Blur Blends the Lines of NFT Finance

Blur threw a curveball on Monday with its launch of Blend, which has already massively impacted the NFT market. Read on to find out how it works and its impact.

TylerD's Market Summary

GM!

Today's top news includes:

Blur launches Blend and BNPL

NFT market soars

Sotheby's debuts new marketplace

Phantom goes multi-chain

Beeple does $PEPE

🤯 Blur Launches Blend and Buy Now, Pay Later

Leading NFT marketplace Blur shocked most of the NFT world on Monday with their newest announcement.

While most were expecting new features like trait bidding or the addition of Art Blocks or editions to their platform, they went an entirely different route.

Lending.

The Blur team launched a new peer-to-peer perpetual lending protocol named Blend.

The goal?

To unlock more liquidity for NFTs and create the next version of NFT-native financial primitives bringing the NFT market closer to broader financial markets.

There are two components of the launch: 1) pure lending against NFTs and 2) Buy Now, Pay Later (BNPL), which combines elements of lending and leverage to function like an options market.

How It Works

The announcements (yes there were two separate) are intricate and there may be some finer details missed here, but for a quick overview of each program:

Blend Mechanics:

Individuals create loan bids and front the NFT collateral (peer-to-peer)

Loans don't have liquidation prices or expirations (thus perpetual)

Loans have fixed rates

Borrowers can pay back at any time

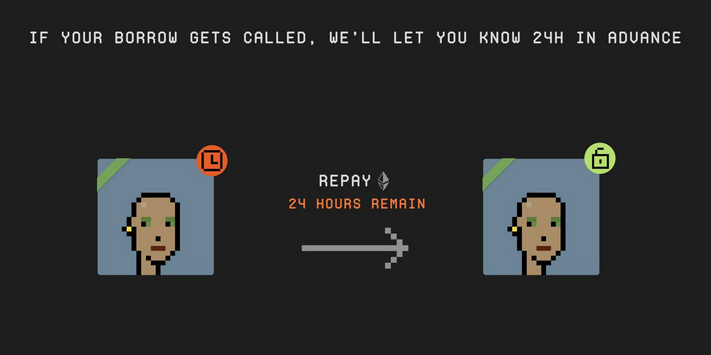

Lenders can call loans due at any time, creating a Dutch auction to find new lender

If no lender comes in, the NFT is liquidated

0 fees for borrowers and lenders

The protocol fees, max interest rate, and auction formula can be managed by Blur governance after 180 days

We have seen mechanics like these before across platforms like NFTfi and BendDAO, but never all together like this, and the Dutch auction feature is the true differentiator.

The auction allows an additional "out" for the borrower if the initial lender wants to close the loan, as someone in the market can pick it up with the borrower mostly unaffected (could face new rates).

Now for the bigger wildcard - Buy Now, Pay Later (BNPL).

BNPL Mechanics:

BNPL is powered by Blend and somewhat reverses the typical lending process.

Interested buyers can now "buy" NFTs with ~10% down payment. The first 3 collections offered by Blur included Punks (buy for 8 ETH), Azuki (buy for 2 ETH), and Miladys (buy for 0.5 ETH).

Here's how it works (using Azuki and a 16 ETH floor as example):

A user chooses an Azuki off the floor and chooses Buy Now

They can toggle the down payment which adjusts the interest rate on a sliding scale (let's say 2 ETH and 0.2% daily interest)

The user "buys" the Azuki for 2 ETH, being connected with a loan in the Blur lending pool for the remainder (14 ETH)

The Azuki buyer now has limited control over the NFT - they can list it for sale on Blur, but nowhere else and they cannot move it

The buyer racks up 0.2% daily interest fees accrued, payable at the time of sale

The buyer can sell the NFT or accept a collection bid at any time, and the lender can call the loan at any time

The loan is closed only if the buyer sells the NFT, or if the lender calls* the loan and it is not picked up in the lending pool, forcing a liquidation

*If the lender does call the loan, it will enter the Dutch auction process and will automatically be picked up by other open loans in the pool with similar terms (unless none exist, in which case the loan is liquidated).

That was a lot, and still not a full description.

Here's an example to show how the math/profit works.

Buyer pays 2 ETH for an Azuki at a 16 ETH floor, with 0.2% daily interest.

The next day, the Azuki floor moves to 17 ETH overnight, and the buyer sells at 17.

The buyer makes 1 ETH, minus 0.5% Blur sales fee and one day of 0.2% interest (1 - 0.085 - 0.032).

So the buyer makes 0.883 ETH, on a 2 ETH investment.

The market functions similarly to call options in traditional stocks, where the buyer puts up a principal amount and experiences the upside linearly, but if the asset falls in value, the buyer can lose their entire principal.

In the example above, if the Azuki floor falls to 14 ETH overnight in a crash, the buyer is likely wiped out and loses their entire 2 ETH principal when the lender calls the loan.

So while there can be nice upside in an uptrend, the downside is still 100% of investment.

Market Impact

The NFT market is showing big green this morning.

The 3 collections involved in Blend and BNPL had great days:

Wrapped Cryptopunks: 56.2 ETH floor (+12%)

Azuki: 16.8 ETH floor (+14%)

Milady: 3.59 ETH floor (+28%)

But several other projects are up in the 5%-10% range, likely as buyers speculate on which collections could be next up for BNPL (and likely to see an initial pump).

Rumors are swirling around what could be next, but if going off of the Blur Points tab, the next sets include:

DeGods

Beanz

BAKC

BAYC

CloneX

Of course, we won't know until announced, and Blur said expect the next set of collections soon.

Conclusion

This overview did not even get into the Points aspect of this launch, which are the incentives that drive the farmers and whales.

And that's the X factor here.

Farmers are incentivized to make loan bids, but not actually get their loans accepted. And the longer those funds are locked in loans, the less those farmers can do with the funds.

Thus, we are likely to see a decent amount of turnover in these loans.

As for broader market impact, this is effectively adding new leverage to a market that felt like it was trending to zero.

A temporary pump has already happened, and will likely continue for a brief period - but then what?

Without real buyers coming into the picture, in the near future, this will collapse at some point.

So be careful out there. But there will be profits to be made along the way.

If you are going to participate, do yourself a favor and read the docs, starting with these three:

Season 2 Rewards (full detail on points)

Repaying your borrow (more details on how BNPL works)

Good luck!

🚚 What else is happening in NFTs?

Here is the list of other notable headlines from the day in NFTs:

Trading volume jumped 30% to 16.5k ETH on Monday after the launch of Blend and the BNPL program, with volume on top movers up considerably; most NFTs in the green 5%-15%

Sotheby's launched its own curated secondary marketplace, with 2.5% fees, enforced royalties, and aggregated 1/1s across other marketplaces

Jack Butcher launched the opt-in for Opepen Pack 001 and 002 on Monday, both of which were over-subscribed (meaning they will launch)

Phantom Wallet released multi-chain support covering Ethereum, Polygon, and Solana on Monday allowing users to keep just 1 wallet to cover all 3 ecosystems

OpenSea Pro announced new updates for its platform, mostly tied to the handling of ERC-1155 NFTs (one of its primary edges over Blur)

RTFKT announced its SZN1 apparel has started to ship and the "unhubbing" for its Cryptokicks will take place later this month

Azurbala shared news on its plans for a re-launch, including a points system, separation of Jenkins and Azurbala IP and more lor

🌎 Around Crypto and Web3

A few other Crypto and Web3 headlines that caught my eye:

The crypto market fell on Monday; BTC down 2% at $28,020; ETH -1% at $1,830

$PEPE soared to a $600M marketcap after being memorialized by Beeple in his latest everyday, before settling at $480M this morning

Crypto exchange Poloniex pays $7.6M in fines tied to Sanctions violations across 60,000 transactions

TinyTap, a Web3 EdTech platform, raised $8.5M to accelerate expansion into the Web3 education system

🚀 NFT Total Volume

Azuki (4,028 ETH; 16.95 ETH Floor)

Wrapped Cryptopunks (3,499 ETH, 56.2 ETH)

MAYC (1,841 ETH, 11.4 ETH)

BAYC (1,701 ETH, 49.77 ETH)

Milady (1,642 ETH, 3.59 ETH)

📈 NFT Floor Price Increase

Milady (28%, 3.59 ETH Floor)

Kanpai Pandas (26%, 1.29 ETH)

rektguy (22%, 0.67 ETH)

Nakamigos (18%, 0.26 ETH)

Azuki (15%, 16.95 ETH)

🗓 Upcoming NFT Mints and Reveals

Today is another slower day of new drops, so expect attention on the new Blur Blend protocol and the 3 collections available for BNPL. Any new collections announced to be included will see immediate demand.

Steady Stack Legends (12:00 p.m. ET); 0.5 ETH

Focus Bloc (12:30 p.m. ET); 0.3 ETH

Lyra (TBD); 0.04 ETH

Enjoy this write-up? Follow along with me on Twitter @tyler_did_it or reach out via email tyler.warner@luckytrader.com.

For all volume and floor price data, see Lucky Trader's Project Rankings page.

For all upcoming mints, see Lucky Trader's Project Schedule page.