki Elementals (revealed) at 1.55 ETH

Beanz at 0.64 ETH (-45%)

Rare Elementals have seen some nice sales, with 9 sales over 30 ETH and 32 over 10 ETH - a tribute to how well the rares and grails were received.

But the most telling factor here for real holder sentiment is the Azuki floor.

If the art reveal had held up, it seems very likely the Azuki floor would be a few ETH higher.

Many were concerned that this whole mint experience feels rushed, and those concerns were validated in the mint experience and reveal.

The primary question right now is - what will the whales do?

This collection has been carried by its whales, and if they choose to exit, it could mean a significant downturn. But my gut is they will hold through at least a bit longer and see how the team reacts and tries to rectify the situation.

I'll continue to report on this evolving situation here this week, likely the biggest story in the NFT space.

🚚 What else is happening in NFTs?

Here is the list of other notable headlines from the day in NFTs:

Trading volume came in over 36k ETH on Tuesday, led by the 4 major Azuki collections; NFTs saw mostly redon the day though DeGods and Pudgy Penguins saw green, with DeGods flipping Azuki and becoming the 3rd PFP by floor

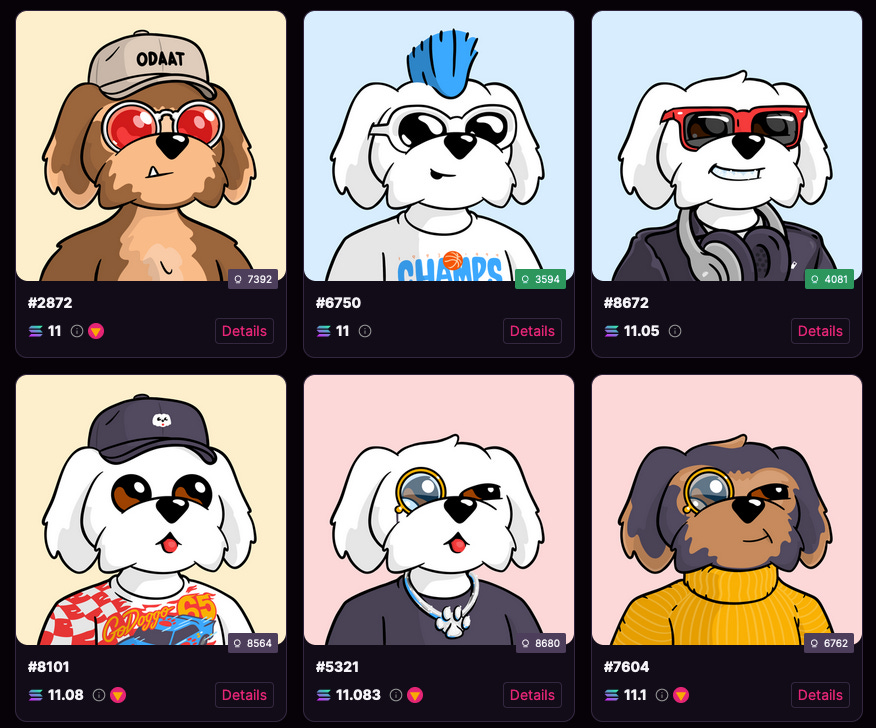

Bodoggos successfully sold out its 8,888 NFT mint on Solana, holding a 11 SOL floor ($178) from its $80 mint, a 2x return for minters

Grant Yun announced that his latest 1/1 "Park" sold for 50 ETH, coming with an accompanying physical print for the buyer

Prominent digital art collector Cozomo de' Medici and Avant Arte announced a partnership aimed at making physical and digital art more accessible, featuring 7 artists and creating physical editions of Cozomo's pieces

Transient Labs officially launched "The Lab" as a new innovative platform for artists with new features like batch minting, Synergy and Story mechanics and more

🌎 Around Crypto and Web3

A few other Crypto and Web3 headlines that caught my eye:

The crypto market was down slightly on the day; BTC -1% to $30,360; ETH -1% at $1,860

Web3 game studio Mythical Games has raised $37M in a Series C1 funding round

Another Real World Asset NFT loan is in the books, after Arcade.xyz facilitated a 35,000 USDC loan against a Patek Philippe watch

🚀 NFT Total Volume

Azuki (17,603 ETH, 9.35 ETH Floor)

Azuki Elemental Beans (8,812 ETH, 1.92 ETH)

Azuki Elementals (6,463 ETH, 1.68 ETH)

BAYC (4,346 ETH, 36.36 ETH)

Beanz (4,204 ETH, 0.67 ETH)

📈 NFT Floor Price Increase

The Weirdo Ghost Gang (32%, 0.5 ETH Floor)

RTFKT Animus Egg (15%, 0.34 ETH)

Valhalla (14%, 0.4 ETH)

Kanpai Pandas (10%, 1 ETH)

DeGods (9%, 9.7 ETH)

🗓 Upcoming NFT Mints and Reveals

Today is a hangover day after the Elementals rush yesterday.

Expect most attention to remain in the Azuki ecosystem as holders grapple with what to do with all of those assets.

In the art world, John Gerrard is debuting "World Flags" on Art Blocks in collab with Pace Gallery. The supply of 195 NFTs will be on sale in a Dutch auction. John's first drop, Petro National, holds a 3.48 ETH floor and was fully embraced by AB collectors at time of mint. Expect some real demand on this one today.

If you want more, see the full list of today's drops from Swizzy's daily mint monitor.

Memes by 6529 (11:00 a.m. ET); 0.06529 ETH

Art Blocks x Pace "World Flag" (12:00 p.m. ET); Dutch auction

Seize CTRL (3:00 p.m. ET); 0.14 BTC

Enjoy this write-up? Follow along with me on Twitter @tyler_did_it or reach out via email tyler.warner@luckytrader.com.

For all volume and floor price data, see Lucky Trader's Project Rankings page.

For all upcoming mints, see Lucky Trader's NFT Calendar page.