MEV Bot Makes Millions on Memecoins

A bot has skimmed a small fortune in "sandwich" transactions this week, feasting on memecoin traders and driving up gas fees in the process. How does it work and how has the NFT market been impacted?

TylerD's Market Summary

GM!

Today's top news includes:

MEV Bot making $$ on memecoins

3AC Grails to be sold at Sotheby's

Unique NFT traders fall off cliff

Coinbase moving offshore?

Ledger catches flack for necklaces

🥪 MEV Bots Are Eating Your Lunch

If you have traded either crypto or NFTs in the past few days and wondered "why is gas so high?" you can thank "jaredfromsubway."

The high-frequency "sandwich" trading bot with the hilariously appropriate name has made a small fortune in the past few days front-running transactions in the memecoin crypto market.

Why memecoins?

The typical buyer is less experienced and sophisticated than those frequently trading in the crypto and DeFi space.

So NFT buyers rotating into $PEPE this week?

They likely were preyed on by jaredfromsubway.

How It Works

MEV stands for "maximal extractable value" and MEV bots are akin to high-frequency traders in typical stock markets.

They look for arbitrage opportunities where they can "sandwich" transactions.

It works like this (shout out to Sea Launch for a great primer thread):

the MEV bot identifies pending transactions in the mempool (pool of pending transactions) to front-run

they submit a similar transaction as those pending, but with a higher gas price and miner tip to buy or sell the crypto token; this ensures the MEV transaction is accepted first

then they rapidly execute the opposite transaction to sell (or buy), with lower gas fees, to ensure it occurs after the targeted transaction

Revenue is generated via the spread

MEV bots are effectively targeting opportunities to buy a crypto token at a slightly lower price than buyers are paying, and then selling it to them.

Thousands of times per day.

And this method has been quite effective for jared over the past few days.

By the Numbers

A few numbers from jared's work this week:

$1.4M in profit

$1.1M spent on Ethereum gas fees

70 gwei, the average gas fee for transacting on ETH on Tuesday ($20 per transaction)

The numbers over the past 2 months are even crazier, as jared has executed over 180,000 transactions, spending over $7M on fees.

NFT Market Impact

The impact of all of this memecoin trading, and activity from MEV bots, has led to increased gas prices on the Ethereum network for multiple days now.

That spike in gas fees has certainly impacted the NFT market, leading traders to second guess making transactions due to the excessive fees.

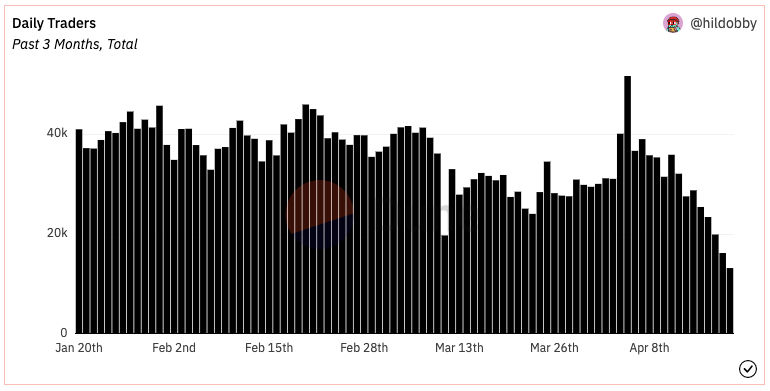

In fact, daily active NFT traders have fallen a whopping 50% on the week and are at yearly lows - likely driven at least in part by gas fees.

Fewer traders means fewer buyers and NFT prices have suffered, with almost all majors in red on the week.

Want to avoid Jared?

You have a few options (though I'm no expert here).

Use a MEV blocker

Use protocols like CowSwap

Trade on networks like Eden Rocket where transactions are disguised

It's important to know who you're up against in the crypto markets.

Don't let jaredfromsubway eat your lunch.

🖼 Sotheby's To Sell 3AC Grails via "GRAILS"

Is tainted art more valuable?

We are about to find out.

Yesterday, Sotheby's announced their newest digital art collection "GRAILS."

The collection includes some of the most notable pieces in digital art and will feature some of the most anticipated auctions in NFT history.

The kicker?

The pieces are all from now-defunct hedge fund Three Arrows Capital (3AC).

Will the stigma tied to their brief ownership impact the price at the Sotheby's sale?

The Details

The pieces will be released "in chapters" across various sale formats (i.e. private sales, auctions) and across multiple global locations.

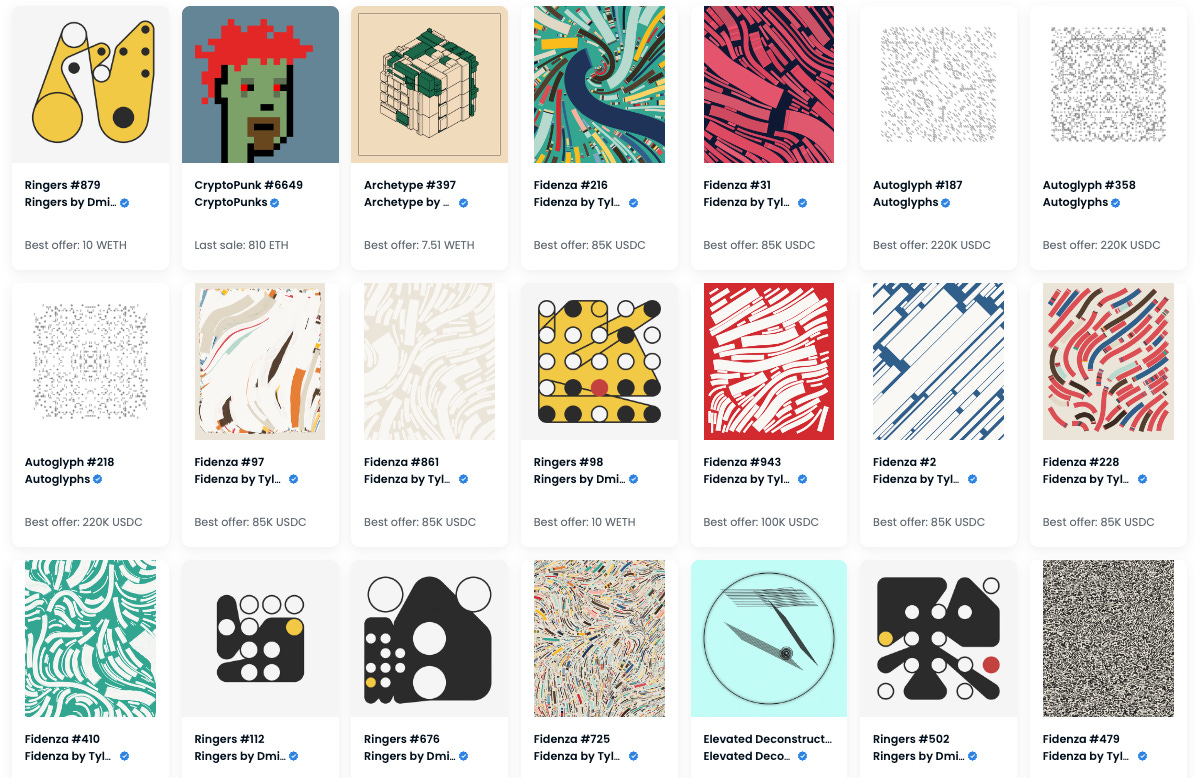

Some of the most notable pieces in the collection (along with the price 3AC paid):

Ringers #879 "The Golden Goose" (1,800 ETH or $3.56M)

Zombie CryptoPunk #6649 (810 ETH or $1.6M)

Cube Archetype #397 (420 ETH or $832,000)

A full spectrum Chromie Squiggle #1780 (70 ETH or $139,000)

A small-scale Fidenza #725 (135 ETH or $267,000)

Across just those 5 NFTs, 3AC spent $6.4M.

And that doesn't include some of their other pieces included in GRAILS feature an ACK one-of-one and a few Autoglyphs.

You can find 3AC's incredible collection here, valued around ~3,500 ETH using OpenSea's floor price calculation (not accurate but gives baseline).

Market Expectations and Impact

A few very relevant questions here:

Will these pieces sell for more than their previous prices?

Does the 3AC "stigma" make these pieces more valuable?

Will the Art Blocks and grail art market rebound post-sale?

And my answers:

Not in aggregate, but some (the Fidenza, the full spectrum Squiggle) will certainly sell for more than 3AC paid. But it's hard to see that Golden Goose moving for $3.56M right now. The fees that Sotheby's tacks on for buyers (can be upwards of 26%) will also impact the sales prices here.

Yes, for the most elite and rare pieces in the GRAILS collection, the fact that they are now forever tied to the 3AC implosion and crypto meltdown does add historical and cultural significance. Though that impact is hard to quantify.

I think so. The art market is heavily driven by whales, many of which have been quietly waiting on these 3AC grails to come on sale. And keeping their liquidity on the sidelines in preparation. Post-Sotheby's, there is a chance we see some capital flow back in from the whales.

Those are my guesses and all difficult to quantify, but we will see how this very interesting situation plays out soon.

The whole digital art market could be impacted.

🚚 What else is happening in NFTs?

Here is the list of other notable headlines from the day in NFTs:

Trading volume was around 17k ETH on Wednesday, down 15% from Tuesday; OS Pro captured 7% share, with Blur holding 61%

NFTs were red again on the day, with top volume projects down 2 to 5 percent; Punks fall below 50 ETH with BAYC at 50.5 ETH

Unique daily NFT traders drop to 16,200 wallets, down over 50% on the week in an extreme cliff dive

Yuga Labs gained ownership of the CryptoPunks wrapper yesterday as a part of the Punks Restoration project, now officially stored at https://wrapped.cryptopunks.app/

Nakamigos rebound 33% to a 0.33 ETH floor after the founding team tweeted that "Nakamigors are half the story. Next part coming for holders later this year."

CyberBrokers Mech Assembly went live yesterday, as the culmination of months of Quests conducted across 2022 to collect up to 70,000 Mech parts; assembled Mechs will be available for use in the interoperable metaverse

Voting went live on 4 new Rug Radio DAO proposals, involving expanding use of the $RUG token, more utility for Genesis Rug NFT holders, more engagement incentives and establishing a grant committee

🌎 Around Crypto and Web3

A few other Crypto and Web3 headlines that caught my eye:

The crypto market fell again yesterday; BTC -1.1% at $28,850; ETH -1% at $1,950

Memecoin $PEPE jumped another 30% to a $150M marketcap

Coinbase makes plans to build an offshore presence as soon as next week, with a Bermuda-based Derivatives Exchange

Ledger caught some backlash for security concerns after unveiling its new Ledger Nano X OnChain bundle seemingly encouraging the device to be worn as a necklace

Microsoft is working with Space and Time to make real-time blockchain data available in the Microsoft Azure Marketplace, enabling better analytics

🚀 NFT Total Volume

Wrapped CryptoPunks (3,210 ETH, 49.9 ETH Floor)

BAYC (2,061 ETH, 50.5 ETH)

MAYC (1,862 ETH, 11.15 ETH)

Azuki (1,040 ETH; 15.8 ETH)

Clone X (759 ETH, 2.68 ETH)

📈 NFT Floor Price Increase

Cool Cats: Fractures (47%, 0.11 ETH Floor)

Redacted Remilio Babies (41%, 0.62 ETH)

Nakamigos (32%, 0.33 ETH)

Consortium Key (29%, 4.25 ETH)

Checks - Originals (28%, 0.37 ETH)

🗓 Upcoming NFT Mints and Reveals

Some notable drops are happening today.

The Pacemaker team hit the talk show (Twitter spaces) circuit hard this week in preparation of their drop coming at 10 am ET.

The Rolling Stones always see demand for their NFTs, with the OneOf community members getting first access.

Escher is back with a new edition drop from generative and meme artist Arsonic (known recently for Sgt Pepe). The supply is set at 420 with a $69 price tag (all the meme numbers) and is likely to mint out at that price point.

The Killacubs are the most anticipated of the day, with 3,333 minting free for Killabears holders and 8,888 minting for 0.25 ETH. The Killa ecosystem has been incredibly strong, but that's a steep price tag for this market and will more than double their supply.

A La Mode by Zuzana Breznanikova (3:00 a.m. ET); auction

Pacemaker (10:00 a.m. ET)

The Rolling Stones – Vintage Slides (3:00 p.m. ET); $199-$300

Escher Exclusive #5 - ft Arsonic (4:20 p.m. ET); $69

Killabears - Killacubs (TBD); 0.25 ETH

Enjoy this write-up? Follow along with me on Twitter @tyler_did_it or reach out via email tyler.warner@luckytrader.com.

For all volume and floor price data, see Lucky Trader's Project Rankings page.

For all upcoming mints, see Lucky Trader's Project Schedule page.