Crypto Markets Hang in Balance Ahead of Rate Cut Decision

How deep will the Fed cut? And what does it mean for markets, near term and longer term?

TylerD's Market Summary

GM!

Today's top news:

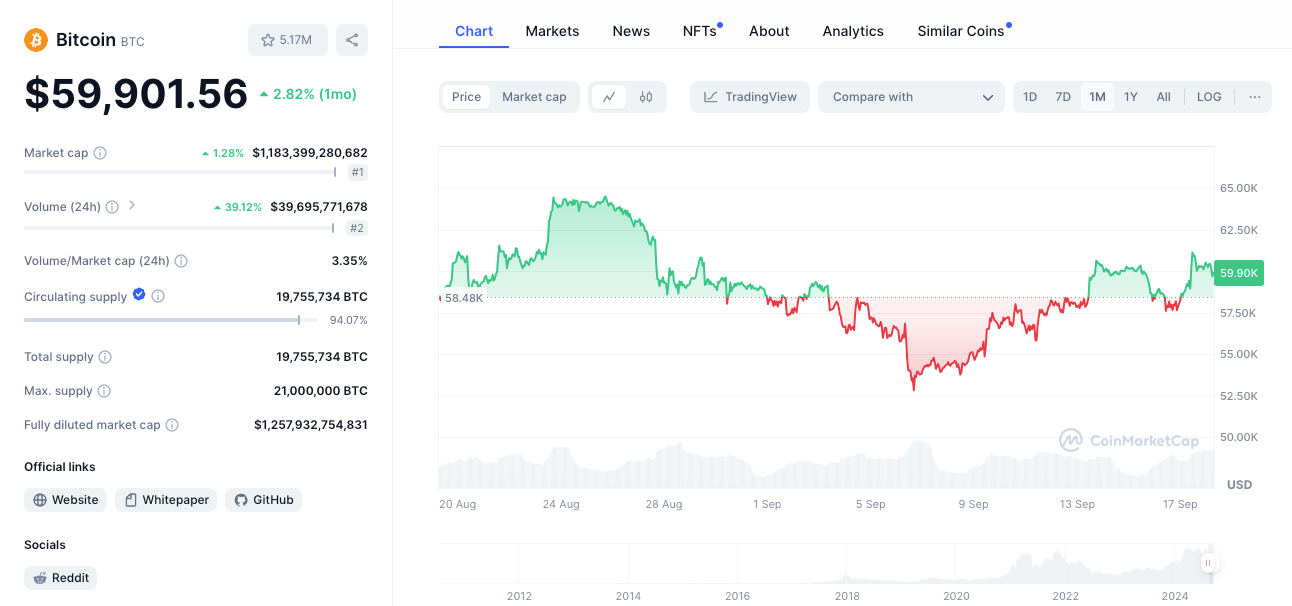

Crypto majors chop ahead of FOMC today; BTC at $59k

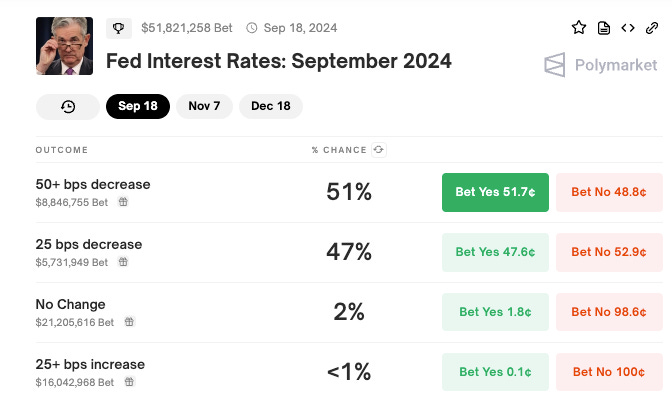

Odds of a 50 bps rate cut at 51% with $52M wagered

Bitcoin deposited to exchanges hits multi-year lows

Wintermute introduces new prediction market OutcomeMarket focused on elections

Sui partners with MoviePass to allow USDC for movie subscriptions

💸 Rate Cuts Come Today - What Happens Next?

The September FOMC meeting is finally here, set to start at 2 pm EST today.

Several markets hang in the balance as we await Powell's decision for rate cuts, with a range of outcomes from 0 bps to 75 bps on the table.

Then the question becomes - what happens next?

What Is Happening?

The Federal Reserve is expected to cut rates today for the first time since 2020.

Current Polymarket odds see it as a coin flip: 51% chance of a 50 bps cut and 48% chance for a 25 bps cut (odds of No cut at 2% and 75 bps at 1%).

It's a notable market with over $51M wagered ahead of today's outcome.

And there's a lot on the line for whatever decision they make.

Market Impact - Near Term

Arthur Hayes, notable crypto investor, co-founder of BitMEX and thought leader, shared thoughts on the potential impacts of these cuts.

He's mostly focused on what it means for the Japanese Yen (JPY), and any moves that lead to a stronger JPY equate to bad news for risk assets in the near term.

And the deeper the rate cut, the weaker the USD is in comparison to JPY.

Folks may remember the "Yen carry trade" which led to the brief dip in markets back in early August. Bitcoin went from $67k to $53k in just a few days during that dip.

So there's a chance we see it flare up again.

Market Impact - Long Term

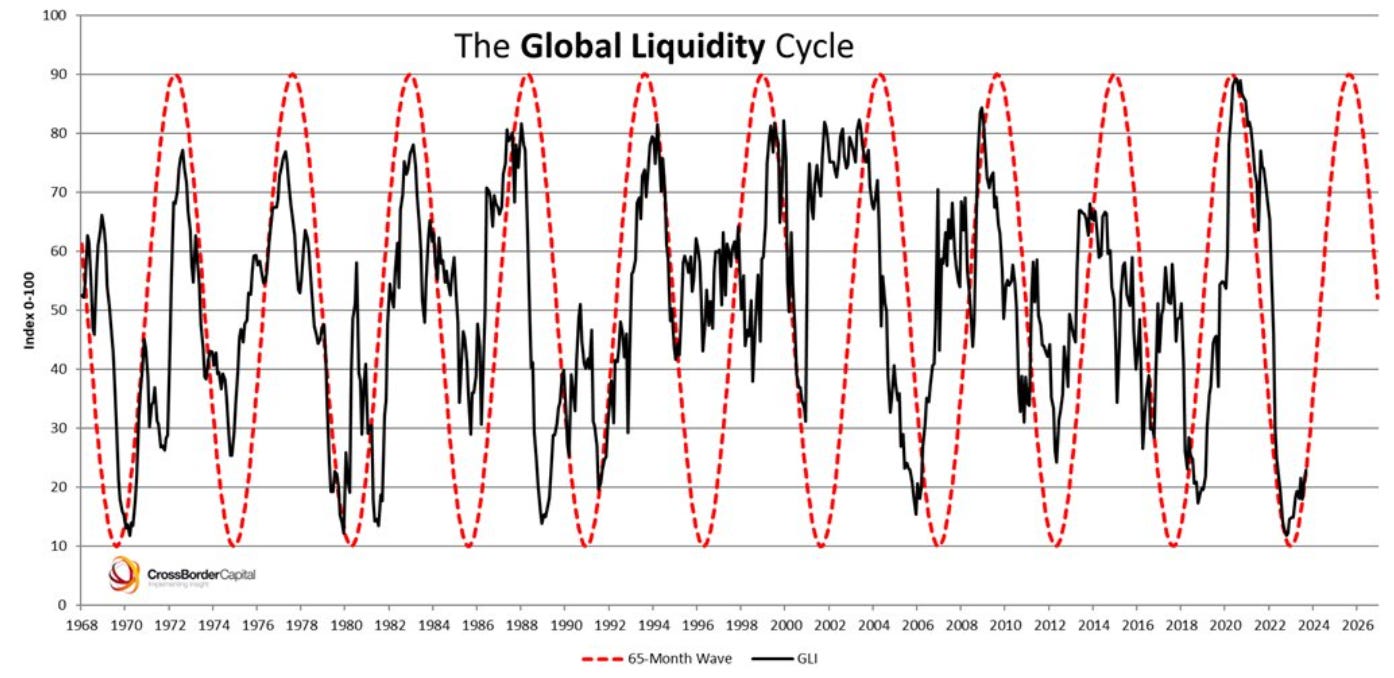

Any short term pain should be erased by the longer term impacts of lower rates and the global liquidity cycle ramping back up.

Lower rates means yield on simply holding cash and/or treasuries goes down, leading to investors moving further out the risk curve into risk assets.

This should be good for stocks and crypto majors like Bitcoin.

That's my working thesis and I'm positioned accordingly.

But this will take quarters to play out.

As for the near term - expect a bumpy ride...

🚚 What else is happening in NFTs?

Here is the list of other notable headlines from the day in NFTs:

Ethereum led NFT trading volume with $3.5M on the day; BTC was next with $1.9M, and then Solana with $1.8M

ETH NFT leaders were slightly red; Punks -1% at 29.44 ETH, Pudgy -1% at 10.8, BAYC -2% at 11.8 ETH, Azuki +6% at 5.75, Doodles +7% to 1.86 ETH

Cyberkongz VX (+30%) and Topia Worlds (+18%) were notable top movers

A Hoodie Cryptopunk sold for 130 ETH, which was 170 ETH less than the last Hoodie which sold (albeit with better traits)

BTC NFT leaders were mixed; NodeMonkes +8% at 0.139 BTC, Puppets +1% at 0.082 BTC, Quantum Cats -1% at 0.243; OCM Genesis +20%

The Runes leaders were mostly red; DOG -5% at $229M mc, RSIC -6% at $56M mc, PUPS even at $22.5M

Solana NFTs were mostly green; Mad Lads +10% at 66 SOL, SMB Gen 2 +4% at 28, DeGods -3% at 27 SOL, Claynos -2% to 17

BAYC shared new details and gameplay for Season 2 of Dookey Dash which starts on Sept 19

💰 Token, Airdrop & Protocol Tracker

Here's a rundown of major token or airdrop news from the day:

Gemini announced deposits and withdrawals for WIF with trading starting soon

Wintermute introduced a new prediction market OutcomeMarket focused on the U.S. election and powered by TRUMP & HARRIS tokens

Hamster Kombat announced that Season 1 of its in-game rewards will end on Sept 20, with those rewards converted into HMSTR tokens

Limitless raised $3M to build a prediction market on Base, with focus on daily markets (like the price of a crypto token at end of day) vs longer duration markets (like the election)

Wallet Connect introduced its Connect Token (WCT) as its native token of the WalletConnect Network

🌎 Around Crypto and Web3

A few other Crypto and Web3 headlines that caught my eye:

Crypto majors are mixed this morning ahead of FOMC and the rate cut decision; BTC +1 at $59,900; ETH -1% at $2,300, SOL -3% at $129

Memecoin majors are slightly red with DOGE -1%, PEPE -2%, WIF -2%, BONK -2%, MOG -1%

The Binance-listed NEIRO ran another 140% on the day to $370M mc, becoming the 2nd biggest meme on ETH by market cap

U.S. Congressmen have requested clarity from the SEC on a framework for handling crypto airdrops, on the same day that the SEC settled with FTX auditor Prager Metis for $1.95M

The amount of Bitcoin deposited to exchanges has hit new multi-year lows

Circle launched USDC support for businesses in Mexico and Brazil, expanding its stablecoin reach

Sui partnered with MoviePass to allow USDC payment options for movie subscriptions

🚀 Memecoin Movers

$NEIRO (+140%, $360M market cap, ETH)

$MOODENG (+140%, $17M market cap, SOL)

$BILLY (+64%, $33M market cap, SOL)

$BOBO (+20%, $88M market cap, ETH)

$TURBO (+15%, $355M market cap, ETH)

📈 NFT Floor Price Increase (ETH)

Agoria (257%, 0.06 ETH Floor)

LasterCat (69%, 15 ETH)

Chubbicorns (68%, 2.44 ETH)

Alpha Gate (38%, 1.49 ETH)

Cyberkongz vx (29%, 0.1 ETH)

🗓 Upcoming Mints and Events

Today is another slower day of mints.

Expect all focus on FOMC this afternoon and then market reactions afterward.

See the full list and dive in for more details with Swizzy's daily mint monitor.

Yoon Hyup x Avante Arte - City Fountain (9:00 a.m. ET)

Mutable Trees (10:00 a.m. ET)

Error 404 (12:00 p.m. ET)

pxlshrd x Verse - Conversations (1:00 p.m. ET)

Taproot Witches (5:00 p.m. ET)

Enjoy this write-up and/or want to sponsor the Morning Minute? Follow along with me on Twitter @tyler_did_it or reach out via email to tyler.warner@luckytrader.com.