Is The Panic Over?

SVB shutting down Friday was a black swan event, but now the Fed has swooped in to "save" the day. Are crypto fears subsiding, or just beginning?

TylerD's Market Summary

GM!

Today's post includes:

SVB closing and USDC depegs

Fed bailout details

The War on crypto

NFT market impact

All of the weekend's NFT headlines, featuring BrainDrops, the new Global Digital Rights Charter, Pixel Vault and more

📉 SVB Closes, Causing Panic

Friday was one of those days that feels like a year.

The day started with rumblings of a run on Silicon Valley Bank, and crypto was tanking on the uncertainty of the situation.

Then by mid-morning we got the news that California regulators had shut SVB down.

Fears of contagion and a widespread run on the banks caused spreading panic.

Next, Circle (the issuer of USDC) shared that it had significant funds with SVB.

USDC started to de-peg.

It ended up falling all the way to $0.87 in panicked overnight trading before rebounding to ~$0.92 Saturday morning.

Stablecoins are not supposed to do that.

By Saturday morning, the situation had somewhat stabilized amidst increasing calls for the Federal government to come in and guarantee deposits at SVB.

ETH had rebounded from lows around $1,375 to $1,430 and stabilized around $1,470 on Saturday evening.

Saturday evening and into Sunday morning felt more calm, as more pundits theorized on what moves the Fed had to make to right the situation.

Fast forward to Sunday evening and we finally got the news that many expected - SVB depositors would be made whole by the Fed.

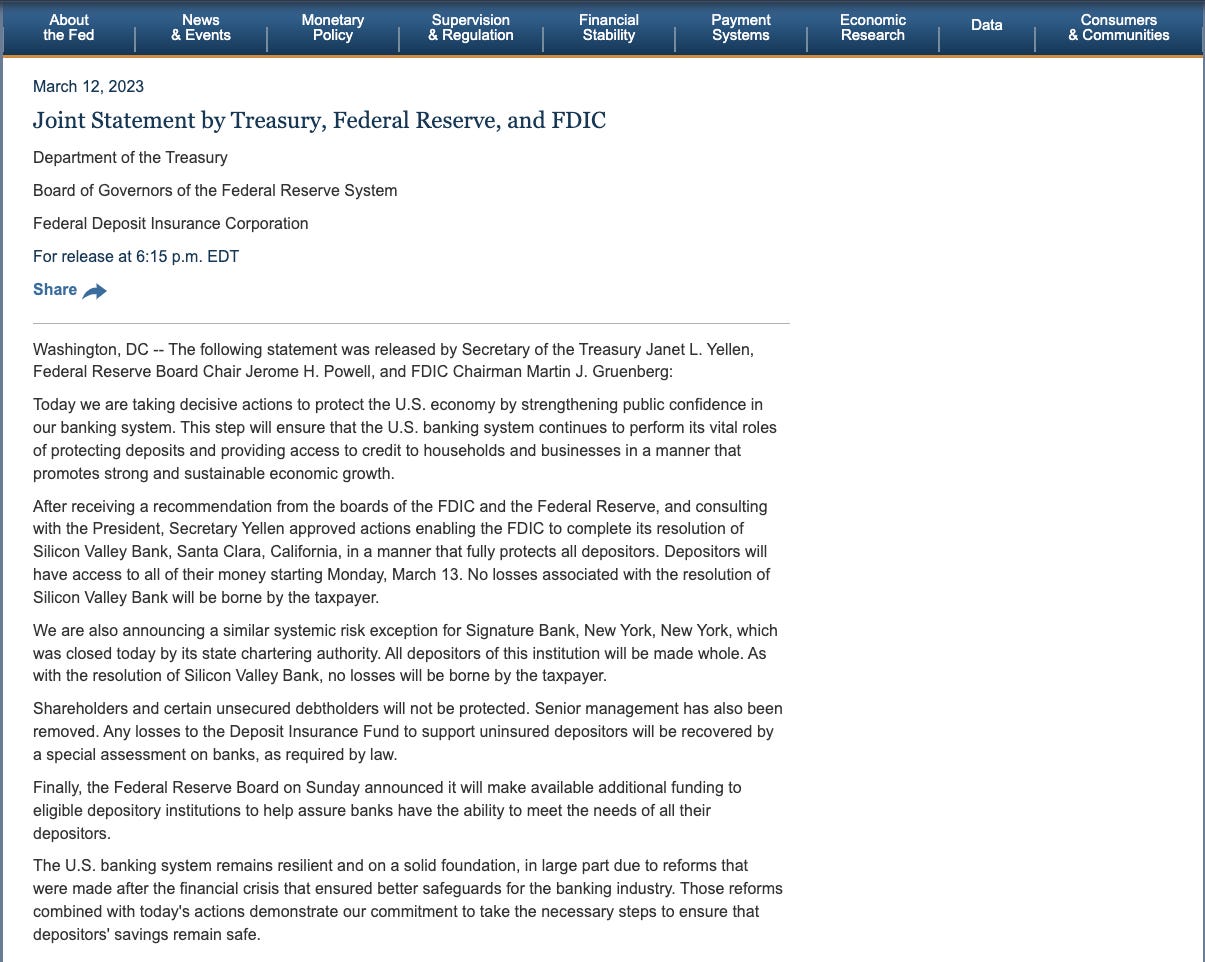

What was the Fed announcement?

There were 3 primary components to the announcement:

The Fed would cover 100% of SVB deposits and depositors would have access to funds on Monday (today)

Signature Bank was closed, and once again depositors would be made whole

The Fed is standing up a new facility to provide additional funding and liquidity to banks under stress during this wider "run" called the Bank Funding Term Program

Crypto full sent on the news, with ETH immediately surging almost 10% to $1,600 and BTC doing the same, running from $20,400 to $22,500 in a few hours.

But while some were celebrating the price action, others started to realize the full implications of the Fed's announcement.

All of the primary crypto-friendly banks had been shut down.

⚔️The Great Crypto War Begins

Lost in the hurrahs that the Fed was bailing out SVB depositors was the fact that Signature Bank had been shut down.

It was the last standing crypto-friendly bank.

In one week, Silvergate, SVB, and Signature Bank were all shutdown.

Operation Choke Point was a success.

It feels like we are now at a very pivotal moment for the future of crypto and all of the crypto and Web3 businesses being actively built.

Will they find a way to self-bank and stop relying on traditional finance?

Is this move by the Fed the final straw that rips the bandaid off reliance on the banks once and for all?

We certainly will see. Expect some tumultuous times ahead.

📉📈How were NFTs impacted?

The severity of this situation feels bigger than NFTs, but given this is an NFT-focused publication, let's do them some justice.

Saturday morning was bad.

The crypto panic from Friday night clearly bled over to NFTs, with some mid-tier PFPs approaching levels not seen since mint.

Some notable prices from Saturday AM:

Azuki at 13 ETH (-6%)

Moonbirds at 4.94 (-24%)

Pudgy Pengus at 5 (-3%)

Doodles at 4.15 (-14%)

Clone X at 3.98 (-7%)

Captainz at 5.1 (+5%)

Gitcoin at 0.13 ETH (-57%)

Holoself at 0.2 (-26%)

Mocaverse at 1.33 (-4%)

The crypto blood bath from Friday finally hit NFTs by Saturday, with the mid-tier PFPs and the new projects hit the hardest.

Taking a look at a few specific projects and their drivers:

Moonbirds were driven down by one whale who bought up 300+ birds hoping for a quick scalp, before selling most of them off, driving the floor to 4 ETH in the process before it rebounded to 4.8 ETH

Gitcoin felt the wrath of Machi, as the whale farmer ended up taking a 900+ ETH realized loss on the project before finally selling off (he owned >30% of the collection at peak)

Looking at the Blur board this morning, most of the pain has been reversed.

Most PFPs and new projects are still down 5-10% on the week, but overall, not in terrible shape given the extreme nature of the situation.

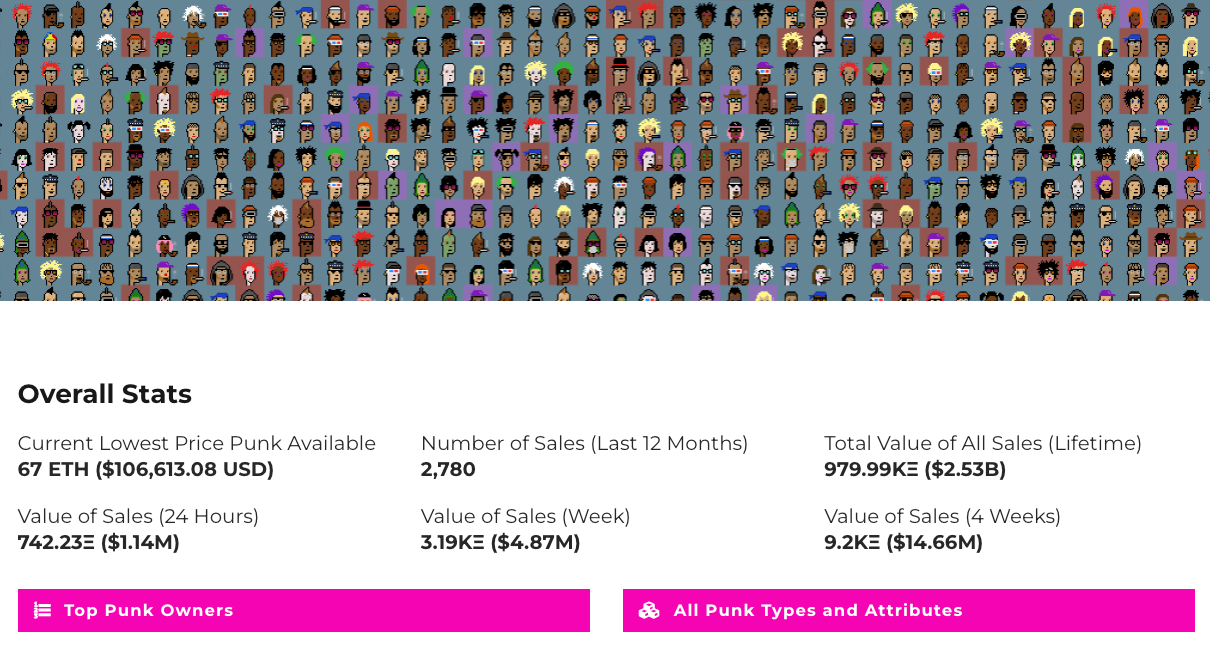

One project standing out though - CryptoPunks.

The CryptoPunk floor is at 67 ETH (66.9 ETH on Blur), in the green on the week.

Perhaps the primary winner in a "flight to quality" move.

🚚 What else is happening in NFTs?

Crypto and macro Fed actions led all new over this weekend and not much happened in NFTs, but there were a few notable headlines:

Trading volume came in at just 20k ETH on Sunday, the lowest levels since Blur SZN2 began and down over 60% from local farming highs

Punk6529 launched the Global Digital Rights Charter as a sort of constitution for the digital realm and era, along with a free-to-mint NFT to celebrate the launch

Braindrops airdropped "All AI Art Looks the Same" to its top collectors, with the collection featuring worksfrom the first 14 Braindrops artists (floor opened at 4.269 ETH)

Braindrops also had a new mint "Materia Mania" which minted for 0.2 ETH and instantly jumped 350% to 0.75 ETH

Pixel Vault released its "BattlePaper" (its whitepaper) for its upcoming Inhabitants PVP game called BattlePlan

OnChainMonkey announced Dimensions, a new animated 3D collection coming on Bitcoin and available only to OCM holders

Gutter Cat Gang teamed up with Spotify to launch the official Gutter Shop as a storefront to sell Gutter Merch

Strands of Solitude was the big winner in the art sector of the weekend, as William Mapan's new project soared over 200% from mint to a 5.95 ETH floor

The PROOF team shared that they had significant funds with SVB, as other NFT teams began sharing the status of their treasuries

🌎 Around Crypto and Web3

A few other Crypto and Web3 headlines that caught my eye:

The crypto market was up big on the day after falling hard Friday; BTC +8% at $22,200 and ETH +8% at $1,580; BLUR at $.51 (+8%) and APE $.430 (+10%)

Gary Vee and VeeFriends released new details for their upcoming VeeCon 2023 conference

LinksDAO extended play benefits to more than 450 golf and social clubs across North America

🚀 NFT Total Volume

Moonbirds (2,247 ETH, 4.8 ETH)

Wrapped CryptoPunks (2,112 ETH, 66.9 ETH)

MAYC (1,322 ETH, 14.6 ETH)

Azuki (1,231 ETH, 14 ETH Floor)

BAYC (1,155 ETH, 67 ETH)

📈 NFT Floor Price Increase

Strands of Solitude (86%, 6.8 ETH Floor)

OnChainBirds (84%, 0.22 ETH)

Cosmic Bloom by Leo Villareal (23%, 0.43 ETH)

Braindrops (17%, 0.36 ETH)

Checks - VV Edition (12%, 1.27 ETH)

🗓 Upcoming NFT Mints and Reveals

Today is likely to be another very volatile day in the markets given all of the expected macro news.

The Art Blocks drop has just a 36 supply, meaning you can throw most of the normal rules out the window. When this one starts minting, it will go fast, but these low supply collections can turn illiquid very fast.

Then this evening artist Gxng Yxng brings their Elemxnts collection, with a discount for Zxdiac holders, in what's likely the mint of the day.

Memes by 6529 (11:00 a.m. ET); 0.06529 ETH mint

Art Blocks Presents: Coalition by Generative Artworks (1:00 p.m. ET)

Elemxnts (12:00 p.m. ET); 0.12 ETH mint

Petaverse (TBDT); 0.15 ETH mint

Enjoy this write-up? Follow along with me on Twitter @tyler_did_it or reach out via email tyler.warner@luckytrader.com.

For all volume and floor price data, see Lucky Trader's Project Rankings page.

For all upcoming mints, see Lucky Trader's Project Schedule page.