PayPal Stuns with New Stablecoin Launch

PayPal shocked the crypto and payments space yesterday with its PYUSD stablecoin launch, unlocking broader crypto access for millions of users. Here's what you need to know.

TylerD's Market Summary

GM!

Today's top news includes:

PayPal launches PYUSD

Jack & Jalil debut infinity collection

Reboot announces $GG token

Brian Armstrong minted NFTs on Base

Reddit tokens surge

📈 PayPal's Stablecoin Era Begins

PayPay rocked the crypto, TradFi and FinTech world on Monday with a major announcement.

They are launching their own stablecoin, PYUSD, which will reside on the Ethereum network. This is the first stablecoin to be launched by a major financial company.

But this groundbreaking announcement came with some mixed reactions from the crypto community.

Here's the good, bad and the ugly from the announcement so you can make up your own mind.

What Happened

The core details of the announcement include the following major details:

Issuing and Backing: PYUSD will be issued by New York-based Paxos Trust, backed by U.S. dollar deposits, short-term Treasuries, and similar cash equivalents.

Availability: It will first be available on PayPal, then Venmo, and will be exchangeable for U.S. dollars at any time

Interoperability: Users can transfer PYUSD between PayPal, supported external digital wallets, and convert PayPal-supported cryptocurrencies (BTC, ETH) to and from PYUSD.

Transparency: Beginning September 2023, Paxos will publish a public monthly Reserve Report for PYUSD, including third-party attestation.

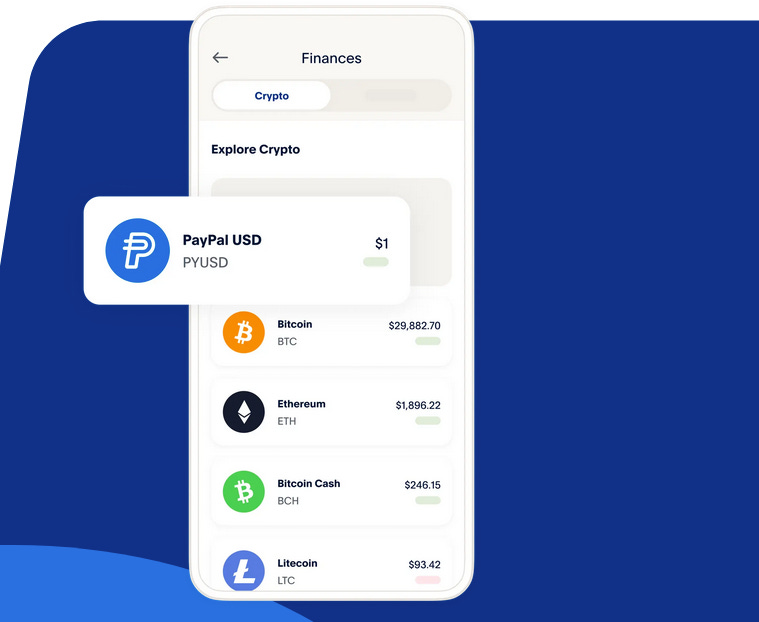

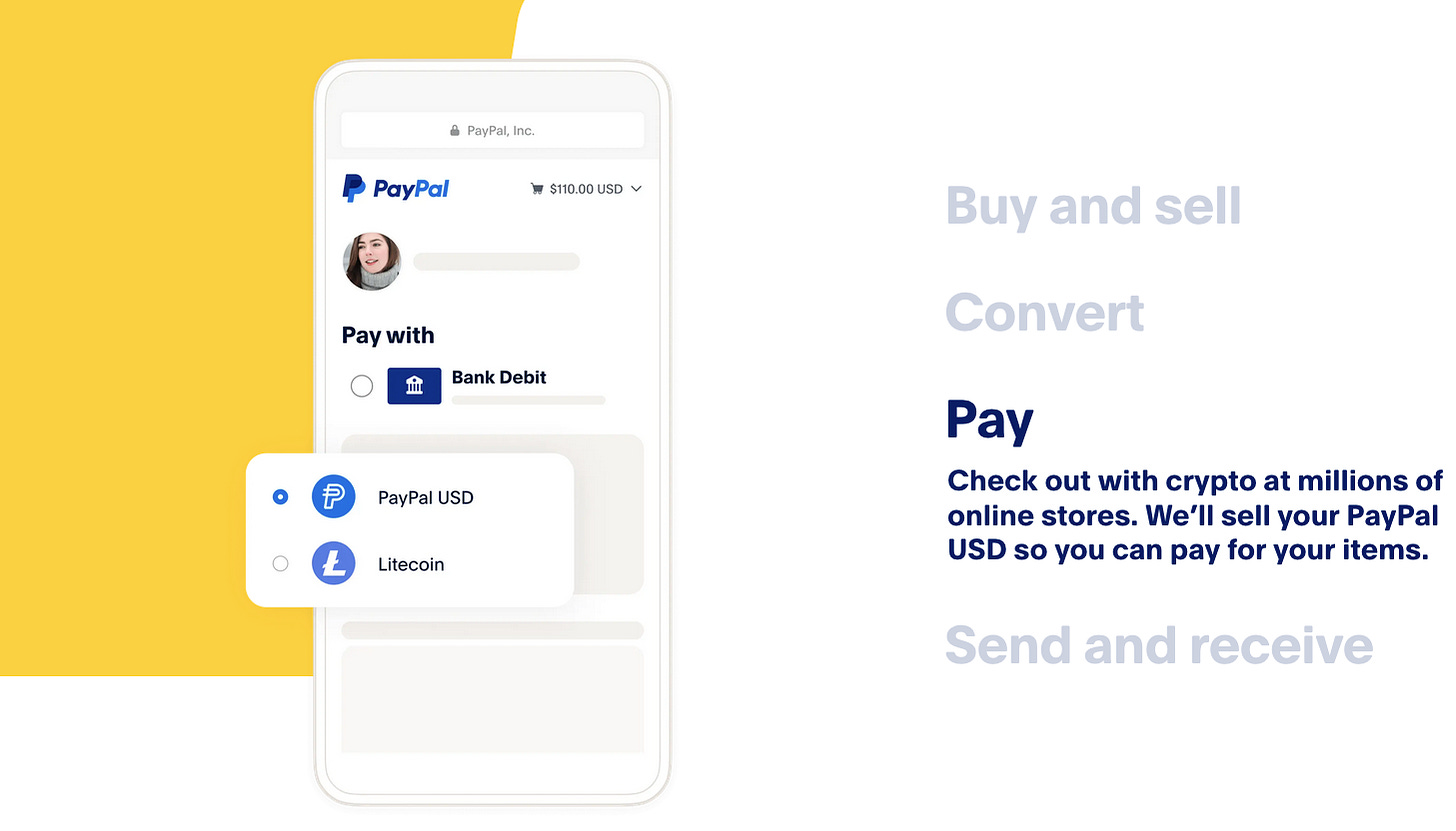

PayPal simplifies it even more on their site, highlighting these 4 core functions users and execute with PYUSD:

Buy and sell

Convert

Pay

Send and Receive

Previous gripes with PayPal's crypto program were that it was a "walled garden." You could buy crypto (namely BTC and ETH), and you could convert it, but you couldn't do much else with it. You couldn't send it outside PayPal or use it.

Now that has all changed.

Users can buy PYUSD with real dollars in their account, exchange it for other crypto, send it to supported ETH wallets, and even use it to purchase irl goods in stores where PayPal is accepted.

Enter PayPal CEO Dan Schulman, who had this to say:

"The shift toward digital currencies requires a stable instrument that is both digitally native and easily connected to fiat currency like the U.S. dollar. Our commitment to responsible innovation and compliance, and our track record delivering new experiences to our customers, provides the foundation necessary to contribute to the growth of digital payments through PayPal USD."

The Good

This is a major move from a giant in the payments space, and the first big mover in stablecoins.

It provides a major onboarding ramp for Ethereum, unlocking access to the world of Defi, NFTs and more. And it also provides a new and likely easier offramp to purchase IRL goods with crypto through PayPal and Venmo's apps.

The move helps to cement crypto's spot in the future of banking; with each additional piece of news like this (along with ETFs, etc.), crypto's backing gets bigger and bigger and less and less likely to simply go away or become irrelevant.

Politicians agree and have already weighed in.

“This announcement is a clear signal that stablecoins — if issued under a clear regulatory framework — hold promise as a pillar of our 21st century payments system,” Rep. Patrick McHenry (R-North Carolina), chair of the House Financial Services Committee, said in a statement.

Regarding that regulatory framework, PayPal is regulated by the NYDFS and their stablecoin guidance requires BSA/AML and sanctions compliance. PayPal also requires KYC. This could be viewed as good or bad pending on your angle, but there will be regulations to comply with here.

Perhaps a good segue...

The Bad

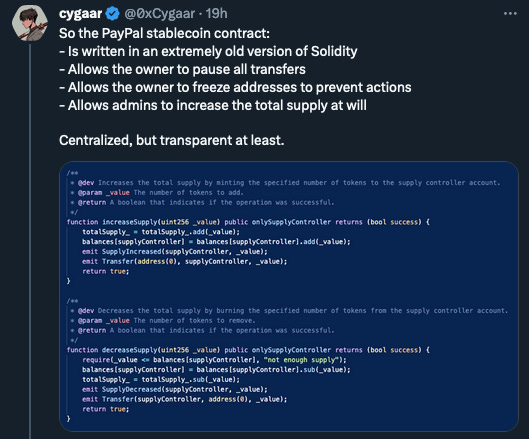

This is very much a centralized stablecoin that comes with centralization risks.

The codebase includes functions that can wipe user balances (also an attack vector risk).

It also has controls that allow the owner to pause all transfers, freeze addresses to prevent actions, and allow admins to increase the total supply at will.

These should not come as a huge surprise, but the differences should be understood in how this stablecoin can be used vs truly decentralized ones as their use cases are different (instant payments the same, freedom to transact not quite as much).

Additionally, there are fairly restrictive limits in place on sends, including just $10k per week in send limits and $100k in weekly purchases (that one is likely ok for most haha).

The Ugly

Crypto native devs have been dunking on PayPal's code as it is written in an "extremely old version of Solidity."

From notable crypto dev, writer and auditor 0xfoobar:

"the great thing about normalizing open-source interoperability is exposing the embarrassment that underpins every single one of our hundred-billion-dollar financial institutions when they come to compete on a level playing field."

Not great, but also not a huge problem - more funny and exposing than anything else.

Conclusion

Jokes and some interesting codebase choices aside, this is a really big deal.

PayPal has 435M active accounts. They did $1.36T in payments volume in 2022 across 22B transactions. They own 43% of the global payments market share.

They have 29M merchant accounts and span 200 countries across the globe.

This is a major unlock for crypto and it's based on Ethereum (arguably the biggest winner here).

It was always obvious that the path to mainstream adoption for crypto would include both centralized and decentralized options, and here comes PayPal with a major centralized onboarding ramp.

But it has an offramp into the decentralized ETH ecosystem, and thus users will have a choice for which world they want to play in.

That's likely the best we can ask for.

Kudos to PayPal for making this major move. Now we wait to see what user adoption looks like...

🚚 What else is happening in NFTs?

Here is the list of other notable headlines from the day in NFTs:

Trading volume again came in around 5k ETH on Monday; NFTs mostly chopped with green from Metal Tools, Nakamigos and Winds of Yawanawa

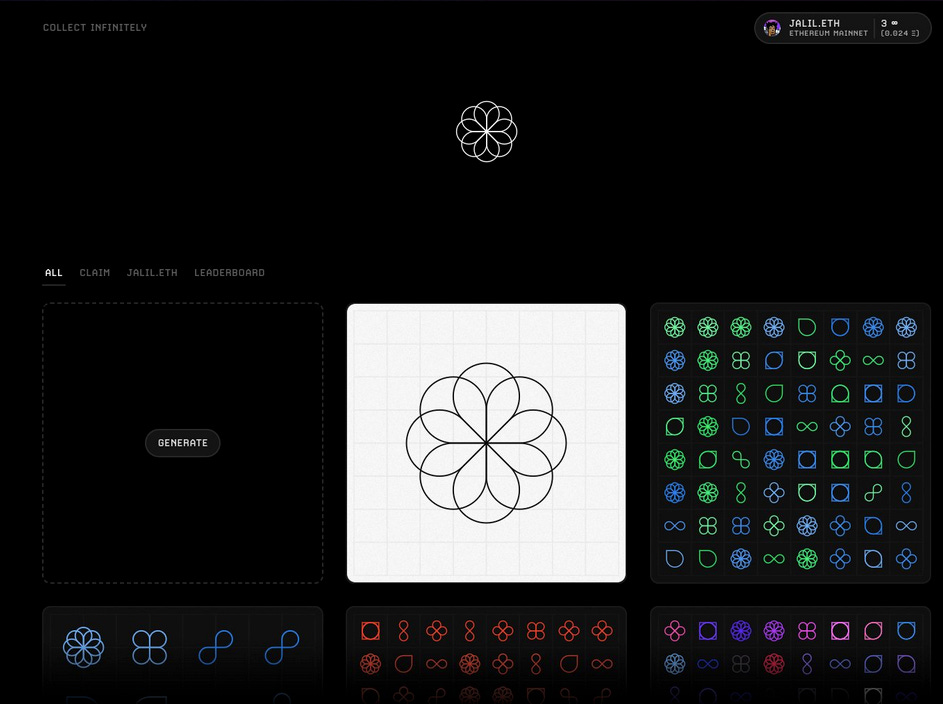

Jack Butcher and Jalil debuted the infinity collection late last night, with an uncapped supply, a fixed price of 0.008 ETH and a refund mechanism

PROOF's Grails IV started minting on Monday, with 6 of the 20 pieces already minted out

Pixel Vault / Reboot introduced a new official token of the Reboot Protocol $GG, to be used for game items to credits and rewards to governance; more details are expected soon

Brian Armstrong touted a new mint on Base called "MINT #001: Based" available on Zora for "free" (0.000777 ETH) as OnChain Summer is set to start on Aug 9

Pudgy Penguins announced that "Left Facing" collectible toys will go live Aug 8 at 9:45 pm ET, based on the infamous Pudgy 1/1; they are 150 in supply priced at $250

Frank DeGods shared a detailed history of DeGods and y00ts on Twitter/X over the weekend, from his decision to go with human PFPs over animals, the Paper Hand Bitch Tax, the $DUST launch, art upgrade, the bridge off SOL and more

Gala Games plans to migrate reserve and unsold NFT game items from ETH to its new GalaChain to avoid Ethereum gas fees

NFT lending protocol Arcade.xyz shared 4 notable loans from this past week including a 130 ETH XCOPY 1/1 loan, 27,000 USDC loan against Rolexes, a 235 ETH Gold BAYC loan and a 50,000 USDC loan against a Jake Fried 1/1

🌎 Around Crypto and Web3

A few other Crypto and Web3 headlines that caught my eye:

The crypto market was up slightly on Monday; BTC +0.6% at $29,260; ETH even at $1,832

Reddit community tokens MOON and BRICK both jumped nearly 50% after being listed on Kraken yesterday

Cryptoys will release a limited edition digital Yoda toy later this year for collectors of its Star Wars Vol. 1 toy line

🚀 NFT Total Volume

MAYC (601 ETH, 5.82 ETH Floor)

BAYC (540 ETH, 29.35 ETH)

DeGods (432 ETH, 9.14 ETH)

Azuki (288 ETH, 4.89 ETH)

Milady (269 ETH, 3.5 ETH)

📈 NFT Floor Price Increase

Metal Tools (42%, 1.7 ETH Floor)

Punks2023 (38%, 0.08 ETH)

Little Lemons (32%, 0.07 ETH)

Nakamigos (22%, 0.34 ETH)

Winds of Yawanawa (17%, 3.09 ETH)

🗓 Upcoming NFT Mints and Reveals

Today has a few art mints and a new genesis pass on the docket.

The highlight is likely "Boundless" from Yue Minjun, a part of his multi-chapter Kingdom of the Laughing Man project. Yue is a prominent contemporary artist who has sold individual pieces for millions and is making his Web3 debut with this drop. It's a PFP style set featuring 999 1/1 pieces, priced at 0.35 ETH in presale (0.39 ETH in public).

Other drops to watch include a new Verse art drop from Zach Lieberman and Anime Figurine shop Weebox dropping their genesis pass.

If you want more, see the full list of today's drops from Swizzy's daily mint monitor.

Boundless by Yue Minjun (8:00 a.m. ET)

Verse "Studies in color, light and geometry" (1:00 p.m. ET)

Weebox Genesis Pass (TBD)

Enjoy this write-up and/or want to sponsor the Morning Minute? Follow along with me on Twitter @tyler_did_it or reach out via email tyler.warner@luckytrader.com.

For all volume and floor price data, see Lucky Trader's Project Rankings page.

For all upcoming mints, see Lucky Trader's NFT Calendar page.