NFTfi Pushes Boundaries of NFT Finance

Multi-year NFT loans with the same interest rates as mortgages? One NFT lending protocol is trying to make it happen with a major upgrade.

TylerD's Market Summary

GM!

Today's top news includes:

NFTfi launches major protocol upgrade

Memeland teases $MEME coming soon

Transient Labs debuts "Shatter" contract

Michelin sells 30% of its NFTs in mint debut

Larry Fink hails Bitcoin rally as "flight to quality"

💰 NFTfi Ushers In New Era

NFT finance continues to evolve even through this bear market.

Enter NFT lending protocol NFTfi and their newest protocol upgrade, pushing the space forward.

And they are cementing certain NFT collections as "blue chips" in the process.

What Happened?

On Oct 13 NFTfi announced its long-awaited protocol upgrade, set to roll out its core features in Q4.

Those core features include:

Extended loan durations up to 5 years

Support for ERC-1155 tokens

Pro-rata loans and re-financing

New smart contracts and enhanced protocol security

Of course the smart contracts and security are important, but it was those first 3 bullets which jumped out as the most impactful.

Extended loan durations up to 5 years (already available on the platform) imply greater trust in certain NFT collections than we've seen in this still immature market. The pilot 2-year loan on a Chromie Squiggle (74% LTV, 10% APR) highlights that trust in Squiggles as well as the type of financial instrument blue chip NFTs can become.

Support for ERC-1155s opens up the world of real world assets (RWAs) and several other types of NFT and collectibles that weren't previously included.

Pro-rata loans allow borrowers to only pay interest on time the loan is held (vs a fixed interest fee). Re-financing allows borrowers to continue to roll-over loans without closing and restarting each time - a major time savings (and likely fee savings).

Overall it was a massive upgrade for the 2nd-leading NFT lending protocol by volume (behind just Blur/Blend) with $495M in lifetime lending volume.

Why It Matters

NFT lending is foundationally important to the NFT sector because it provides liquidity without one being forced to sell the asset.

This matters even more for non-fungible assets than fungible ones, as they often can't be replaced once sold.

Extending the time horizons along with these other features continues to provide more and better liquidity options for holders, and turning NFTs into more serious financial assets at the same time.

The 10% APR on a 2-year Squiggle loan isn't far off the interest rate one gets on their house (albeit the time scales are different). But as 2 years pushes towards 5, the comparison grows closer.

Kudos to NFTfi for continuing to build and ship through this market, to the benefit of the entire space...

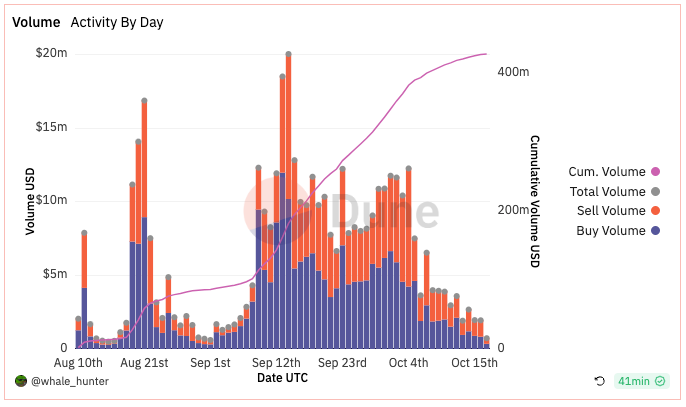

👥 Friend Tech Trend Tracker

It was another quiet day in the Friend Tech market while some SocialFI competitors continue to gain steam.

Here are some of the core Friend Tech metrics for 10/17 and their day-over-day change:

Return users: 3,757 -> 3,875 (+3%)

Daily Buy volume: $0.89M -> $0.83M (-7%)

Total Volume: $1.96M -> $1.95M (even)

TVL: $44.17M -> $44.07M (even)

Highest key: Vombatus 8.33 -> 8.33 (even)

*TVL in ETH terms 27,929 -> 27,801 ETH (even)

So TVL and trading volume even on the day, but buy volume at $830k is lowest total since Sept 1 (returning users lowest since Sept 7).

The highlight for today will be CBB's mascot launch the CBBuuull, marking the debut for his WL tool. Quick info:

Will open at 1.53 ETH live at 5 pm UTC today

Each WL buy will result in an automatic 1-for-1 sell by CBB, so no net price movement

WL buyers will get a refund on same day and another in 72 hours (to reward loyalty), with estimates of net cost between 0.7-0.9 ETH

With promises that the CBBuuull will deploy 200 ETH, on top of trading fees, it's set to be the most exciting launch of the week. Expect major volume.

In other SocialFI news:

StarsArena officially relaunched its platform without trading, saying that once the Paladin security audit is complete, trading will be set to re-open (no timeline yet)

New Bitcoin City TVL jumped 25% from $1.1M -> $1.38M

Tomo Social also boasts a TVL of $1.35M (though down from a peak of $1.57M on Monday)

🚚 What else is happening in NFTs?

Here is the list of other notable headlines from the day in NFTs:

Trading volume spiked to $8.2M (5,160 ETH) on Monday, the highest daily volume total in a month; the leaderboard saw a mix of red and green

Velocity Series led top movers up 35% to 1.36 ETH as the Snowfro mint approaches (launches tomorrow)

Transient Labs debuted its newest contract "Shatter" which lets artists and collectors break 1/1s into editions (and put them back together), along with a pilot project in "Traffic Jams" by Bryan Brinkman and Rich Caldwell

Memeland teased a busy October for $MEME, including farming, a community presale and the official $MEME launch on CEX and DEX within the next 2-3 weeks (Captainz up 6% to 3.65 ETH on the news)

Art Blocks announced "reGEN," a collection of charitable auctions to raise funds for the Cure Alzheimer's Fund, running Oct 23-27 with 5 generative projects 200 in size, and featuring artists like Melissa Wiederrecht, Robert Hodgin and more

Animoca Brands is increasing its $APE delegation to Mocaverse NFT holders, upping it from 1.5M to 3.5M $APE, following the Moca DAO launch

Michelin (known for tires and restaurant reviews) launched its NFT mint on Monday, selling 1,434 (of 5k) so far at 0.05 ETH; the project's utility includes raffles for restaurant experiences, access to a community discord and a PFP of the Michelin Man

🌎 Around Crypto and Web3

A few other Crypto and Web3 headlines that caught my eye:

The crypto market jumped on Monday; BTC +2.6% at $28,480; ETH even at $1,585; SOL +4.7% at $24.20

A fake news headline from Cointelegraph incorrectly saying the BlackRock BTC ETF was approved went viral and sent the price of BTC up $2000+ before it was proven false (and BTC retraced before re-pumping)

BlackRock CEO Larry Fink commented on the recent BTC rally calling it a "flight to quality"

A new Animoca game Formula E: High Voltage will be the first official web3 Formula E video game when it launches on the Flow on Oct 19; it comes with a Crate NFT sale, 17,500 in supply ranging $20-$149

🚀 NFT Total Volume

BAYC (1,768 ETH, 25.5 ETH Floor)

Winds of Yawanawa (622 ETH, 11.79 ETH)

MAYC (393 ETH, 4.78 ETH)

Pudgy Penguins (308 ETH, 5.4 ETH)

Wrapped CryptoPunks (295 ETH, 46.5 ETH)

📈 NFT Floor Price Increase

Velocity Series (35%, 1.36 ETH Floor)

Contractual Obligations (34%, 4.9 ETH)

Ready Player Cat (25%, 0.15 ETH)

VOX Series 2 (24%, 0.13 ETH)

Ether Capsule (19%, 0.32 ETH)

🗓 Upcoming NFT Mints and Reveals

The next Pokemon card NFT drop is here today over on Courtyard with their "Legend of the Haunted Vault." Priced at $99.99, each pack contains 1 graded Pokemon card vaulted at Brink's

See the full list and dive in for more details with Swizzy's daily mint monitor.

Courtyard - Legend of the Haunted Vault (1:00 p.m. ET)

WalletWars.io (6:00 p.m. ET)

ALTS by adidas - Swap your ALT (TBD)

Enjoy this write-up and/or want to sponsor the Morning Minute? Follow along with me on Twitter @tyler_did_it or reach out via email tyler.warner@luckytrader.com.

For all volume and floor price data, see Lucky Trader's Project Rankings page.

For all upcoming mints, see Lucky Trader's NFT Calendar page.