NFTs Rally As Blur Farming Heats Up

$BLUR is green, Blast TVL is soaring and NFTs are pumping. Find out what happened from an unexpectedly wild long holiday weekend of action.

TylerD's Market Summary

GM!

Today's top news:

NFT trading volume soars as Blur incentives get in full swing

PFPs close the week up 5-10%, gaming NFTs up more

Checks Editions and Originals jump 60-70% as Jack mania continues

Gordon Goner teases new NFT buying spree

DeGods new roadmap comes out today

📈 NFT Weekend Recap

The consensus view was that the Blur airdrop would be bearish for $BLUR and for the NFT market.

Well, the incentives that Pacman Blur and team rolled out for SZN3 are looking genius, and NFTs (PFPs) are benefitting.

Most leading PFPs are up 5-10% on the week, and there is green all over the board.

So who are the winners?

What's Happening?

It was a busy holiday weekend, and buyers were out in force.

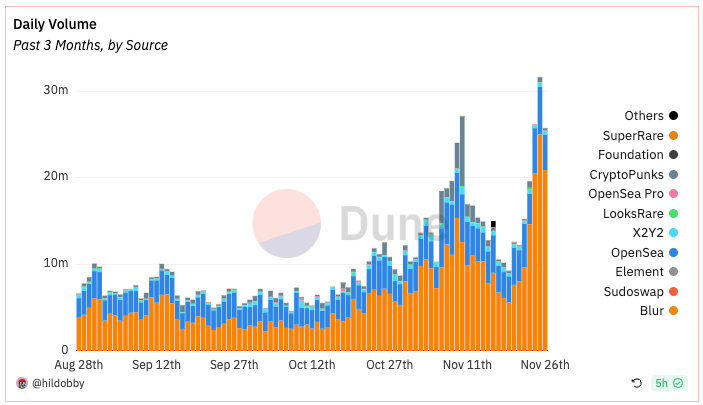

Trading volume had the biggest 3-day stretch in months:

Friday: $26.2M

Saturday: $31.7M

Sunday: $25.8M

Blur incentives (i.e. farmers) clearly drove the volume, with Blur capturing a whopping 75.5% market share in the past week.

That's a solid 20-25% jump in market share from the trailing 3-month average.

Blur was all over the timeline all weekend, with its new L2 Blast passing $568M in TVL in its first week.

The spike in attention saw whales like OSF depositing 1,000 ETH, Pacman making clarifying statements about its security, and a Paradigm investor raising concerns over Blur's marketing of Blast.

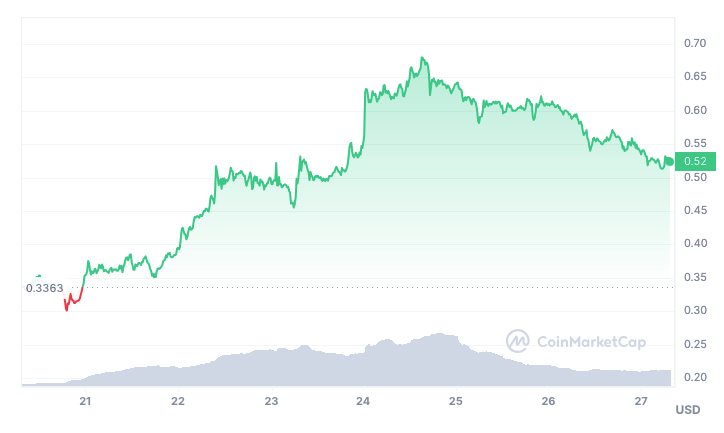

Those concerns seemingly impacted the token, with $BLUR -11% on the day at $0.53 and down nearly 30% from local highs on Friday after it was listed on Binance.

With 3 ways to farm the new Blast token <Redacted>, and Blast increasingly becoming the most crowded trade, more folks turned to old-fashioned NFT farming on Blur.

Expect that to be a driving force in the market in the near term.

But some ecosystems seem to be winning without pure farming volume - gaming and token ecosystems.

Gaming and Token NFTs Soar

Some of the biggest winners on the week:

raW Pass at 0.33 ETH (+186%)

Yogapetz at 0.71 ETH (+172%)

BlockGames Dice at 0.61 ETH (+161%)

Treeverse at 0.54 ETH (+54%)

The Grapes at 2.8 ETH (+45%)

Creepz at 1.99 ETH (+42%)

Shrapnel at 0.24 ETH (+27%)

Mocaverse at 2.43 ETH (+23%)

The common theme for those projects is that they have a token and/or game out or coming soon.

The Grapes have led this sector, briefly hitting 3.8 ETH at peak over the weekend before retracing to 2.8 - still a massive win for long-term holders.

The market is clearly hungry for potential tokens, and more and more seem to be joining this list by the week.

Jack Butcher Eco Runs after Trademark

The other major winner from the long weekend?

Jack Butcher.

His new Trademark collection dropped with AOI and Velocity Series took over the timeline, running to 0.33 ETH at peak (from a 0.069 ETH mint), now settled at 0.224 ETH.

That explosion of interest drove rotation to his other NFTs as well.

Checks - VV Edition jumped 73% on the week to 0.64 ETH, and his VV Originals popped 62% to 0.31 ETH.

Opepens lagged relatively, with the floor up just 1% at 0.44 ETH, though the unrevealed floor was up to 0.48 ETH.

His other collections, like his Meme card, Signature, Elements and more caught attention and volume as well.

Now we'll see if the leading candidate for "Artist of the Year" is able to keep the momentum into December.

NFT Market Overview

Now for a quick look at broader price action.

Here is a quick rundown of the notable floors and their 7-day price changes:

Fidenza: 65.3 ETH (-7%)

CryptoPunks: 56.5 ETH (+1%)

Ringers: 35 ETH (-17)

BAYC: 30.1 ETH (+6%)

Gazers: 11.5 ETH (-11%)

Chromie Squiggle: 9.25 ETH (-2%)

Grifters: 8.58 ETH (-2%)

Winds of Yawanawa: 7.41 ETH (-2%)

Azuki: 6.18 ETH (+8%)

Pudgy Penguins: 6.16 ETH (+12%)

MAYC: 5.74 ETH (+8%)

Captainz: 4.17 ETH (-4%)

DeGods: 3.53 (+17%)

PROOF: 3.3 ETH (-6%)

Otherside Koda: 2.86 ETH (even)

Milady: 2.39 ETH (+11%)

So most PFPs were up 5-10%, though most leading art projects were in red on the week.

DeGods were a notable winner, up 17% ahead of their new roadmap plans to be released later today.

Pudgy Penguins are also looking strong, finding a new ATH in USD terms as the floor passed 6 ETH for the first time in months.

Now the question becomes - is this pump real? Or solely farming driven?

This setup has some key differences from the farming pump of Feb 2023.

For one, prices are down significantly across the board and there are fewer heavy bag holders.

Two, Flooring Protocol is here now, and promising to buy 10-30% of PFP collections.

For awareness, most leading sets have 60-70% of their NFTs which haven't sold in the past year. So Flooring buying 10-30% is huge for the available supply.

Three, sentiment feels different. The crypto market is stronger and most tokens are at or near yearly highs.

NFT sentiment is definitely stronger after a few weeks of sustained green, and anecdotally it feels like traders are back off the sidelines (though no new joiners have entered).

My gut read is it's a real pump and we'll continue the up trend into the new year.

As Blast TVL creeps up towards its inevitable $1B level, its airdrop becomes more and more valuable, creating a bit of a flywheel.

And the only way to get it is to bridge, stake $BLUR, or farm. Expect more and more farming, as it’s the highest-effort option (and likely least crowded).

Here's hoping for a green December.

👥 Friend Tech Trend Tracker

Friend Tech vibes may have turned around.

TVL is up 10% off the bottom at $33.3M (16.5k ETH) as buyers returned last week.

Why?

A change in communication from the team, admitting they made a mistake, and re-emphasizing portfolio value in the weekly airdrops.

And re-emphasize they did, with most users seeing 150 points per ETH this past Friday.

On top of that, Racer deactivated his Twitter and has seemingly left the shitposting in public behind for now.

This combination has restored a bit of confidence in the ecosystem.

If points come in similarly this Friday, expect TVL to continue grinding up.

🚚 What else is happening in NFTs?

Here is the list of other notable headlines from the weekend in NFTs:

Trading volume spiked hard over the weekend, coming in at $31.6M on Saturday and $25.8M on Sunday, driven by massive Blur volume; the leaderboard was mostly red

Opepunks led top movers, jumping 5x to a .08 ETH floor; Ether Capsules (+48%) and Checks - VV Originals (+33%) also jumped

Gordon Goner alluded to a new buying spree on X last night, leading to speculation on which NFTs he will add next

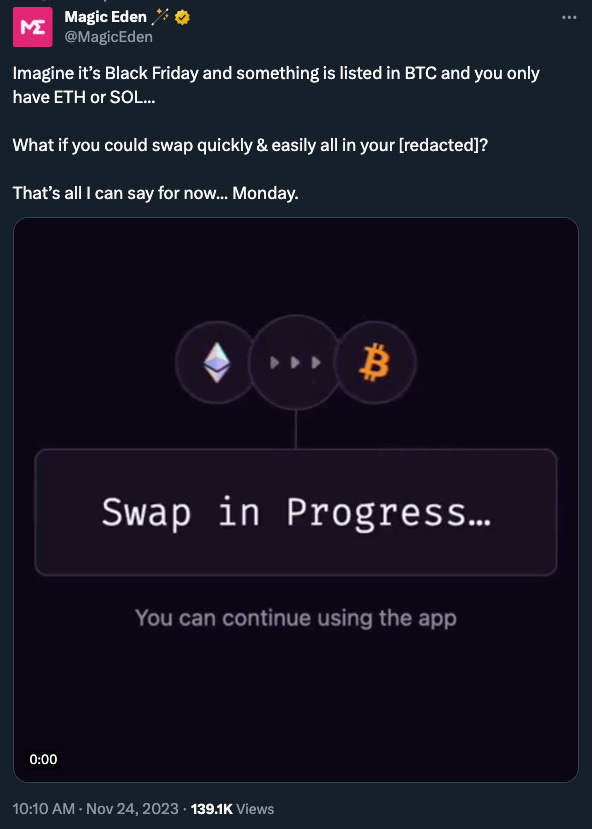

Magic Eden teased the ability to swap currencies like BTC, ETH and SOL to buy NFTs directly on its platform, with more info coming today

DeGods and y00ts new roadmap dubbed "Clarify" is coming out today at 6:33 p.m. ET

🌎 Around Crypto and Web3

A few other Crypto and Web3 headlines that caught my eye:

The crypto market fell over the weekend; BTC -1.8% at $37,050; ETH -3% at $2,020; SOL -5% at $55

GROK was the major memecoin winner, pumping 50% on the day to a $168M FDV

LooksRare announced its $LOOKS token has become deflationary tied to its new game and NFT mint Infiltration which leads to token burns

🚀 NFT Total Volume

BAYC (4,003 ETH, 30.1 ETH Floor)

MAYC (2,174 ETH, 5.74 ETH)

DeGods (1,388 ETH, 3.52 ETH)

CloneX (564 ETH, 1.52 ETH)

Moonbirds (398 ETH, 2.2 ETH)

📈 NFT Floor Price Increase

Opepunk (514%, 0.08 ETH Floor)

Plooshies (129%, 0.33 ETH)

Ether Capsules (48%, 0.42 ETH)

Timeless (44%, 0.32 ETH)

Checks - VV Edition (33%, 0.64 ETH)

🗓 Upcoming NFT Mints and Reveals

Today is a fairly busy day of drops, spanning memes, art and PFPs.

Daniel Calderon Arenas' "Elevate Heart" is a highlight today, dropping in partnership with Squiggle DAO and on the 3rd anniversary of Squiggles minting. Today's mint is just for Squiggle DAO members, with the public mint coming tomorrow.

See the full list and dive in for more details with Swizzy's daily mint monitor.

Memes by 6529 (11:00 a.m. ET)

Makeitrad x Mirage Gallery "Evolution's Echoes" (12:00 p.m. ET)

Daniel Calderon Arenas "Elevate Heart" (2:00 p.m. ET)

Doodles Holiday Capsule (TBD)

Enjoy this write-up and/or want to sponsor the Morning Minute? Follow along with me on Twitter @tyler_did_it or reach out via email tyler.warner@luckytrader.com.