Fungible Non-Fungible Tokens

NFTs can now be traded like crypto tokens on central exchanges. Is this the catalyst for the next leg up?

TylerD's Market Summary

Today's Morning Minute is brought to you by Wasabi, THE leading NFT leverage protocol.

Have you been itching to buy a Bored Ape, but don’t have 25 ETH lying around? Or have you been wanting to short Bored Apes because you think their time is over?

In either case, your answer is Wasabi. Wasabi boasts the most liquid NFT derivatives market, allowing NFT traders to go long or short NFT projects with a few button clicks.

Interested traders have 2 options: use Wasabi’s Perps app to go long or short indefinitely, with liquidation based on an index price; or use their Options app, which uses expiration dates for call and put options (and no liquidation risk). And with Wasabi’s Season 2, traders will be rewarded with Points which "may be notable" in the future.

For the nerds who want to see under the hood, Wasabi stands out because of the asset-backed nature of the positions. Positions are secured by the underlying tokens themselves (leveraging a partnership with Flooring Protocol), serving as collateral. This avoids a purely virtual settlement, ensures a more liquid settlement layer for NFT derivatives and significantly reduces counterparty risk. Oh, and the app has been audited and signed off on by 0xFoobar.

So start trading today, and earn those rewards points!

💰 You Can Trade NFTs Like Cryptocurrencies

At peak 2023 bear, it seemed that no one really wanted to trade NFTs at all.

But over the past few months, interest in NFTs has picked up along with the resurgence in crypto prices.

Volume is up, prices are (mostly) up.

Along with that, traders are facing "bull market" issues - being priced out of trading their favorite NFTs because the floor is too high.

Thanks to Flooring Protocol and now central exchanges, that is no longer an issue. And the broader public will be able to participate as well.

How Does It Work?

Thanks to the WOO X exchange (centralized exchange like Coinbase, or CEX for short) and Flooring Protocol, fractional NFTs can be traded like normal crypto tokens.

Here's how it works:

Flooring Protocol enables NFT owners to exchange their NFT for 1M utokens (for example, 1 Bored Ape becomes 1M uBAYC).

As more NFTs are deposited into Flooring Protocol, more utokens are created, making the market more liquid

Now those utokens can be traded on the WOO X exchange, allowing crypto traders to buy Pudgy or Bored Ape fractions just like any other crypto token

Flooring Lab commented on the partnership:

“Our mission is to create opportunities for NFT holders seeking listings on CEXs by providing a flexible model for fractionalized NFT ownership. These tokens can be bought, sold, and traded like any other cryptocurrency. It is also significantly cheaper to trade with, avoiding the massive buy/sell spreads and platform fees associated with NFTs."

Why It Matters

It probably won't matter right away, if I'm being frank.

But in a scenario where NFTs (re: PFPs) see another bull market run similar to 2021-2022, it will absolutely matter.

NFT owners can now unlock liquidity in new ways and will benefit from additional market demand.

NFT market participants who are priced out (i.e. can't afford a Bored Ape at 25 ETH) are able to participate in the upside for as little as 0.1 ETH stakes.

Now broader crypto participants who may have heard about these projects but aren't into NFT ownership can participate by buying/selling tokens on these exchanges.

And guess what - the higher the utoken prices go, the higher the NFT prices go.

By The Numbers

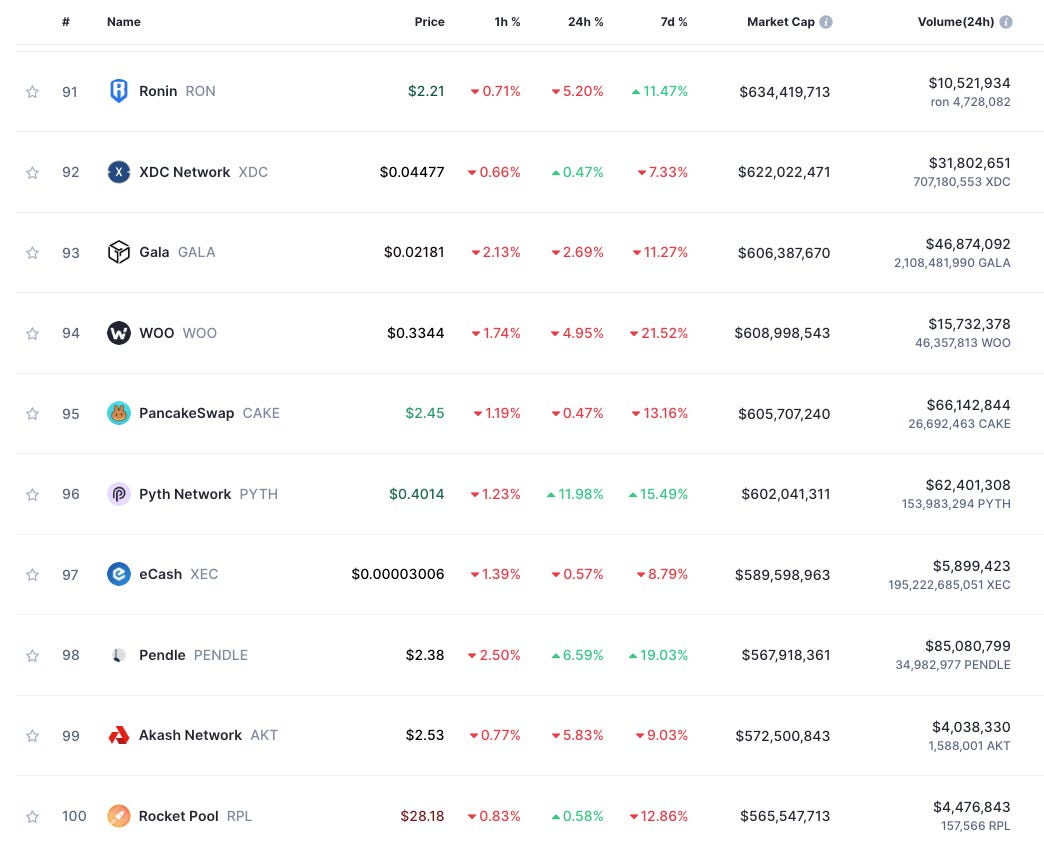

Another key difference that fractionalization at this scale unlocks - evaluating NFT projects by market cap.

NFTs are broadly measured by floor price. While memecoins, shitcoins and broader crypto tokens are evaluated by market cap.

That mindset could shift with a more liquid fractional token market for NFTs.

Let's take a look at the leading PFPs by floor-price market cap (assuming ETH at $2210)

CryptoPunks: 63.4 ETH floor ($1.4B market cap)

Bored Apes: 25.85 ETH floor ($571M)

Pudgy Penguins: 18.38 ETH floor ($361M)

Azuki: 7.25 ETH floor ($160M)

Mutant Apes: 4.49 ETH floor ($198M)

For anyone who's been following this recent memecoin craze, those market caps really aren't that big.

Bonk hit $1.8B. Pepe hit $1.4B. WIF hit $450M.

And compared to broader crypto market caps, these are tiny.

Punks would be the 46th-ranked crypto token by market cap, just ahead of SEI ($1.46B).

Bored Apes would be the 100th-ranked token.

There's room for growth, especially if you believe in digital assets. It doesn't mean these 5 projects specifically will all crack the top 100 or top 50, but it's not that big of a stretch to see Punks level up to top 25.

And perhaps fractional token trading is the unlock that catapults them to that level in this next cycle.

The infrastructure is being put in place to make that happen.

🚚 What else is happening in NFTs?

Here is the list of other notable headlines from the day in NFTs:

ETH trading volume fell 305 to $22.6M on Wednesday, while the leaderboard was very green led by Doodles +20% & Kanpai Pandas +19%

Distortion Genesis led top movers on ETH, popping 160% to 0.78 ETH; Deepblack also jumped 37% to 1.57 in a nice leg up for the OG AI art set

RSIC led action on BTC with 42 BTC in trading volume though holding even at 0.046 BTC; Bitcoin Puppets rallied 20% to 0.037

Solana NFTs were mixed on the day with Froganas leading volume and +6% to 8.9 SOL, while Crypto Undeads fell 12% to 9.6; Mad Lads up a bit at 166 and Tensorians at 88

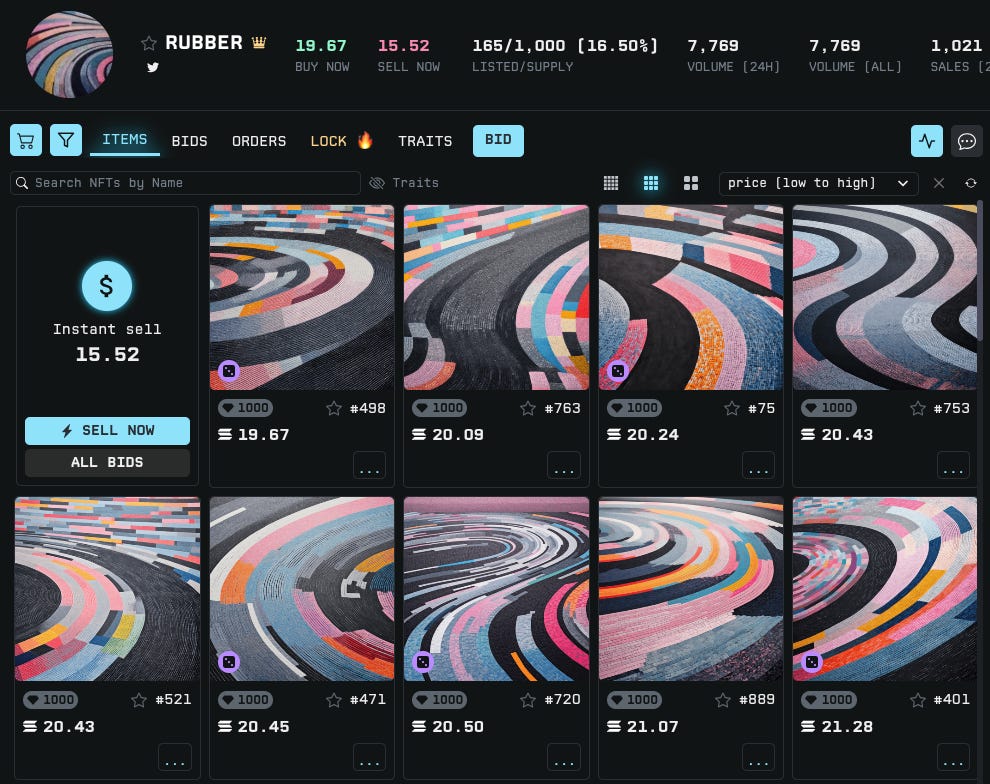

Generative art mint "Rubber" by Pop Punk minted out for 0.25 SOL and ran past a 20 SOL floor overnight (an 80x for minters)

Tensor announced its vision to "allow anyone to build a Tensor-sized platform" and "bootstrap off" their liquidity in a push to go open-source and grow the broader Solana eco

Gondi shared details on new 5-year loan offers on Chromie Squiggles, with 5 ETH principal and 9% APR

Chimpers announced a new arcade game with NFT prizes from several NFT communities

🌎 Around Crypto and Web3

A few other Crypto and Web3 headlines that caught my eye:

Crypto majors are mostly even this morning; BTC -0.2% at $40,130; ETH -0.7% at $2,230; SOL +1.5% at $87.70

Solana Memecoins have rebounded after the SOL dip, with WIF at $350M, $HARAMBE at $26M & $STAN at $20M

Solana Labs launched new token extensions, offering innovative token functionalities for developers and businesses on its blockchain

Bitwise Bitcoin ETF shared that it will allow the public to verify its Bitcoin holdings by publishing its address(es)

The Alt Layer airdrop claim goes live today, available for TIA and Eigenlayer stakers among others

FriendTech dropped a haiku "Money clubs, Points will have a point, Custom curves," perhaps signalling that points will indeed become tokens

🚀 NFT Total Volume (ETH)

Azuki (2,194 ETH, 7.27 ETH Floor)

MAYC (1,587 ETH, 4.48 ETH)

Pudgy Penguins (842 ETH, 18.48 ETH)

DeGods (718 ETH, 3.07 ETH)

Bored Ape Yacht Club (705 ETH, 25.85 ETH)

📈 NFT Floor Price Increase (ETH)

Distortion Genesis (160%, 0.78 ETH Floor)

CryptoPhunks v2 (51%, 0.15 ETH)

Deep Black (37%, 1.52 ETH)

Celestial (28%, 0.39 ETH)

Mittaria Genesis (25%, 1.13 ETH)

🗓 Upcoming NFT Mints and Reveals

Today is a slower day for new NFTs but a huge day for tokens.

Alt Layer has opened its airdrop claim this morning and the token is already trading at $0.29.

Later today, Jupiter is expected to launch its test memecoin (tied to the Ovols NFT project) ahead of next week's $JUP launch.

And the deadline to claim $FRAME ends today ahead of the Jan 31 mainnet go-live.

For new drops, Memory Blocks on BTC is likely the highlight, with 128 NFTs minting for 0.005 BTC each.

See the full list and dive in for more details with Swizzy's daily mint monitor.

Alt Layer - airdrop claim (LIVE)

Tiny Blazers (11:30 a.m. ET)

dailofrog - Memory Blocks (2:00 p.m. ET)

$FRAME token claim ENDS (3:00 p.m. ET)

counterfeit culture (6:00 p.m. ET)

Lemonhaze x The Functions - La Tentation (6:00 p.m. ET)

Zokio (8:00 p.m. ET)

Enjoy this write-up and/or want to sponsor the Morning Minute? Follow along with me on Twitter @tyler_did_it or reach out via email tyler.warner@luckytrader.com