A Rolex NFT Loan Just Changed the DeFi Landscape

Real-world assets are coming to NFTs and DeFi. Find out why it matters, plus prepare for today's Grails auctions with a quick preview.

TylerD's Market Summary

GM!

Today's top news includes:

A ground-breaking Rolex NFT loan

Grails 2 auctions set for fireworks

Unique traders at 2-month highs

Limit Break unveils its Payment Processor

Crypto falls after FOMC's "hawkish pause"

⌚️Tokenized Rolexes and the Rise of Real-World Assets in DeFi

A common complaint against crypto (and NFTs) in 2023 is a lack of innovation.

Folks bearish on the space claim nothing of substance has been built in this past cycle.

Well yesterday we saw the first-ever tokenization of two Rolex watches, then used for an NFT-backed loan allowing on-chain crypto access.

That feels like innovation to me.

Real-world assets are coming to DeFi.

What Happened?

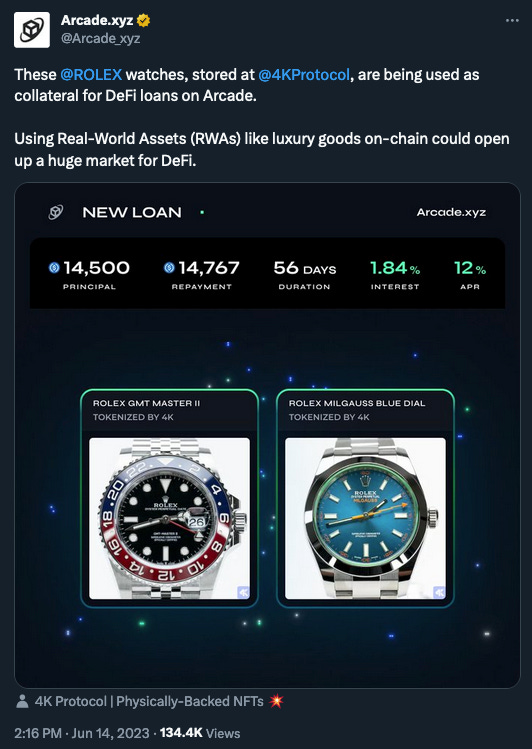

Yesterday, NFT lending protocol Arcade.xyz shared a major update involving a very special NFT loan.

They have facilitated a loan of 14,500 USDC against 2 Rolex watches.

How It Works

Here's how the Rolex loan went down:

The Rolex owner sent the watches to an escrow company (4K protocol)

4k Protocol took custody in escrow, tokenized the Rolexes and sent the owner NFTs

The owner then used the Rolex NFTs to take out a loan on Arcade.xyz's protocol

The borrower got some pretty good terms on the loan.

On the 56-day loan, they will pay $267 in interest (1.84% or 12% APR).

If the borrower defaults, then the lender gets the Rolex NFTs (and can then redeem the watches via 4K protocol).

If the borrower pays back the loan, the lender gets $267 in profit on a pretty risk-free loan (estimated LTV at ~60% pending watch condition).

A win-win for the lender, and the borrower gets access to $14.5k on-chain.

Why It Matters

This is a massive unlock for assets that can be used in DeFi.

NFT lending to date has been capped by the types of NFTs available - basically just the top-end PFPs and digital art.

Not a huge market cap there, especially after this bear market.

But now, physical assets can be used.

The luxury watch market alone has a $42B market size. The luxury purse market has a similar size. And those are just two types of real-world assets that could be tokenized.

The physical collectibles market was estimated at $402B in market size in 2021, with estimates of reaching $1T within 10 years.

The lending process seems easier than current state as well.

I'm no expert in the Rolex lending game, but I don't think the average owner has a ton of options for quick liquidity against their watch(es). Especially at a fair rate.

Now they do.

The scale of potential NFT lending just got a whole lot bigger.

It's huge for the NFT landscape, and even bigger for DeFi.

🖼 A Big Day for Grails

The heavily anticipated Grails Part II auctions are going live at 4 p.m. ET today in what is shaping up to be a blockbuster afternoon for generative art.

We already know that 100% of the lots have been "sold" (meaning they've received an acceptable bid).

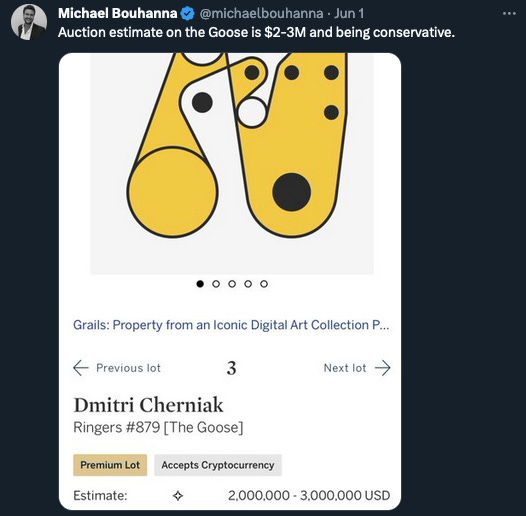

And Michael Bouhanna, the Head of Digital Art at Sotheby's and mouthpiece of the auctions, shared on Rug Radio that they are confident the Goose will sell for more than the high estimate of $3M.

Cue the fireworks.

By the Numbers:

Here are some current bids (and their high estimates) on some of the top NFTs included in this lot:

Autoglyph #218: $240,000 (high estimate of $180,000)

Ringers #98: $85,000 (high estimate of $60,000)

The Eternal Pump #9: $175,000 (high estimate of $80,000)

Fidenza #479 (micro): $490,000 (high estimate of $180,000)

Fidenza #216 (spiral): $300,000 (high estimate of $180,000)

Archetype #397 (Cube): $110,000 (high estimate of $250,000)

Chromie Squiggle #1780 (Perfect Spectrum): $170,000 (high estimate of $180,000)

CryptoPunk $8950: $80,000 (high estimate of $60,000)

The Goose: TBD (high estimate of $3,000,000)

A few takeaways:

First, the bids are outpacing the high estimates because most are set well below current OpenSea floors (and even below active floor WETH offers), so don't get blown away by those comparisons

The Goose auction is the highlight, and clearly Sotheby's is confident they have a $3M bid in the bag; this one could get crazy

Fidenzas are set for a huge day up top, but some of the lower-end Fidenzas are under-pacing (the new floor is 85 ETH or $140,000 and several are close to that number)

The Cube Archetype is a surprising under-performer right now, having previously sold for 420 ETH (or $687k)

The perfect spectrum Chromie Squiggle is the low-key wildcard in the lot and could also see some fireworks in a bid war

Overall this is set to be a really fun, and important, afternoon for Art Blocks and the broader digital art space.

We have already seen the Fidenza market jump 15% overnight (from 75 ETH to 85 ETH) in anticipation, and soon we'll see if these auctions can kickstart a larger run.

Get your popcorn ready.

🚚 What else is happening in NFTs?

Here is the list of other notable headlines from the day in NFTs:

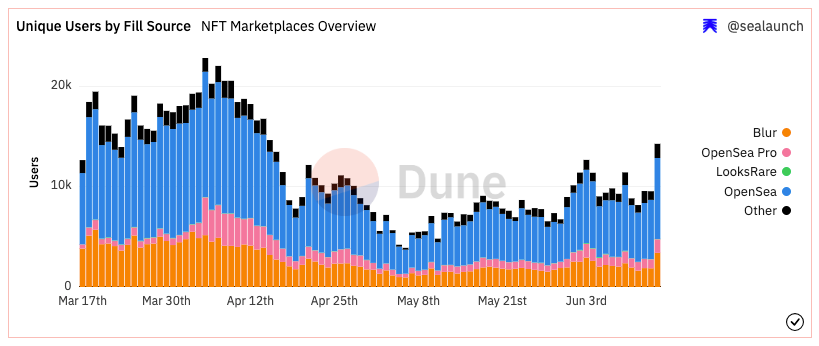

Trading volume came in at 12k ETH on Wednesday, though unique traders raised to the highest levels in 2 months with over 14,000 unique transacting

Blur's 196M token unlock had minimal effect on the token price yesterday, which held at $0.31 (down just 2.4%, less than broader crypto)

Recent rocket Boring Punks seemed to lose its steam, falling over 60% from local highs (now 0.06 ETH floor)

Limit Break unveiled its long-awaited Payment Processor, the first-ever NFT marketplace protocol fully compatible with ERC721-C and programmable royalties; the Payment Processor offers trust-less validation and execution of NFT trades, ensuring transparent payout of all seller, marketplace, and royalty proceeds.

Kanpai Pandas have added renowned lifestyle brand exec Jeff Willard to their advisory board

Okay Bears is rewarding its most dedicated collectors with its new "Grails" feature release, where they can earn a Grail and gain exclusive access and better odds for an upcoming Ordinals drop

Creature World is hosting an album preview show for Portugal the Man on June 20th live from Creature World

🌎 Around Crypto and Web3

A few other Crypto and Web3 headlines that caught my eye:

The crypto market fell hard on Wednesday; BTC -3.8% to $24,990; ETH -6% at $1,640

The Fed paused rate hikes in Wednesday's FOMC meeting, though Powell provided hawkish commentary stating there might not be cuts for 2 years

Santo Spirits, co-founded by Sammy Hagar and Guy Fieri, announced a new Web3 loyalty program with Trident3, using NEAR; the program includes loyalty rewards, a mystery NFT and more

🚀 NFT Total Volume

BAYC (8,647 ETH, 45.21 ETH Floor)

Wrapped Cryptopunks (2,256 ETH, 50.2 ETH)

Azuki (1,640 ETH, 16.5 ETH)

MAYC (1,618 ETH, 9.12 ETH)

BoringPunks (909 ETH; 0.06 ETH)

📈 NFT Floor Price Increase

Cornerstone: Noza Crystals (172%, 0.69 ETH Floor)

FF6000 (94%, 0.13 ETH)

Loyal FF6000 (39%, 0.4 ETH)

Terraforms (11%, 1.33 ETH)

OnChainMonkey (10%, 2.37 ETH)

🗓 Upcoming NFT Mints and Reveals

Today is a huge day of mints & events.

The highlight mint is likely OCM Dimensions from the OnChainMonkey team, releasing 300 BTC NFTs using recursive inscription technology (at 0.08 BTC). Expectations are high for this one.

The AB drop today is from notable artist Jake Rockland who always sees demand, even though this market has been slow.

The burn event for Bored & Dangerous is a big one today. Holders who burn a Bored & Dangerous Book will receive 1 of 3 tiers of Azur Root. The tiers of Azur Roots are “1/1”, “Apex”, and “Origin" and these will have an impact on the eventual rarity of the Azurian down the line. Holders are incentivized to burn early, as there will be random 1/1 giveaways on June 22 and June 29.

Then Grails comes at 4 p.m. (see preview above), capping off the day.

If you want more, see the full list of today's drops from Swizzy's daily mint monitor.

AB Presents: Sonoran Roadways by Jake Rockland (1:00 p.m. ET); Dutch auction

Bored & Dangerous - burn (1:00 p.m. ET)

Everyday Odyssey by StupidGiant (2:00 p.m. ET); 0.04 ETH

Flower Sand by Yuma Yanagisawa (2:00 p.m. ET); 0.04 ETH

Grails Part 2 (4:00 p.m. ET)

OCM Dimensions (TBD); 0.08 BTC

Enjoy this write-up? Follow along with me on Twitter @tyler_did_it or reach out via email tyler.warner@luckytrader.com.

For all volume and floor price data, see Lucky Trader's Project Rankings page.

For all upcoming mints, see Lucky Trader's NFT Calendar page.