Balaji's Big Bitcoin Bet

Monday was a fairly light day in terms of NFT news, but it remains an active time for macro news in the midst of an ongoing banking crisis and an important FOMC meeting on the horizon.

Market Summary

GM!

TylerD is on vacation this week, but no worries, I'm here to fill in and catch you up on all the latest news in web3 and crypto!

Today's top news includes:

Balaji's Big Bitcoin Bet

FOMC Meets Ahead of Rate Move Decision

Wrapped Punk Trading Volume Explodes

ZED RUN Offers Community Grants

💰Balaji's Big Bitcoin Bet

Former Coinbase CTO, Balaji Srinivasan raised eyebrows on Friday when he bet James Medlock that the price of Bitcoin would exceed $1m within the next 90 days. In his challenge, Balaji agreed to send $1m USD while asking Medlock to buy 1 Bitcoin. If the price of Bitcoin failed to reach $1m USD within 90 days, Medlock is to receive $1m in USDC. If Balaji is correct, Medlock will send 1 BTC to Balaji. At the time of the proposal, the price of Bitcoin was around $26k, effectively making this a 38:1 bet. And not only was Balaji willing to take this bet with Medlock, he also put out an open offer for another person to take him up on the bet.

But does Balaji really believe the price of Bitcoin will hit $1m within the next 90 days or is this, as some have suggested, more of a publicity stunt? Let's dig in.

Balaji is calling for a moment when the world "redenominates on Bitcoin as digital gold, returning to a model much like before the 20th century." He envisions this process beginning when a US state or "normal" country (he doesn't define what he considers a "normal" country, but apparently that definition does not include El Salvador) buys Bitcoin. While 90 days seems like an extremely ambitious timeline for this to happen, Balaji believes we'll get there due to hyperinflation, which he expects to be triggered "once people check what I'm saying and see that the Federal Reserve has lied about how much money there is in banks."

The bank runs we've seen at Silicon Valley Bank and others, to a lesser degree, this month have happened extremely quickly, and Balaji is counting on hyperinflation to similarly occur in a "1 to 0" manner. "Just like the bank runs, except this is the central bank," he says. Balaji sees Bitcoin's rise in price from $1 USD to where it is now as a vote against the dollar since the 2008 financial crisis by "much of the smart money."

As news of the bet spread, several of Balaji's followers started retweeting a thread he had posted on January 30, 2020, about a month and a half before the U.S. closed down due to the COVID-19 pandemic. In that thread, Balaji asks, "What if this coronavirus is the pandemic that public health people have been warning about for years?" while correctly predicting some of the resulting effects, like border closures, a rise in remote work, the prevalence of facemasks and distrust in governments.

In 2020, Balaji was able to read the tea leaves and forecast what was likely to happen next. Is history repeating itself with his latest Bitcoin bet? In this case, the "tea leaves" Balaji is reading are:

The amount of "newly printed money" on the Fed's balance sheet.

The potential for hundreds of banks to face the same issues that doomed Silicon Valley Bank.

The potential for Bitcoin to serve as a "digital gold" reserve.

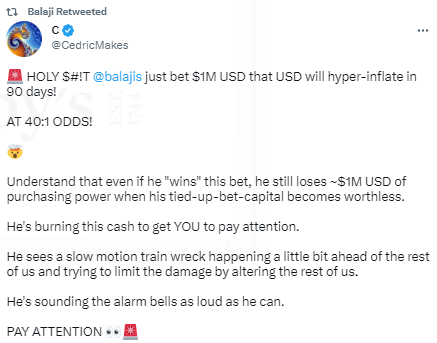

Somewhat ironically, even if Balaji were to win the bet, he will still lose purchasing power, as the $1m USD he placed into escrow will be massively devalued. As one Twitter user suggested (in a tweet that was retweeted by Balaji), "He's burning this cash to get YOU to pay attention."

So, what do you think? Was this a smart bet by Balaji, a publicity stunt, and educational campaign? And will Jack Butcher be wearing this hoodie in late June?

Only time will tell.

🏦 FOMC Meets Ahead of Rate Move Decision

Another major macro event kicks off today with the Federal Open Market Committee (FOMC) scheduled to meet over the next two days, culminating in a press conference tomorrow at 2:00 PM ET with Fed Chair Jerome Powell. The market is expecting Powell to announce a rate hike of 25 bps in the conference, assigning roughly an 86% probability to this outcome per data supplied by CME Group. These expectations have been in flux over the past couple weeks as the Fed is navigating both an inflation rate that is still high, and a banking sector which has come under duress, partially as a result of the break-neck speed at which the Fed has hiked rates over the past year.

Expect more volatility in the markets as we learn more about Powell's plans over the next couple of days. If you'd like to stay updated on these events in real-time, some helpful Twitter accounts to follow include @tier10k and @gurgavin.

🔄 NFT Round Up

With macro news dominating the headlines, it was a slower news day in NFT land. Here are the main stories I'm focused from the last 24 hours:

🚚 What else is happening in NFTs?

Trading volume came in at 32.2k ETH on the day, highest since last Thursday with Wrapped Punks leading the charge (24.3k ETH).

NBA Top Shot is teaming up with HOMAGE to gift free tee-shirts to 2,500 collectors.

In more web3 basketball news, former NBA star Baron Davis is working on a new venture whose goal is to onboard a new demographic that has not yet been exposed to web3.

Pindar Van Arman, a pioneer in the AI art space and BrainDrops contributor, has a 1/1 byteGAN NFT up for auction at Sotheby's.

ZED RUN is offering community grants to those interested in building aliongside the virtual horse-racing platform.

Wrapped Punks had so much sales activity on Blur yesterday afternoon that popular valuation site DeepNFTValue was unable to keep up with the price movement for the first time.

Golf equipment company Titleist filed a U.S. trademark application centered around NFTs.

🌎 Around Crypto and Web3

A few other Crypto and Web3 headlines that caught my eye:

Polygon Labs announced a partnership with Immutable to create a new chain for games that aims to make developing web3 games faster, easier and more secure.

With Signature Bank shut down, Coinbase is no longer supporting Signet, which was a "real-time payments network" offered by Signature. Customers who used this service will no longer be able to deposit or withdraw U.S. dollars outside of banking hours.

Belgian regulators will require crypto ads include the disclaimer, "The only guarantee in crypto is risk."

Florida Governor Ron DeSantis introduced a law to ban the use of CBDCs in the state.

🚀 NFT Total Volume

Wrapped CryptoPunks (24,342 ETH, 65.16. ETH Floor)

Azuki (2,356 ETH, 13.41 ETH Floor)

Mutant Ape Yacht Club (2,116 ETH, 12.67 ETH Floor)

CryptoPunks (1,715 ETH, 58.98 ETH Floor)

Moonbirds (767 ETH, 4.14 ETH Floor)

📈 NFT Floor Price Increase

NFT Worlds (14.9%, 1.11 ETH Floor)

Nouns (14.29%, 32 ETH Floor)

RENGA Black Box (11.18%, 2.52 ETH Floor)

FLUF World (7.28%, 1.75 ETH Floor)

Crypto Citizens (7.1%, 0.59 ETH Floor)

🗓 Upcoming NFT Mints and Reveals

It's another fairly quiet day of mints and reveals with three projects I'm tracking. First up, we have Latent Couture by Mikey Woodbridge, a collection of 555 generative AI art NFTs created by digital artist Mikey Woodbridge.

Next up, we have what I consider the drop of the day in the Candy x Getty Images collection, dropping at 1:00 PM ET. This collection is centered around the music and culture of the 1970's, featuring photography by David Redfern and subjects like David Bowie, Jimi Hendrix and more.

Rounding out the day, we have Archive of PEACEMINUSONE, hosted by OpenSea. This is a collection by K-pop star G-Dragon, in collaboration with Fandom Studio.

Latent Couture by Mikey Woodbridge (12:00 PM ET, 0.1 ETH)

Candy Digital x Getty Images (1:00 PM ET, $25)

Archive of PEACEMINUSONE (11:00 PM ET, 0.27 BNB)

Learn more about today’s drops here.

Enjoy this write-up? Follow along with me on Twitter @wmonighe or reach out via email bill@luckytrader.com.

For all volume and floor price data, see Lucky Trader's Project Rankings page.

For all upcoming mints, see Lucky Trader's Project Schedule page.