Is There an NFT Bull Market on Bitcoin?

Prices are skyrocketing. Whales are sweeping. "Bitcoin NFTs" are literally trending on Twitter. Is it time to pay attention to Bitcoin NFTs?

TylerD's Market Summary

GM!

Today’s post includes:

The Bitcoin NFT bull market

Micro-caps surging

Super burn Sunday

The SEC coming after staking

💰 Bitcoin NFTs are Bumpin

Unless you've been living under a rock in the NFT space, you have heard rumblings about Bitcoin NFTs.

Ordinal Punks have been the collection leading the hype. Their floor reached ~4 BTC (55 ETH or $90,000) yesterday.

For perspective, people were buying those Ordinal Punks for 0.01 BTC just 1 week ago. A casual 400x in a matter of days.

And just last night, a new all-time high sale was reached at 9.5 BTC ($215,000) for Ordinal Punk #94.

What the hell is happening?

The How and Why of Bitcoin NFTs

For starters, the primary reason that the floor has increased so rapidly is that it is incredibly difficult to self-custody or even transact.

Unless a holder is literally running their own Bitcoin node, it is incredibly risky to move assets. The NFT infrastructure on Bitcoin is very immature and the functionality of current wallet options Electrum or Sparrow are very limited.

There is no marketplace, and there are no smart contracts. These are not trustless transactions. In fact, they require a great deal of trust.

Trades are happening off of Excel spreadsheets.

We are so early.

That barrier to transacting has certainly reduced sell pressure, and with demand surging, the 100-supply Ordinal Punk collection has gone parabolic.

This has led to a gold rush over other creators and collectors trying to make (or inscribe) NFTs on Bitcoin. There are now over 21,000 NFTs minted on Bitcoin - there were only 1,200 just 1 week ago.

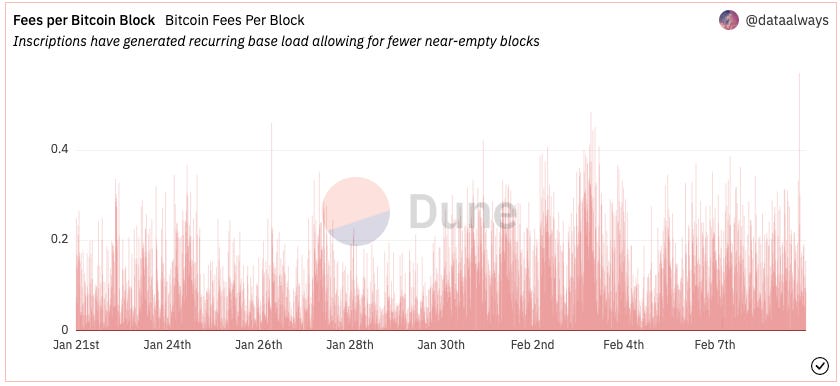

And boy are Bitcoin maxis upset. This NFT activity is clogging up the network and making normal financial transactions (the original intent of the network) more expensive. Fees per Bitcoin block are at their highest levels of 2023.

The anger of the Bitcoin maxis seems to be a self-reinforcing feedback loop, driving ETH and NFT maxis even harder to make Bitcoin NFTs a thing.

Price action aside - it feels like we are just getting started.

For those who want to dive in deeper, here is a nice starter thread and blog post.

But this is not the only bull market happening right now in NFTs.

🌅 The Micro-cap Bull Market

Just look at those gainz.

The open edition meta and its low-cost entry points have brought new attention to the micro-cap (floor below 0.5 ETH) market.

By the numbers:

Here are just a handful of massive ROI returns from the past month:

Checks: $8 to $4,000 (500x)

On the Edge of Oblivion: 0.025 ETH to 3.6 (144x)

Chungos: 0.006 ETH to 0.23 (38x)

Opepens: 0.005 ETH to 0.22 (44x)

Anyone who made a high-conviction play on any of those sets in the past month has had a shot to make life-changing returns.

My concern - this is typical end-of-cycle activity.

Typical bull runs in NFTs start at the top (Yuga assets, high-dollar Art Blocks), rotate into the mid-tiers, and then finally to the microcaps.

Does this mean the music is ending soon?

It all likely depends on that Valentine's Day stimulus coming next week (is that Blur's music?).

🚚 What else is happening in NFTs?

A few headlines from a busy day in the NFT market:

The NFT market saw a whopping 27,000 ETH in trading volume on the day, up nearly 10k ETH from last week's levels

Jack Butcher announced the highly anticipated burn for Checks is coming on Super Bowl Sunday, sending the floor directly to 2.4 ETH before retracing

Yuga officially closed the Sewers, ending the Dookey Dash game and locking scores (anyone who did not play on their pass now has a useless NFT)

Zeneca launches student IDs for ZenAcademy as soulbound tokens, representing an entry point into the ZenAcademy ecosystem

Rug Radio team expands their PFP mint to other communities in an effort to reach more potential buyers

🌎 Around Crypto and Web3

A few other Crypto and Web3 headlines that caught my eye:

Coinbase CEO Brian Armstrong shared rumors that the SEC is coming after crypto staking for U.S. citizens

Crypto prices were down slightly on that news, with BTC at $22.7k (-1.6%) and ETH at $1,630 (-2.2%)

Hermès wins case against NFT artist Mason Rothschild, saying his "Metabirkins" project was guilty of trademark infringement, trademark dilution, and “cybersquatting.”

Google lost $100B in market cap after its AI "Bard" made mistakes in a live demo yesterday

🚀 NFT Total Volume

Pudgy Penguins (3,068 ETH, 5.2 ETH Floor)

Clone X (2,103 ETH, 5.05 ETH)

Otherdeeds (2,059 ETH, 1.69 ETH)

BAYC (1,380 ETH, 74 ETH)

Sewer Pass (1,380 ETH, 2.2 ETH)

📈 NFT Floor Price Increase

OnChainMonkeys (105%, 1.9 ETH Floor)

Boots (100%, 0.16 ETH)

Chungos (90%, 0.2 ETH)

Braindrops (39%, 0.18 ETH)

a KID called Beast (23%, 1.16 ETH)

🗓 Upcoming NFT Mints and Reveals

This market is incredibly liquid, coming off the highest volume day in 2 weeks.

It is a good set up for today's mints, though none are all that exciting.

Expect more volume in the micro-caps, and of course, over on Bitcoin.

Earpitz - Phase 2 (8:00 a.m. ET)

Strangers HQ (12:00 p.m. ET)

The Minthouse (8:00 p.m. ET)

🙈 Sign of the Times

Enjoy this write-up? Follow along with me on Twitter @tyler_did_it or reach out via email tyler.warner@luckytrader.com.

For all volume and floor price data, see Lucky Trader's Project Rankings page.

For all upcoming mints, see Lucky Trader's Project Schedule page.